Domas Golysenko

In the world of cryptocurrencies, the term ‘inflation’ refers to the pace at which new tokens enter the circulation pool.

To avoid sudden and dramatic surges in supply cryptocurrency projects adopt token vesting schedules, which aim to balance out the release of new tokens within a defined timeframe, thereby creating a token distribution model that both appeals to the broader public and ensures long-term sustainability.

Despite the importance of a well-thought-out token vesting schedule, many emerging projects stumble in this regard. These projects often launch with an overwhelmingly high inflation rate, leading to the devaluation of their token value and in some cases, the demise of the project itself.

In this article, we will show how high inflation can negatively impact emerging cryptocurrency projects.

Devaluation of Tokens

The most immediate fallout of high inflation is the dilution of token value, when the market gets flooded with new tokens, but demand remains the same or doesn’t rise accordingly, the value of existing tokens inevitably diminishes.

This scenario leads to a continuous selling pressure in the market as investors aim to dispose of their holdings before further depreciation in price occurs.

This effect creates a feedback loop that further accelerates the drop in token price and in some cases leads to the demise of the project itself.

Threat to Sustainability

High inflation rate can also pose a severe threat to the sustainability of crypto projects. These projects may think that it is rational to release high amounts of tokens into circulation to stimulate network activity and growth in the beginning.

However, the quicker these tokens are released into circulation, the fewer tokens are left to be allocated in the future.

This scarcity of tokens for future allocation ultimately slows down the development and long-term sustainability of the cryptocurrency project.

In such a scenario team members and investors become unmotivated to devote their time and resources to further project development if they already received the majority of their tokens and are aware that others did too.

This situation can create a domino effect where the incentive to hold the token vanishes, causing a rush to sell tokens faster than others.

This rush not only speeds up the decline of the token’s value but also sparks a vicious cycle – the quicker the tokens are sold, the faster their value plummets, and the more people notice the downward trend, the more they want to sell.

Loss of Investor Confidence

High inflation can also cause diminishing investor confidence.

The anticipation of future price drops, sparked by inflation, may scare away potential investors from buying the token and provoke existing holders to sell.

This selling pressure, coupled with the lack of demand, often triggers a significant decrease in tokens price, which makes it very difficult for the project to draw future investments and sustain a stable price of their cryptocurrency.

Case Studies: The Fallout of High Inflation

“Cryowar”

There are multiple instances in the cryptocurrency landscape that serve as painful reminders of how high inflation kills crypto projects.

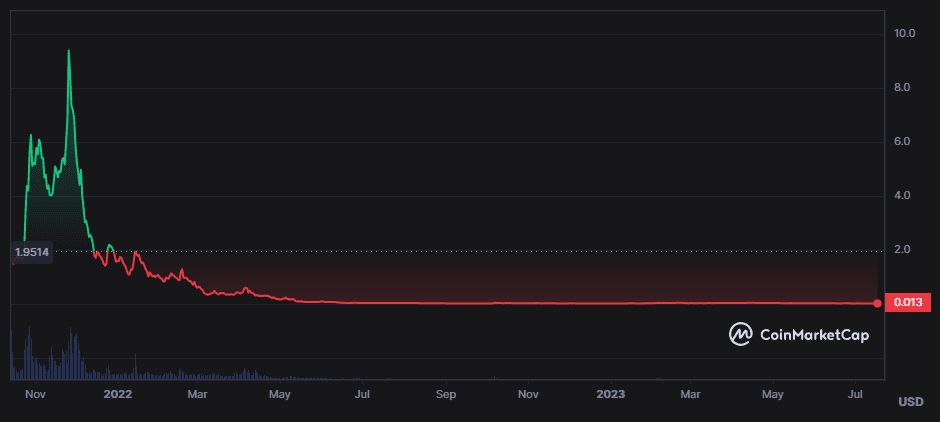

Consider “Cryowar,” a project that launched with an eye-watering 1547% inflation in its first year. Predictably, the token’s price plunged by up to 97% within a year of its launch, largely due to the ill-managed vesting schedule.

Of course there might have been other factors at play in this drastic fall, but high inflation undoubtedly contributed to the sharp drop.

Here is how the price chart of Cryowar looks today:

Historical price of “Cryowar” 2021/11/16 to 2023/06/14

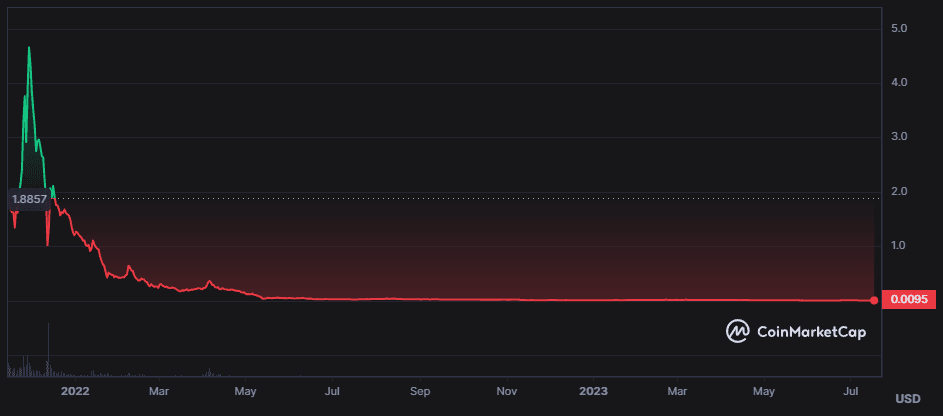

“Defina Finance”

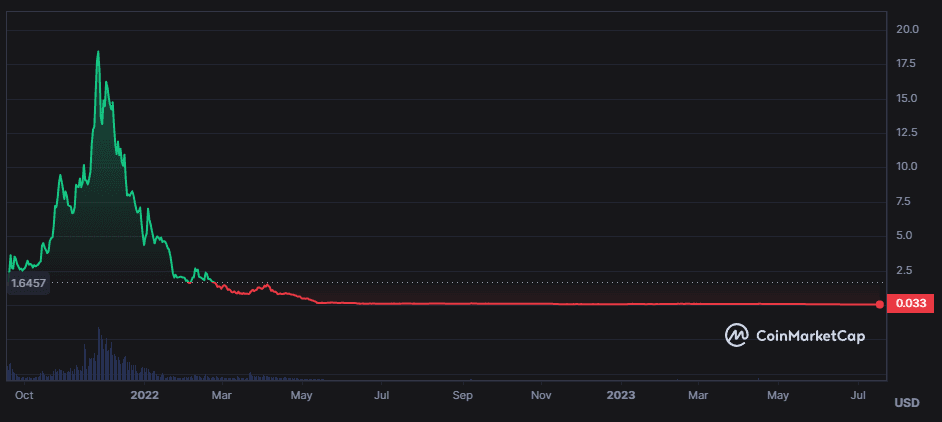

Another instance of destructive inflation is “Defina Finance,” which experienced a 1677% inflation in its first year.

From its launch to the end of the first year, the project’s value plummeted by a staggering 98%, even surpassing the drop seen in “Cryowar”.

Here is how the price chart of Defina Finance looks today:

Historical price of “Defina Finance” 2021/10/12 to 2023/06/14

“Thetan Arena”

Probably the worst hyperinflation title goes to the project called “Thetan Arena”, which suffered a 1705% year 1 inflation.

From its all-time high, this project’s has lost more than 99.83% of it’s value, from $18 to just $0.03.

While the bear market definitely contributed to some of the dilution, the majority came from poorly managed, high inflation vesting schedule.

Here is how the price chart of Thetan Arena looks today:

Historical price of “Thetan Arena” 2021/09/17 to 2023/06/14

All of these projects appear to be inevitably doomed due to three reasons previously discussed. The immense devaluation of their tokens has made them unappealing to both existing and potential investors.

The lost trust and credibility cannot be recovered, which is a crucial element in the success and longevity of any crypto project.

In retrospect, a well structured and sustainable token design could have helped in avoiding these issues.

However, at this stage, it seems that the opportunity for such corrective measures has passed and it is unfortunately too late to reverse the fate of these projects.

Conclusion

In short, poorly managed token designs will cause high inflation rates, which lead to severe consequences, like token devaluation, threats to projects sustainability, and the loss of investor confidence.

A high inflation rate causes a surplus of new tokens into the open market, leading to a decrease in their value, with investors rushing to sell before further depreciation.

Furthermore, releasing tokens too quickly can result in a lack of tokens for future allocation, reducing the motivation of team members and investors to contribute to the project’s growth and success.

Case studies like “Cryowar”, “Thetan Arena” and “Defina Finance” highlight how high inflation can cause significant devaluation and loss of investor trust, emphasizing the importance of well-thought-out tokenomics design for the longevity and success of your crypto project.

Further reading and Services

Thank you for taking the time to read about the severe impacts of high inflation in cryptocurrency projects. We hope this has given you valuable insights into the potential pitfalls of ill-structured token designs.

To dive deeper into this topic and explore our range of services, we invite you to check out our other articles and offerings:

Understanding Tokenomics Design Through Models:

Key Tokenomics Issues Explained:

Our Services:

Domas Golysenko

Research Department Lead