Domas Golysenko

Game theory, in its essence, is the mathematical study of strategic interactions where the outcome of an individual’s decision depends on the choices of others.

It finds numerous applications in the fields of economics, computer science, politics, and even biology. In a standard game theory model players, strategies, and payoffs are the primary elements used to get the best possible outcomes for all the players (also called a Nash Equilibrium).

Each player chooses their strategy based on a set of possibilities and their understanding of the other player’s potential choices. The payoff is the result of the interactions based on the selected strategies.

Game Theory and Crypto

In the context of tokenomics design for crypto projects, game theory offers an innovative framework to evaluate and create mechanisms that incentivize desirable behavior and deter malicious actors.

Given the decentralized and often anonymous nature of the crypto space, where individual participants act out of self-interest, game theory’s strategic thinking becomes especially crucial.

Game theory can help predict possible responses from the market and the network participants to various tokenomics elements such as rewards, penalties, or token burns.

By setting up these elements in a way that the most beneficial course of action for the participants aligns with the project’s overall objectives, we can encourage a prosperous and healthy ecosystem.

How We Apply Game Theory in Our Token Designs

To establish a robust tokenomics model, we incorporate game theory with a particular emphasis on critical factors like incentive structures and potential attack vectors.

As an example, we can design incentive mechanisms using game theory by assigning different payoff structures to actions such as staking tokens, providing liquidity, or participating in governance.

The aim is to make the most rewarding actions align with behaviors that contribute to the project’s success and the network’s security. This could mean higher rewards for long-term staking to encourage holding or more rewards for governance participation to encourage decentralization and community involvement.

Similarly, we can utilize game theory to identify and defend against potential attack vectors. By understanding attacker’s possible strategies and their associated payoffs, we can adjust our design to make attacks costly, risky, or ideally, irrational.

Game Theory Model Example

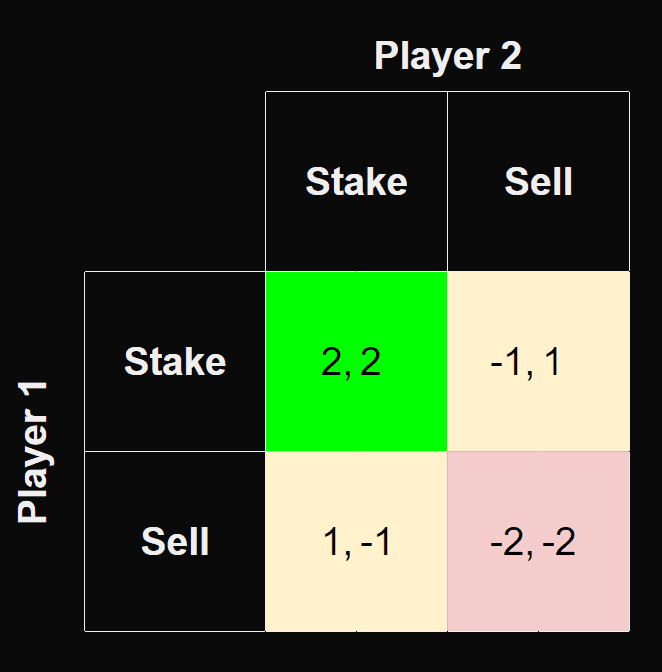

This game theory matrix illustrates the potential outcomes of two strategic decisions in a crypto ecosystem: staking or selling tokens. Here’s what each scenario could mean for the players (token holders) and the cryptocurrency’s price:

Best Outcome (Nash Equilibrium)

Both Players Stake (Payoff: 2,2): This scenario is beneficial for both players and the overall ecosystem. Staking locks up tokens, reducing the circulating supply, which can drive up the token price due to increased scarcity.

Furthermore, staking often earns rewards, represented here as 2 points, adding an additional incentive for this choice. So when both players know that if they both stake they get the best possible outcome, that is what they will choose to do subconsciously.

Worst Outcome

Both Players Sell (Payoff: -2,-2): When both players sell, it increases the token supply in the market, which can lead to a decrease in token price due to oversupply.

Moreover, frequent selling could discourage long-term holding and stability, which is reflected in the negative payoff for both players.

In this scenario, it’s logical that if all the holders decide to sell they will lose money and drag the price of the token down. (That’s what happens during a bear market)

Zero-sum Games

A zero-sum game is a situation in game theory where the total benefits to all players in the game add up to zero. In other words, one player’s gain is another player’s loss.

Player 1 Sells, Player 2 Stakes (Payoff: 1,-1): If Player 1 sells while Player 2 stakes, Player 1 might benefit in the short term, particularly if the price drops after the sale (thus the 1 point).

However, this will be at the expense of Player 2, who chooses to stake and may face a short-term loss due to the decrease in token price caused by Player 1’s selling (hence the -1 point).

The same is true for the last game (Payoff: -1,1) where players switch their places.

The Takeaway:

The matrix provides a way for the players to understand their potential payoffs based on not only their own choices but also the choices of others.

It demonstrates the strategic interdependencies between players’ actions in a token ecosystem, underscoring how collective actions can significantly influence token price and overall ecosystem health.

Final Thoughts

Game theory is just one of many powerful instruments in our diverse toolbox at BlackTokenomics.

Our unique blend of strategic models, including but not only Monte Carlo simulations and the Quantity Theory of Money (QTM), enables us to craft superior tokenomics designs with precision and insight.

Need Expert Guidance?

Our Expert Tokenomics Consulting service offers personalized advice from seasoned professionals.

For those looking to refine their existing model, our rigorous tokenomics auditing service is here to help you optimize.

In essence, BlackTokenomics is your all-in-one solution for all your tokenomics needs.

Domas Golysenko

Research Department Lead