Tokenomics Design

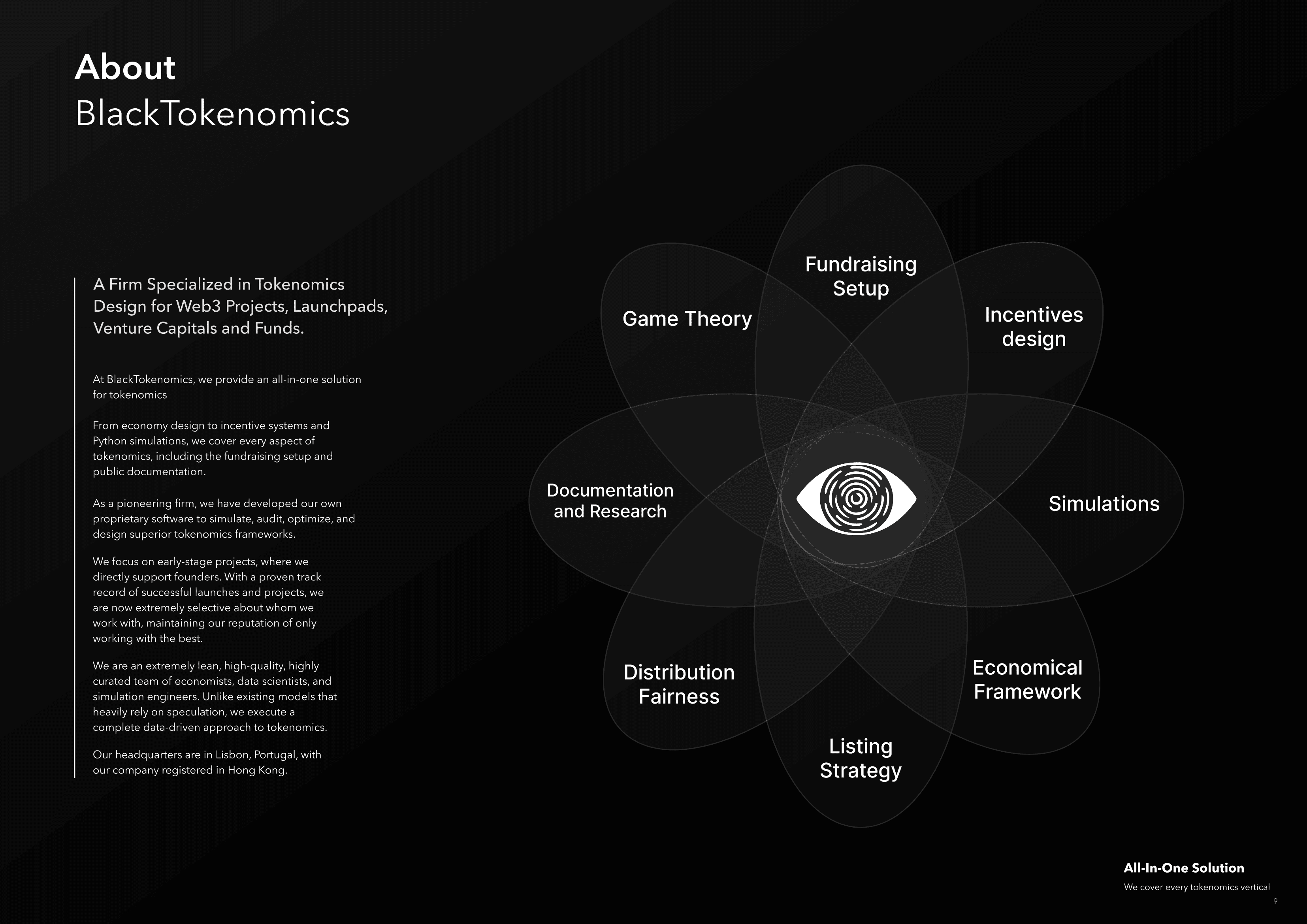

Our tokenomics design program is for projects that are starting from zero ground or those looking to improve their existing model. It includes an all-in-one solution for tokenomics, from economy design to incentive systems and Python simulations, we cover every aspect of tokenomics, including the fundraising setup and public documentation.

Game Theory

Zero to One

Python Simulation

Fundraising

Documentation

Audit

Incentives System

Your all-in-one solution

for your tokenomics, from

fundraising and documentation

to simulations and incentives.

1

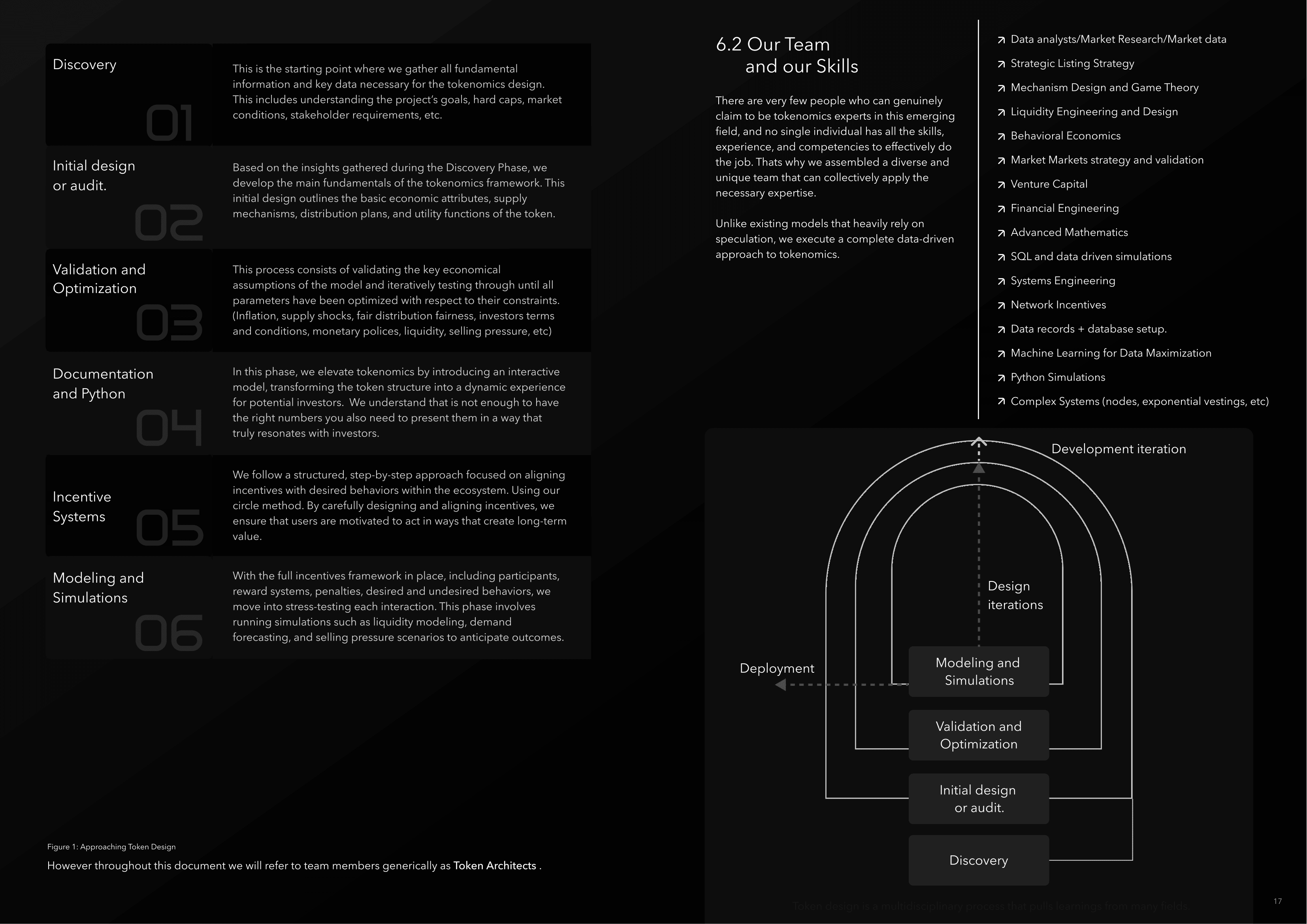

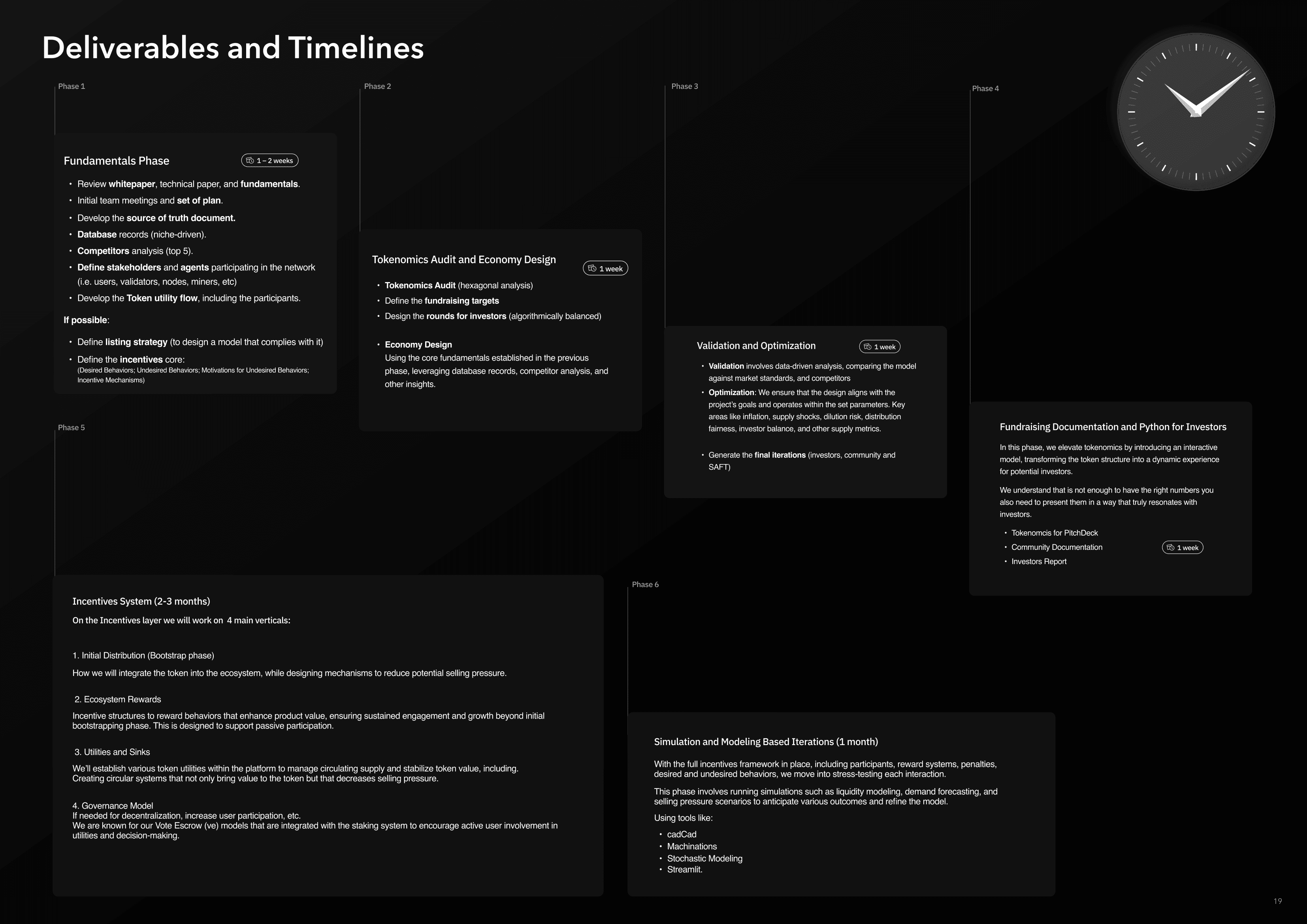

Discovery and Fundamentals

2

Audit and Economy Design

3

Validation and Optimization

4

Documentation and Fundraising Models

5

Incentives System Design

6

Simulations, Modeling and Iterations

The first four phases are completed within 30 days.

While the final two heavy phases may take an additional 1-2 months.

Our Step by Step Process

Discovery

In the Discovery and Fundamentals phase, we lay the groundwork for the tokenomics model by reviewing core documents (whitepaper, technical paper) and holding initial team meetings to set the fundamentals and a clear plan.

We establish a source of truth document and conduct niche-specific research, including a top 10 competitors analysis.

This foundational approach ensures all essential elements are captured for the next phases of tokenomics design

Tokenomics Design or Audit

If a tokenomics model is already in place, we conduct an audit to identify areas for optimization. If no framework exists, and we are working with a client from zero ground we execute the audit after the tokenomics design phase.

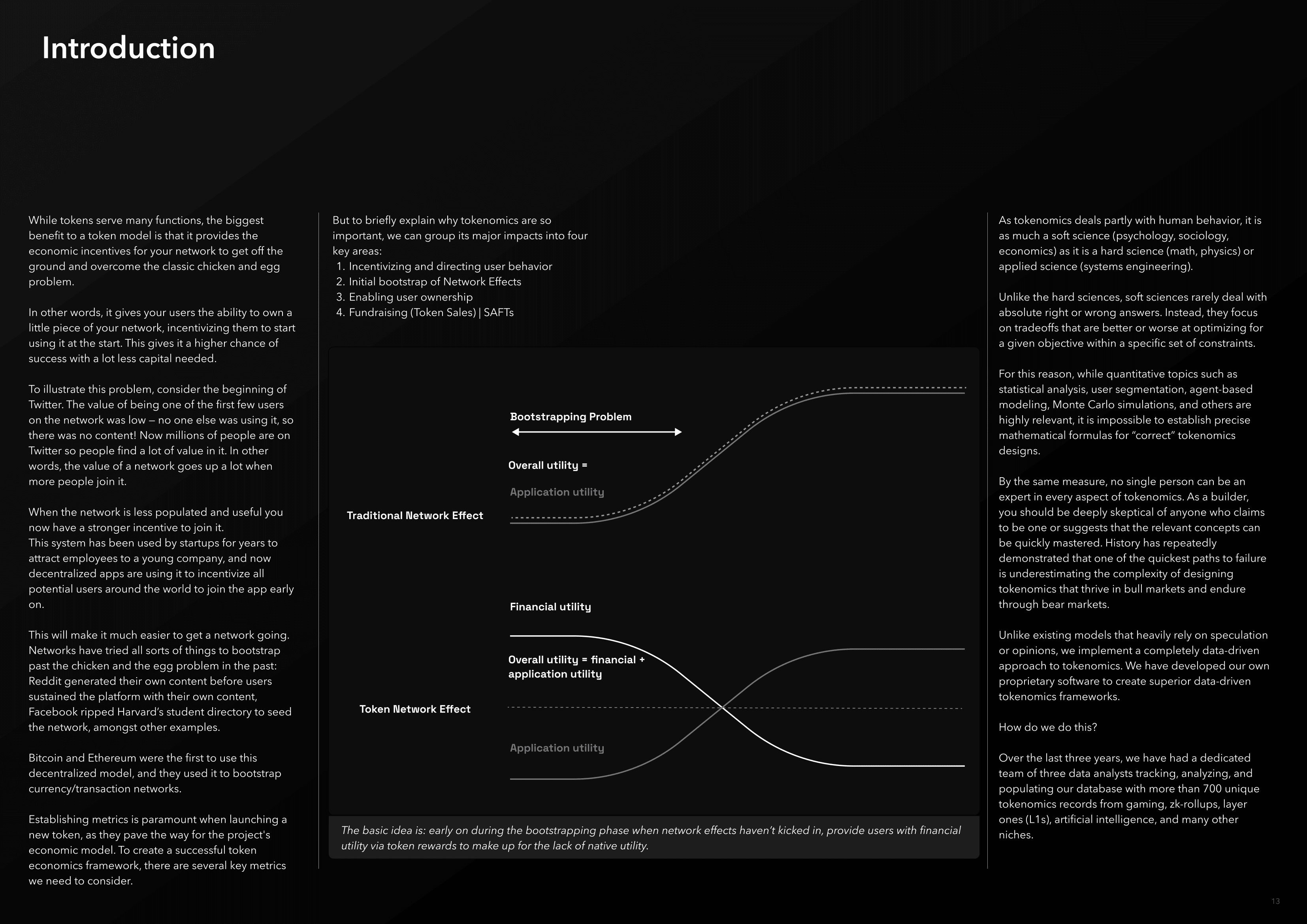

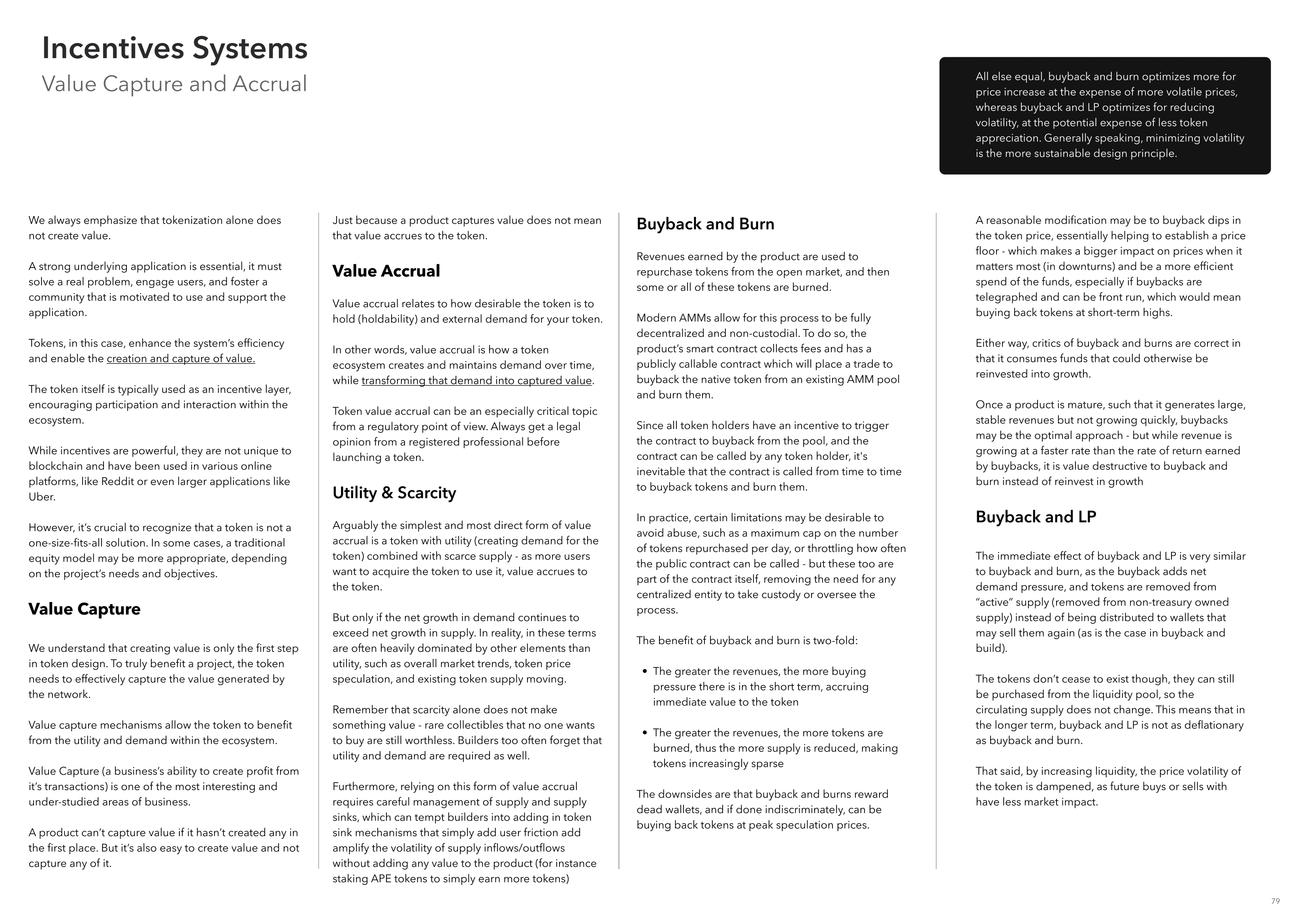

Tokenomics is a multifaceted term that goes beyond simple metrics like a token’s max supply, emissions schedule, or staking yields.

At BlackTokenomics, we design every aspect of tokenomics from governance models and incentive structures to python simulations and compliance listing models.

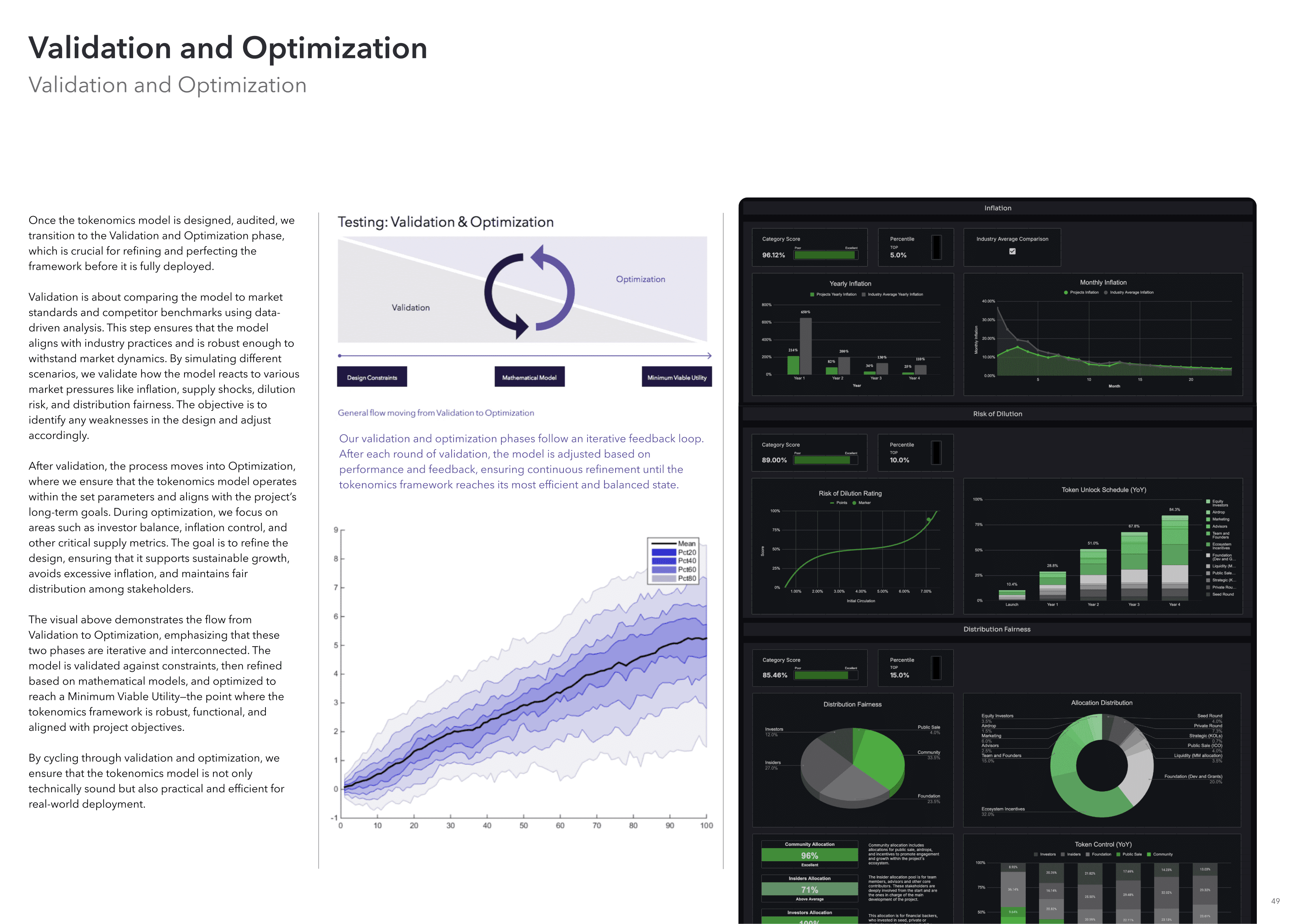

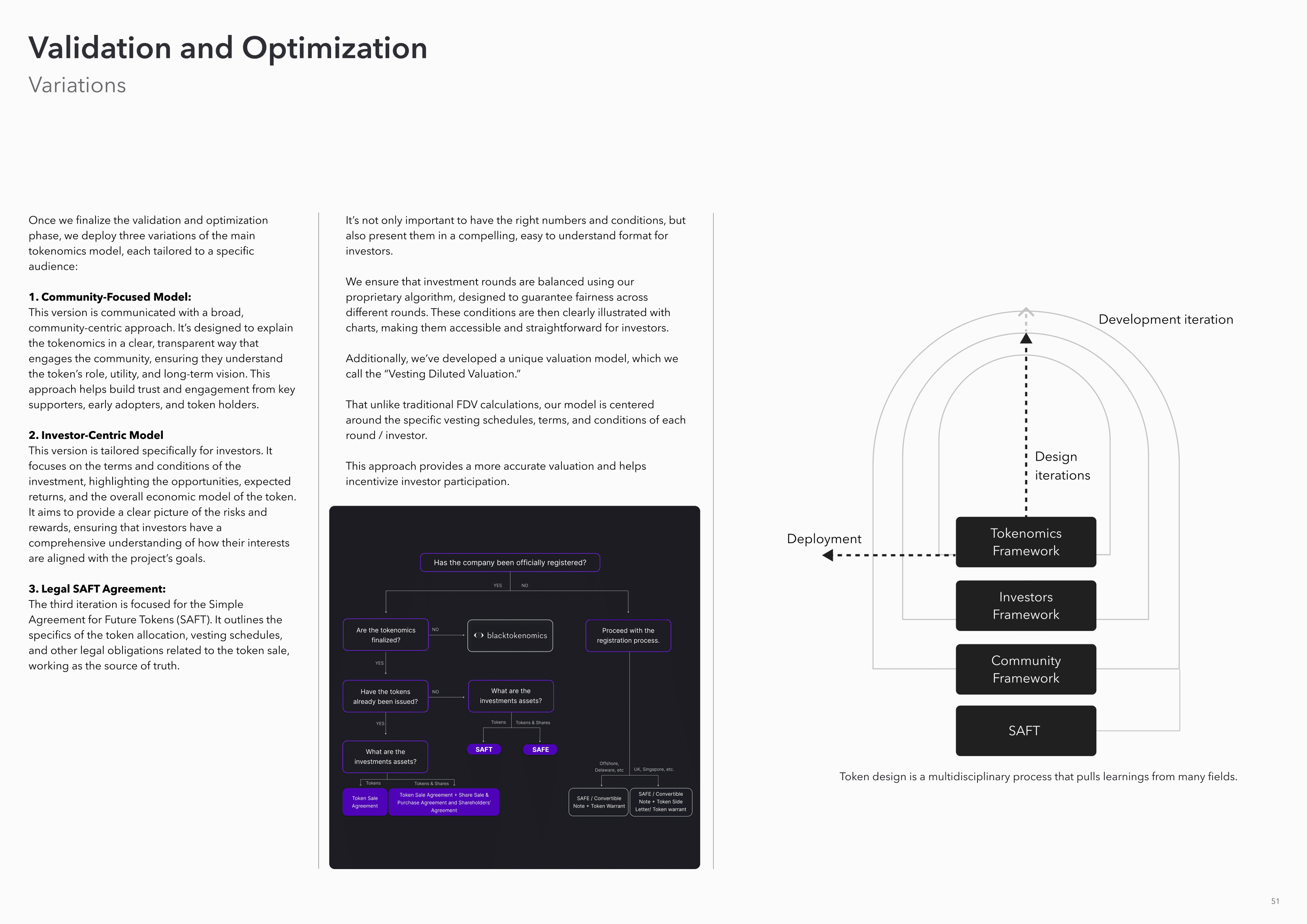

Validation and Optimization

In the Discovery and Fundamentals phase, we lay the groundwork for the tokenomics model by reviewing core documents (whitepaper, technical paper) and holding initial team meetings to set the fundamentals and a clear plan.

We establish a source of truth document and conduct niche-specific research, including a top 10 competitors analysis.

This foundational approach ensures all essential elements are captured for the next phases of tokenomics design

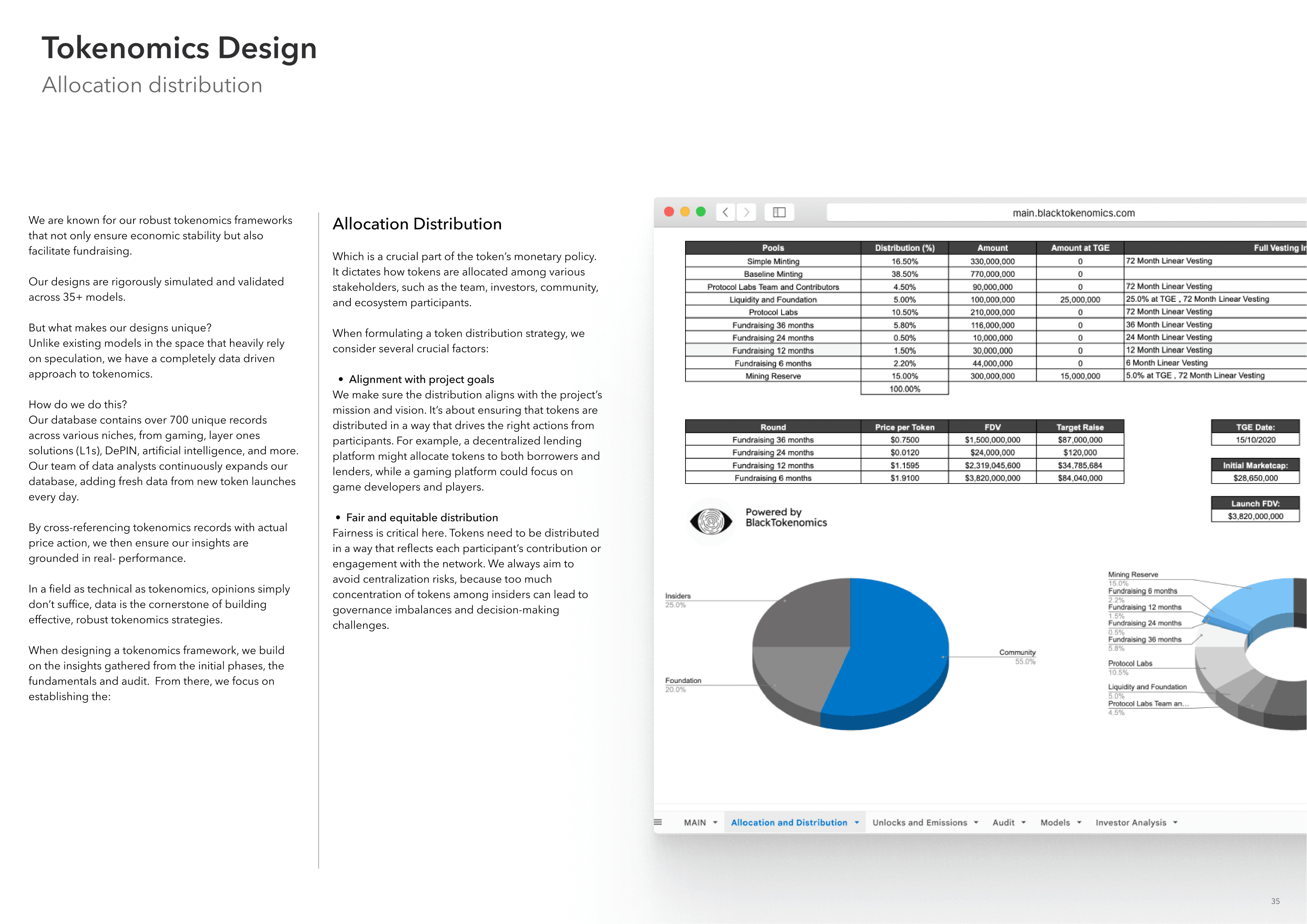

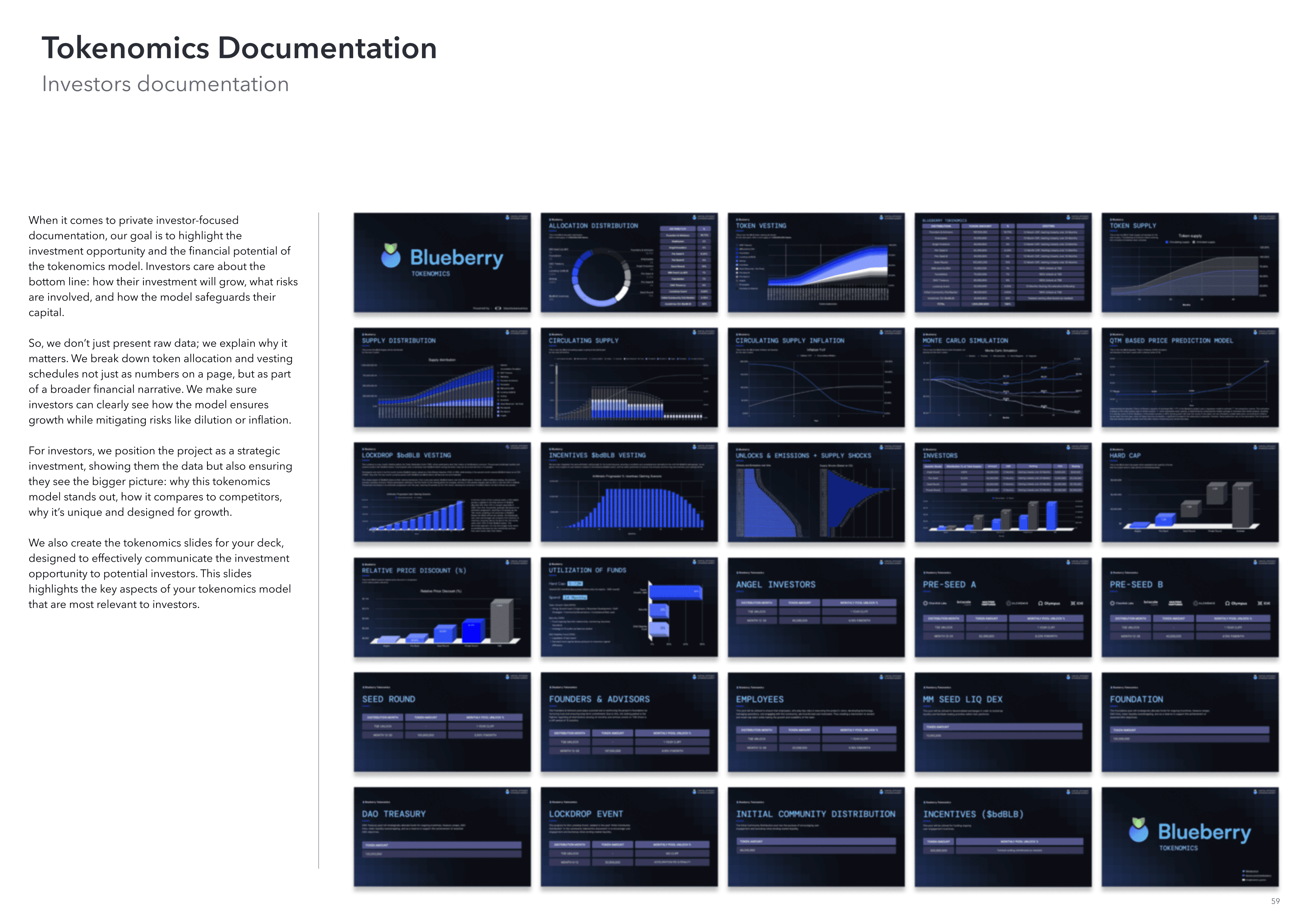

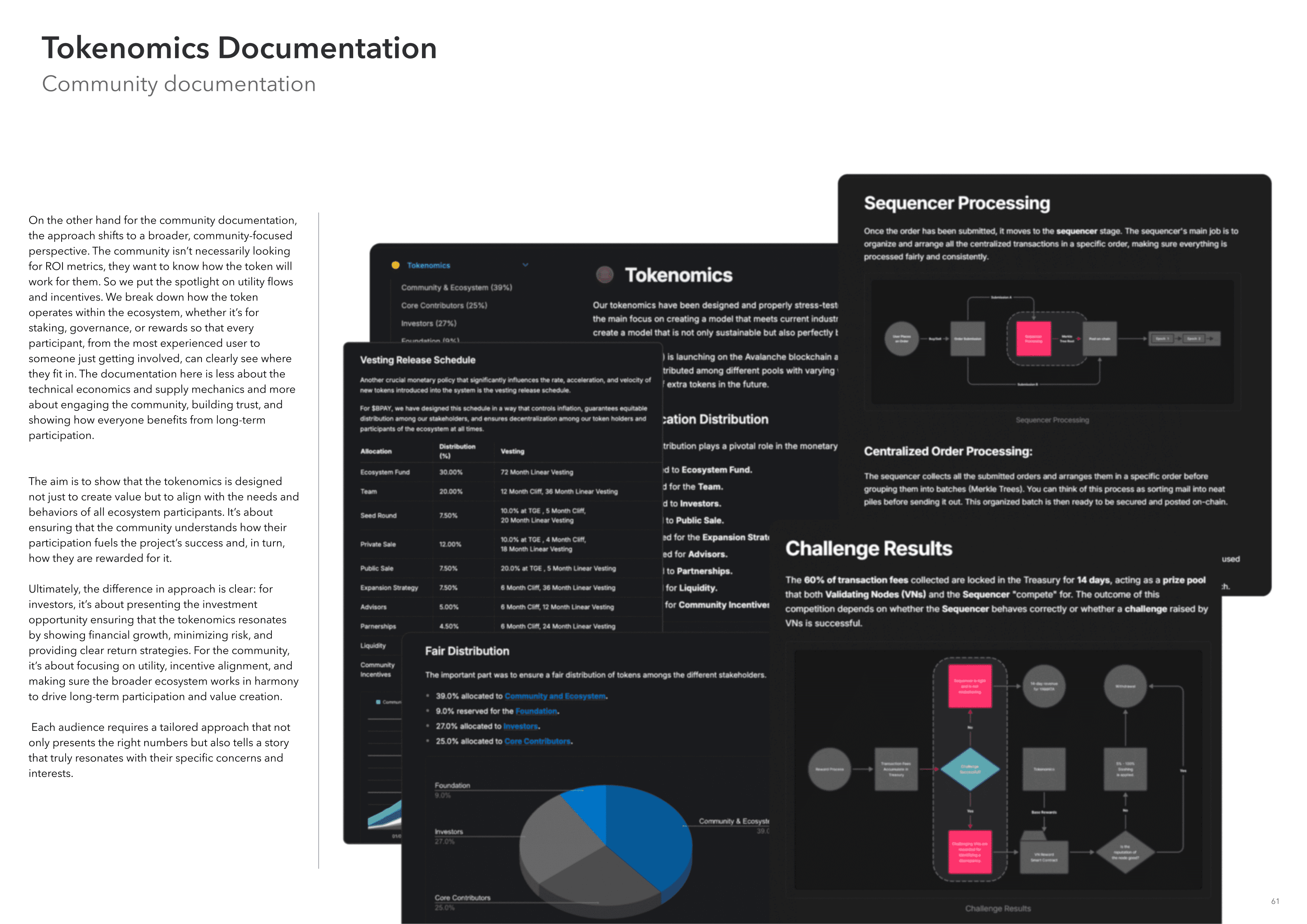

Fundraising Documentation

When it comes to documentation, our goal is to highlight the investment opportunity and the financial potential of the tokenomics model. Investors care about the bottom line: how their investment will grow, what risks are involved, and how the model safeguards their capital.

We understand that it’s not enough to have the right numbers; we also need to present them in a way that truly resonates with investors.

We develop the:

A) Tokenomcis PitchDeck Slides

B) Community Documentation;

C) Investors reports and documentation.

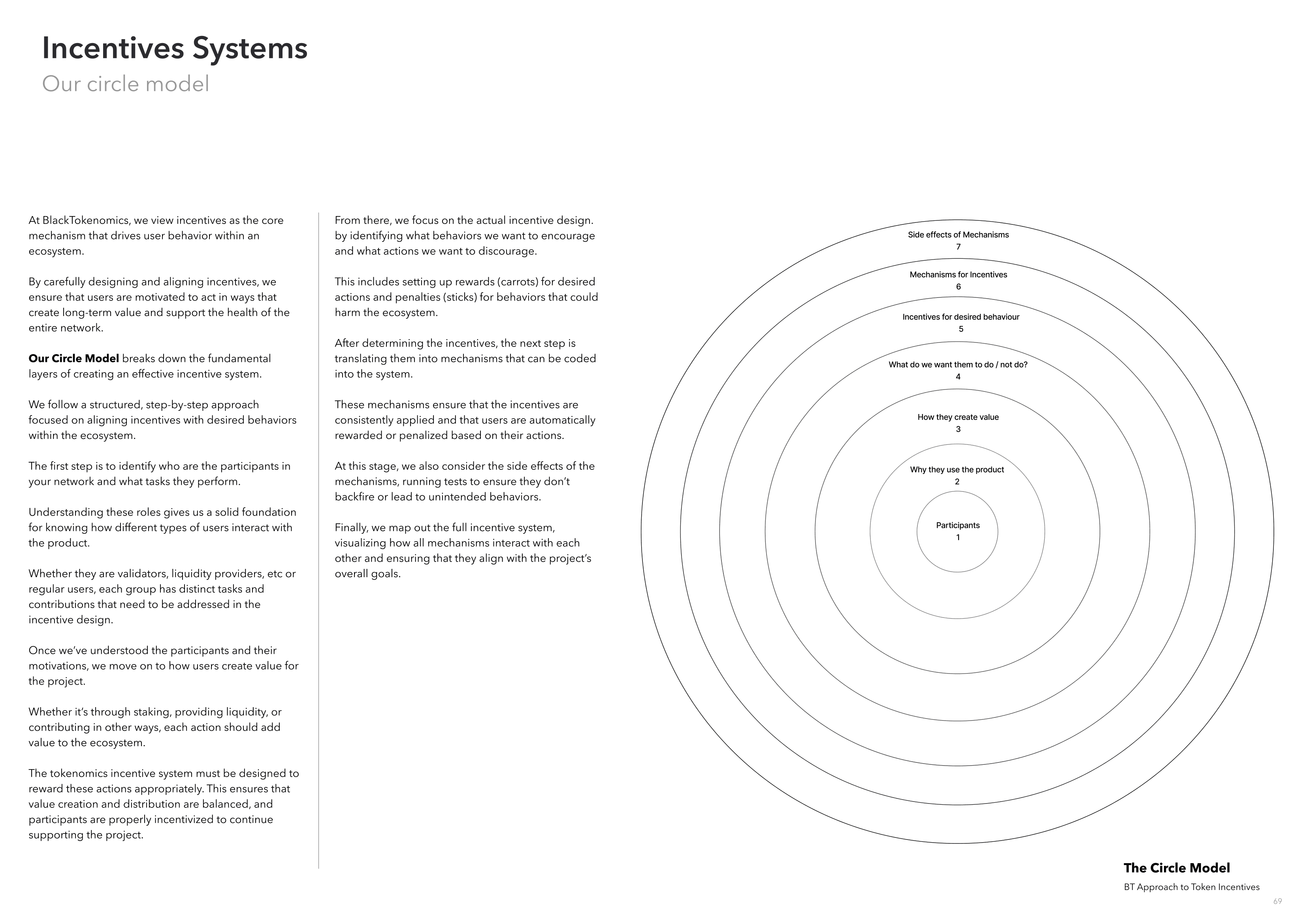

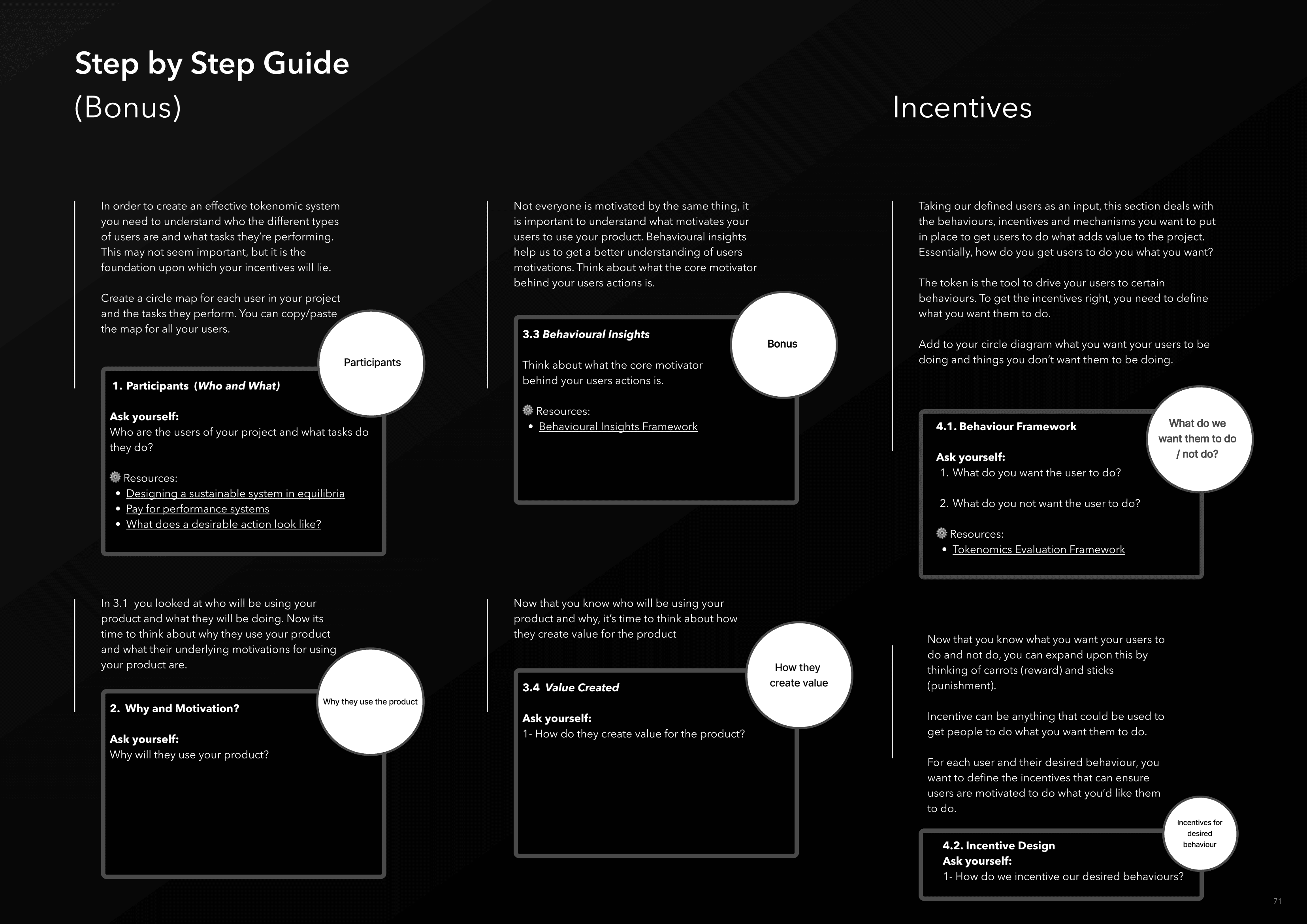

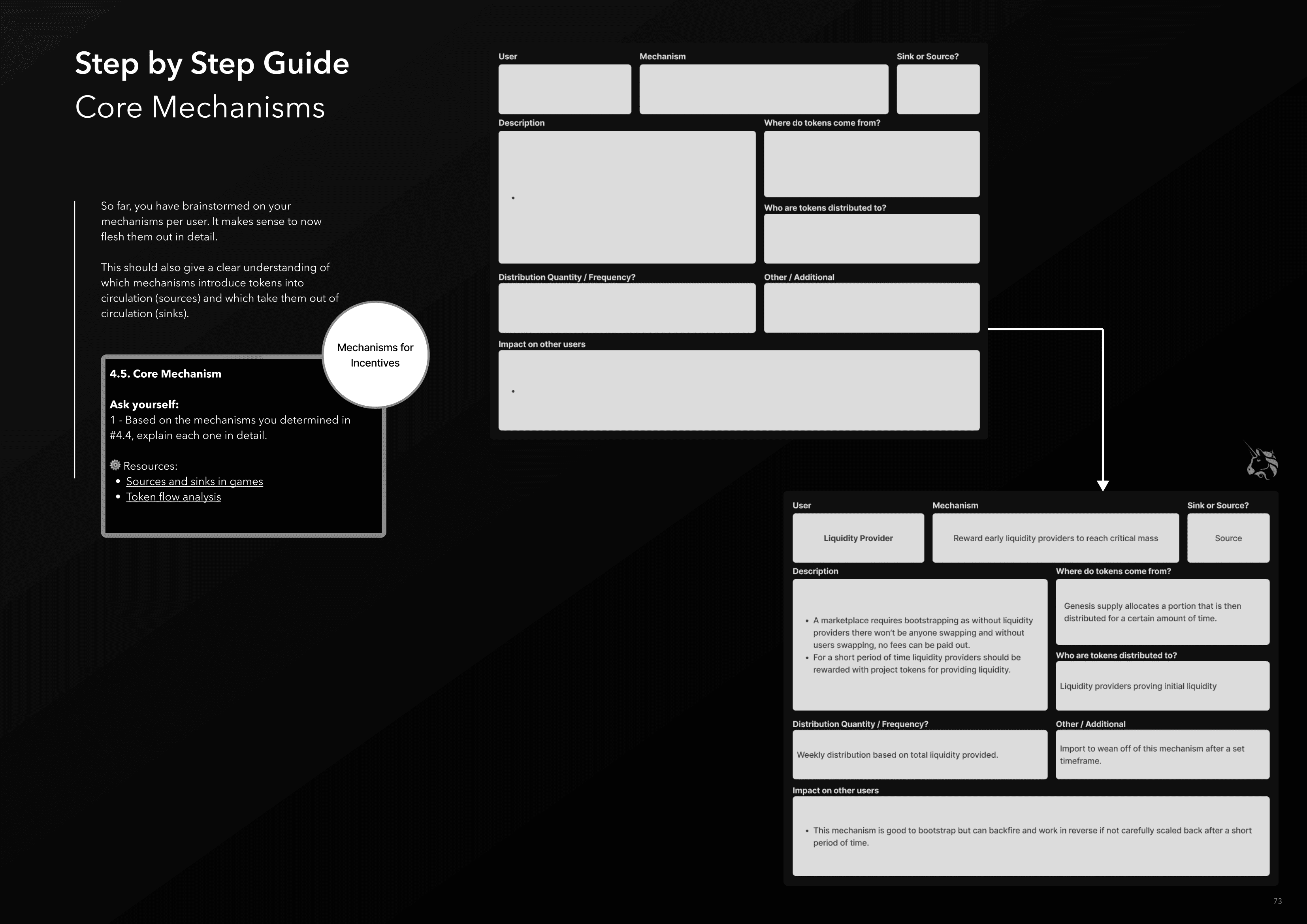

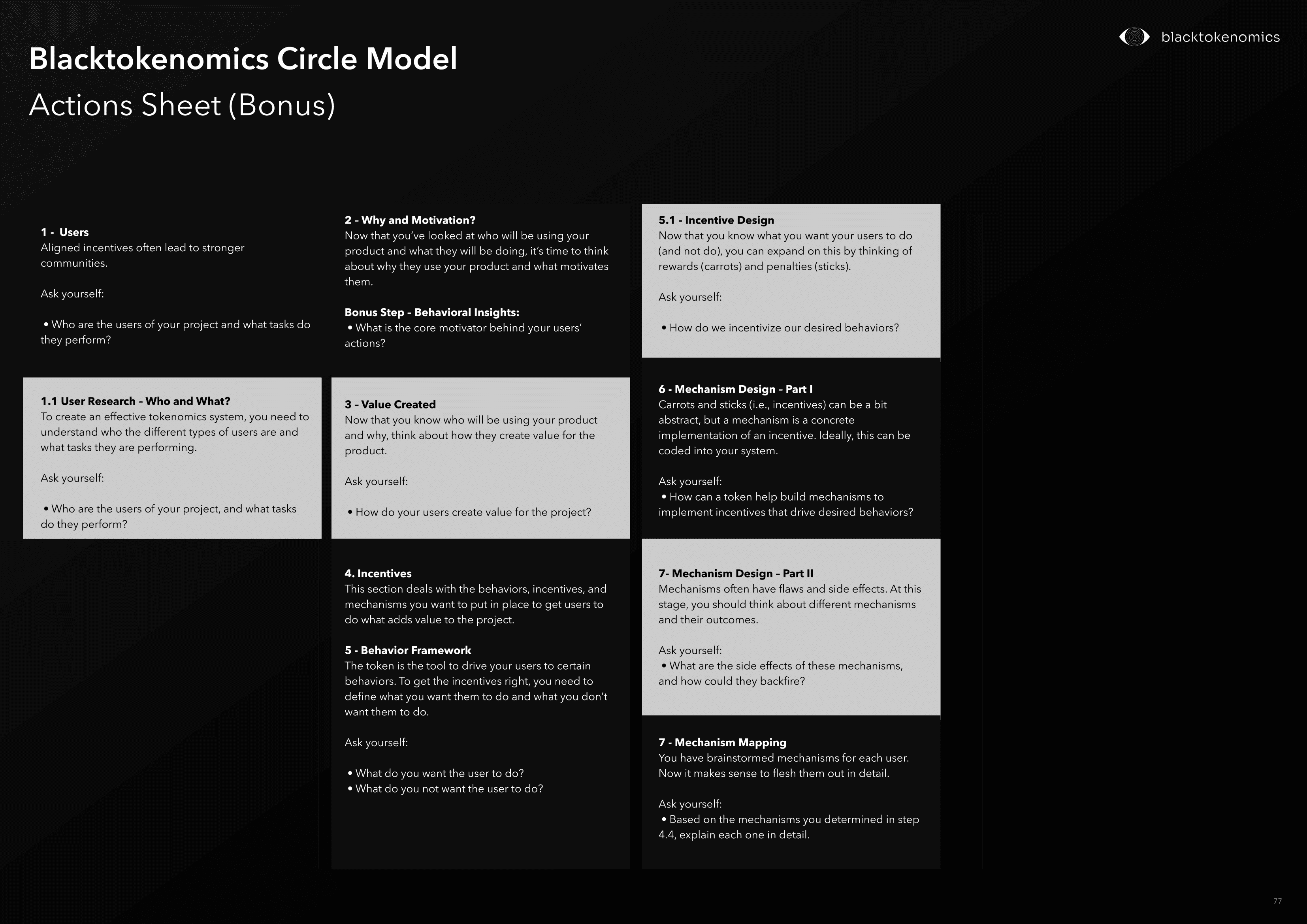

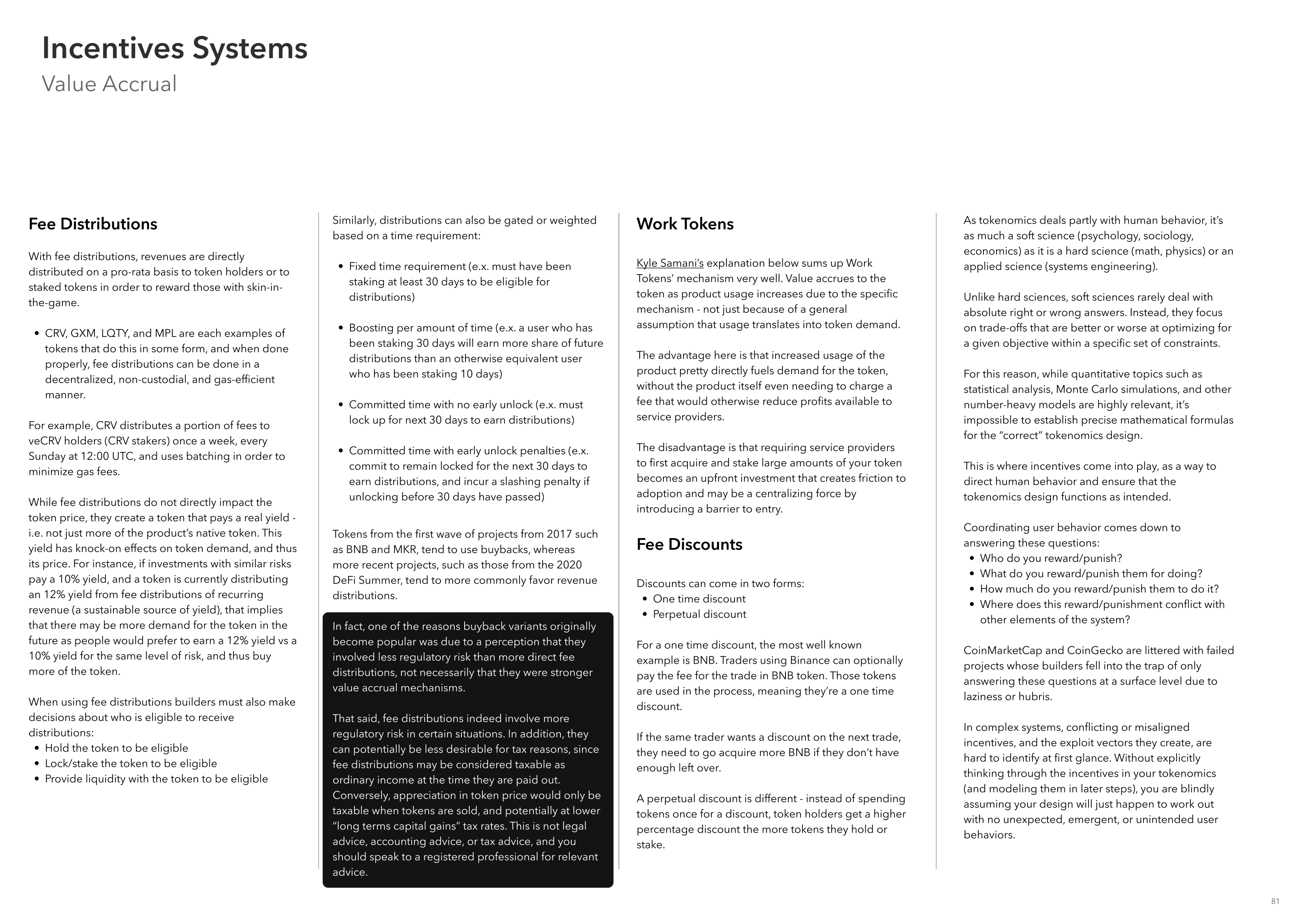

Incentives System

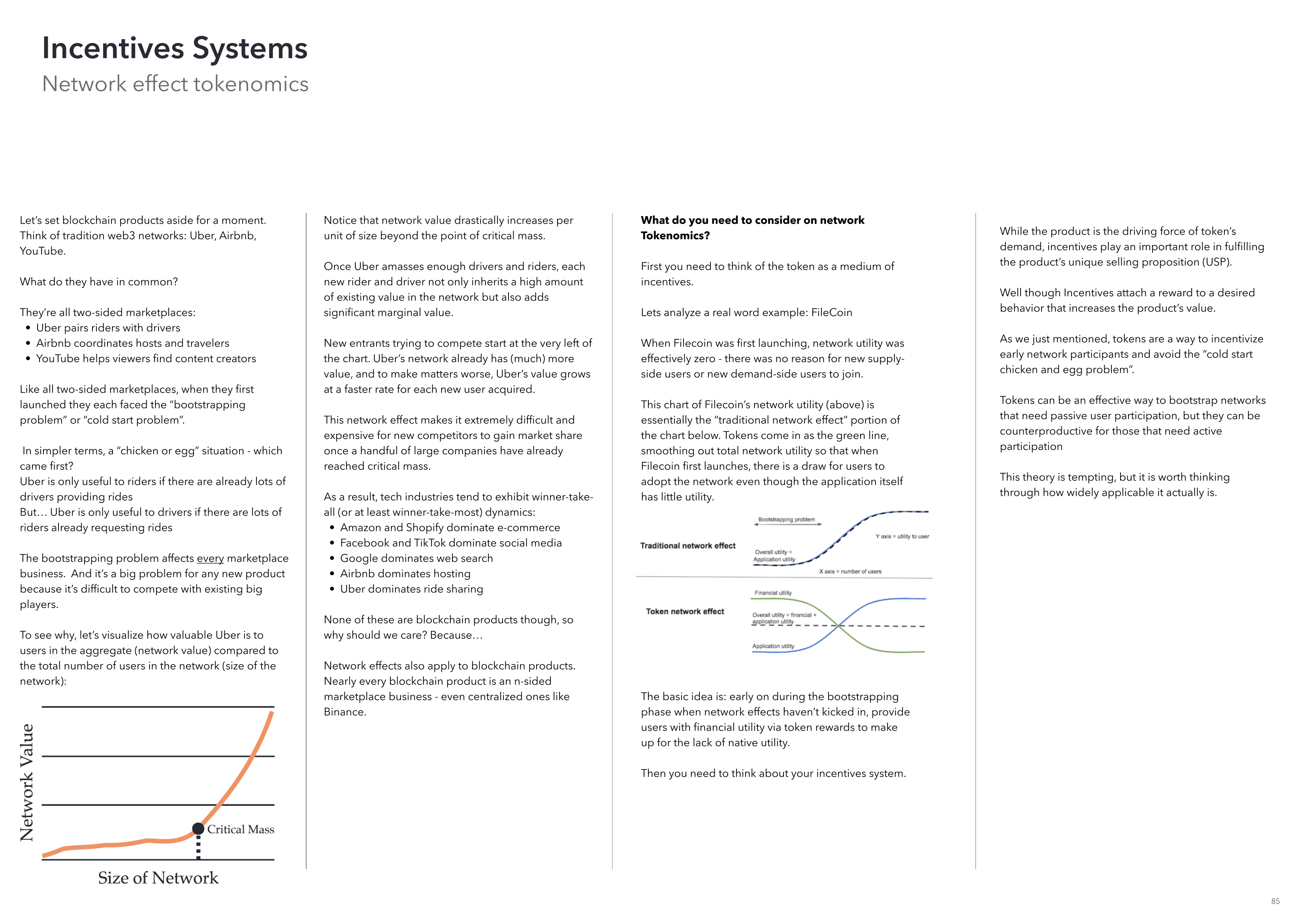

Our Incentive Systems design focuses on four key areas.

First, Initial Distribution: integrating the token into the ecosystem with mechanisms to reduce selling pressure.

Second, Ecosystem Rewards: incentive structures that reward behaviors enhancing product value, supporting engagement and growth beyond the bootstrap phase, and encouraging passive participation.

Third, Utilities and Sinks: establishing token utilities within the platform to manage circulating supply and stabilize token value, creating circular systems that add value while reducing selling pressure.

Finally, Governance Model: if needed for decentralization, we implement Vote Escrow (ve) models integrated with staking to drive active user involvement in utilities and decision-making.

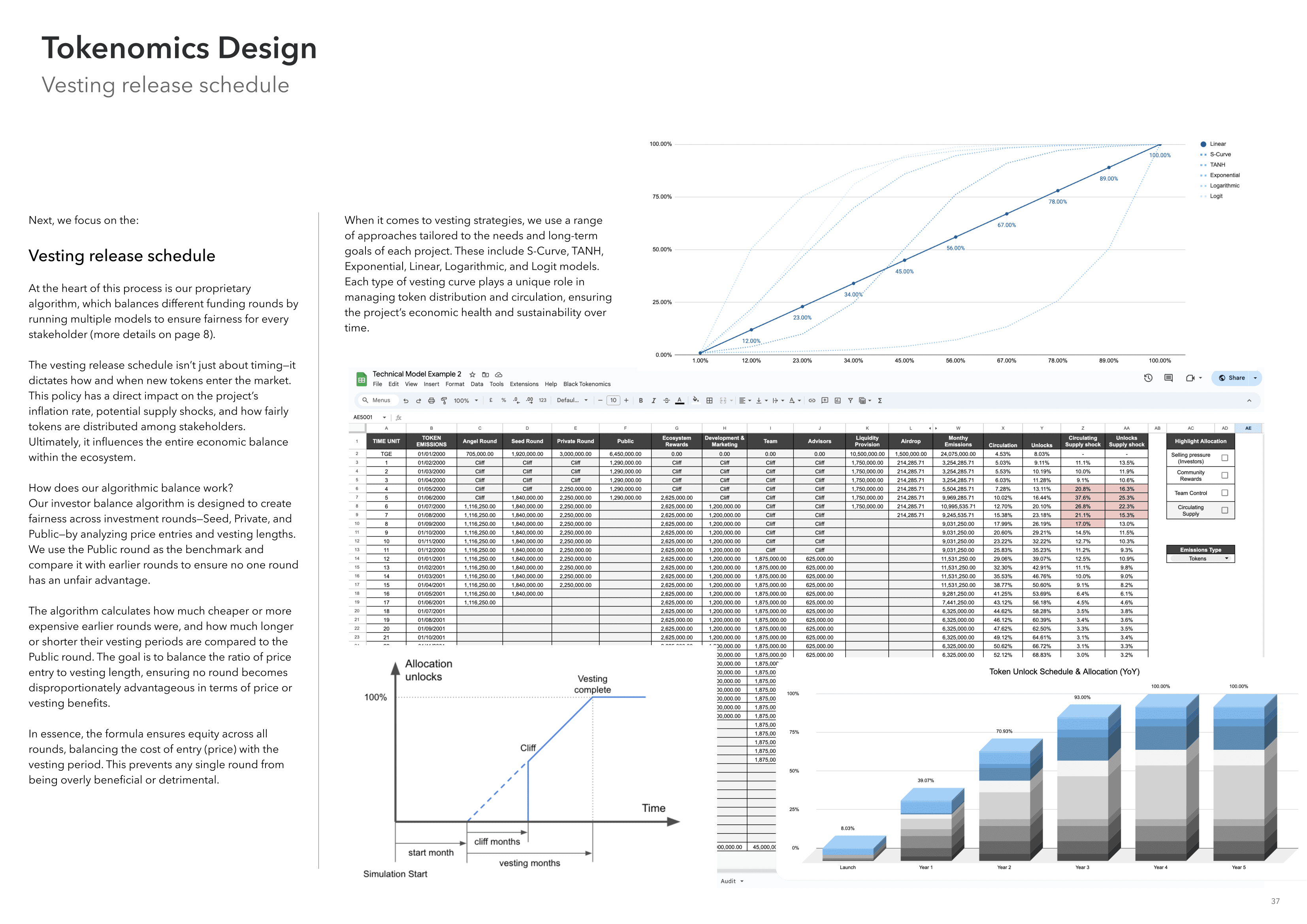

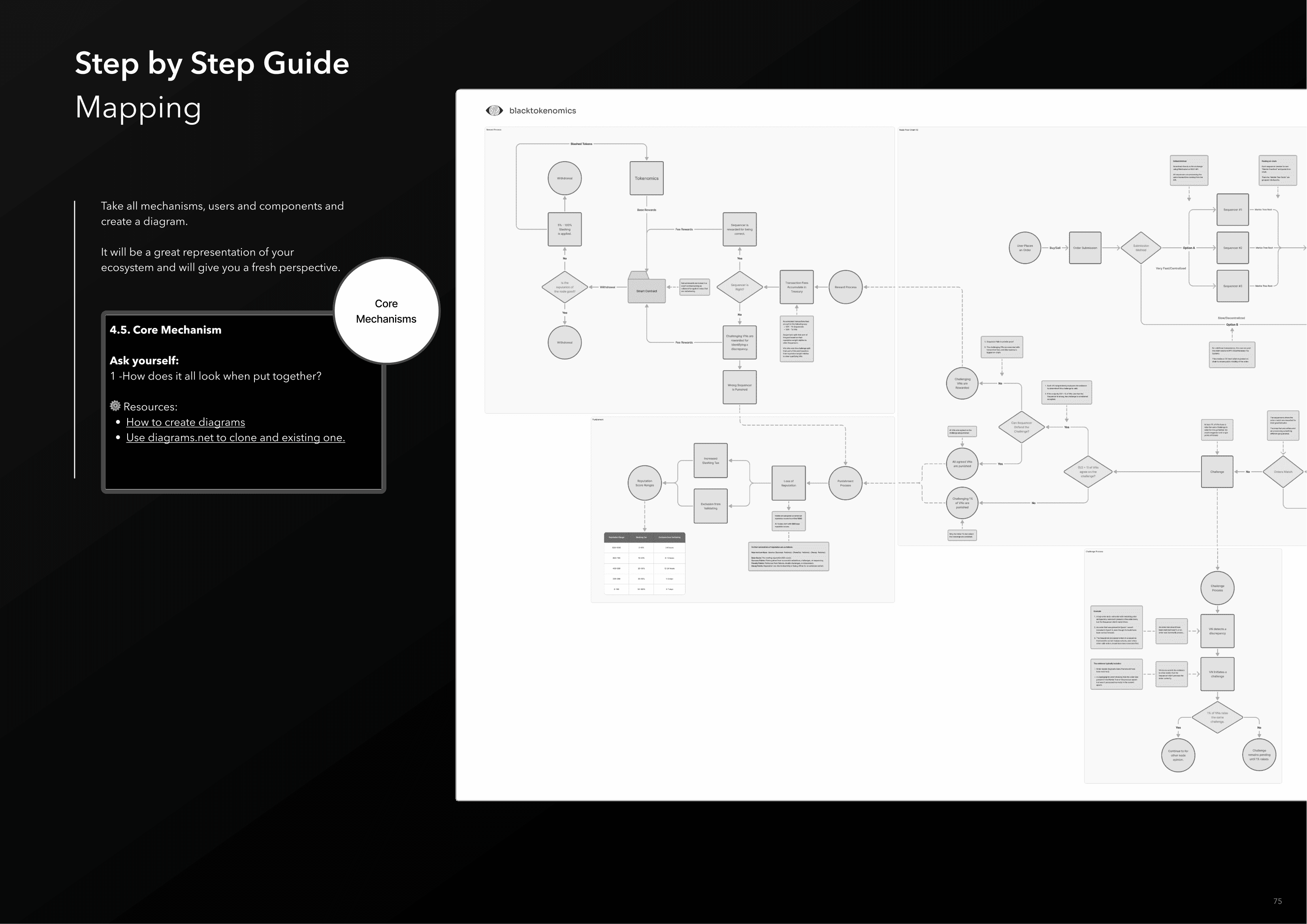

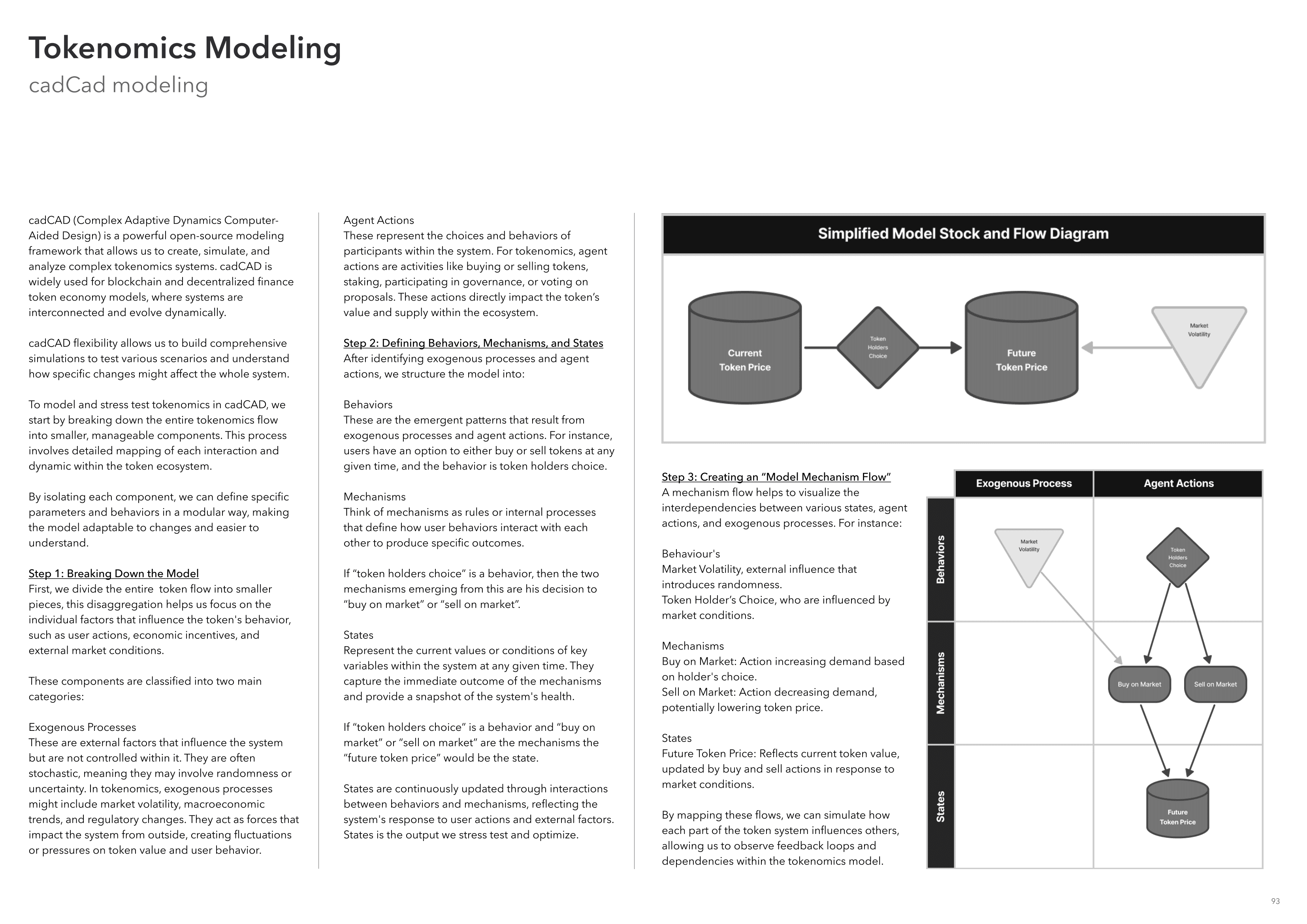

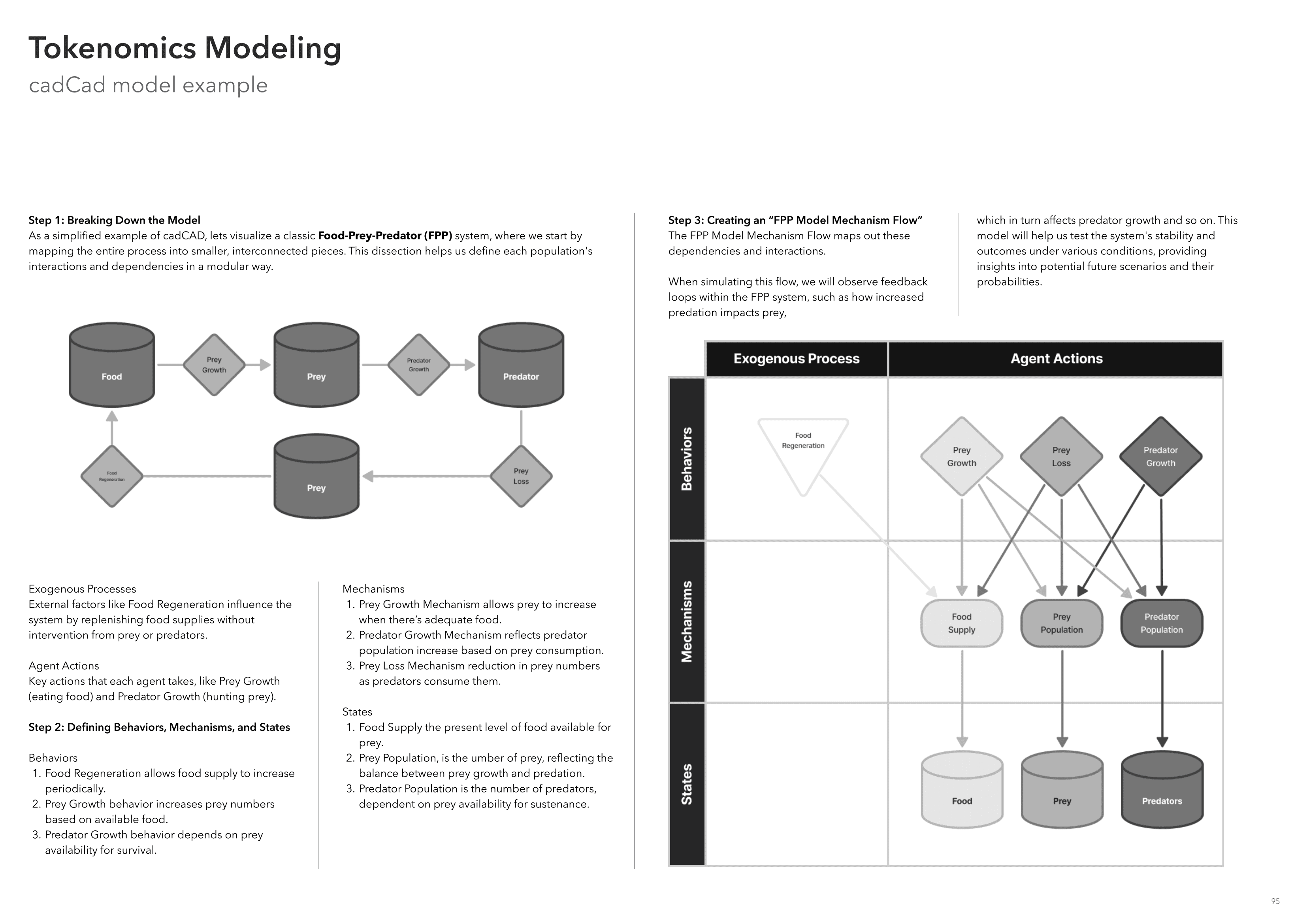

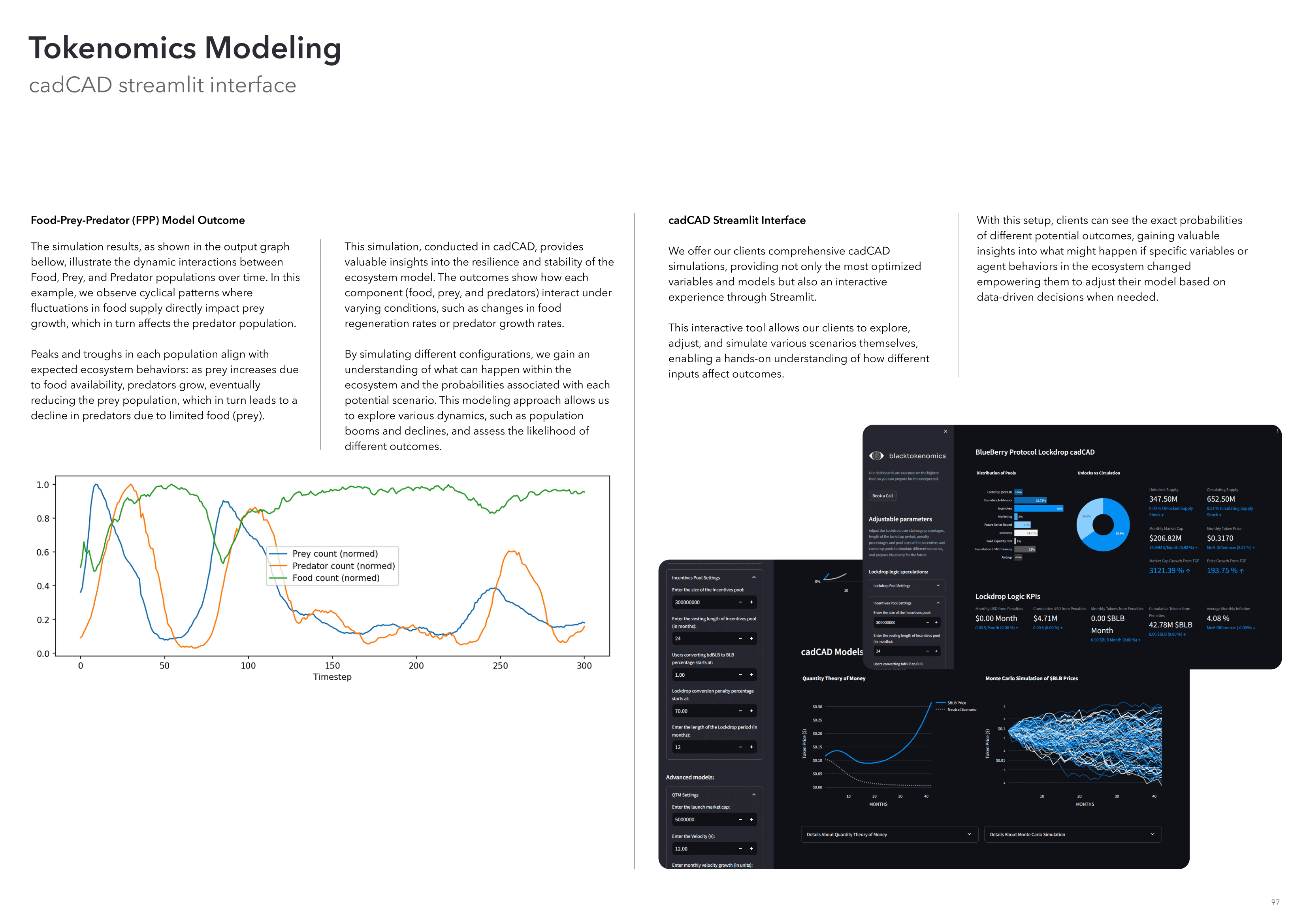

Simulation and Iterations

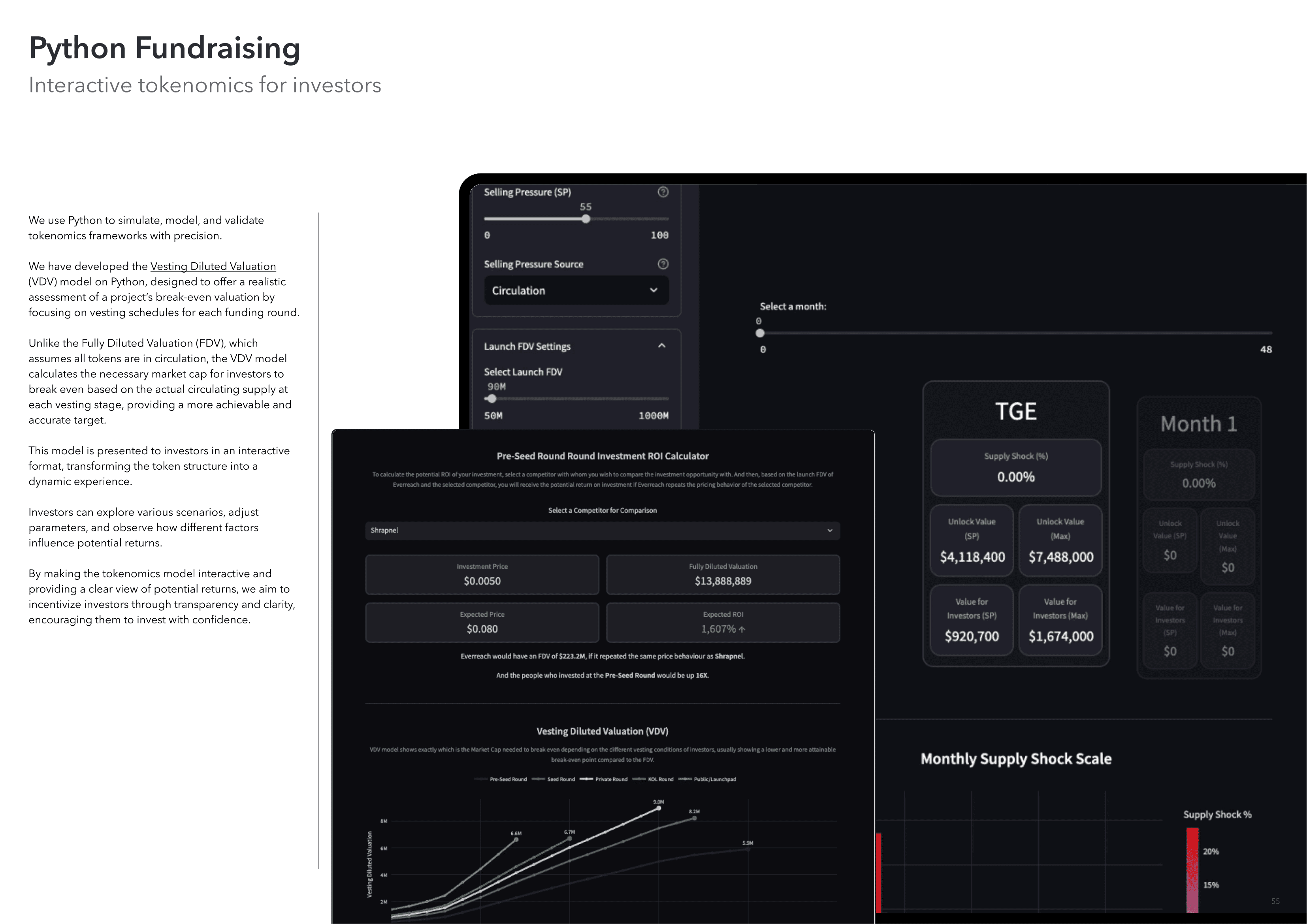

In this phase, we simulate the entire model’s behavior, covering liquidity modeling, demand forecasting, and selling pressure scenarios. This prepares us for various outcomes while validating the tokenomics design through cadCad and stochastic modeling with Streamlit.

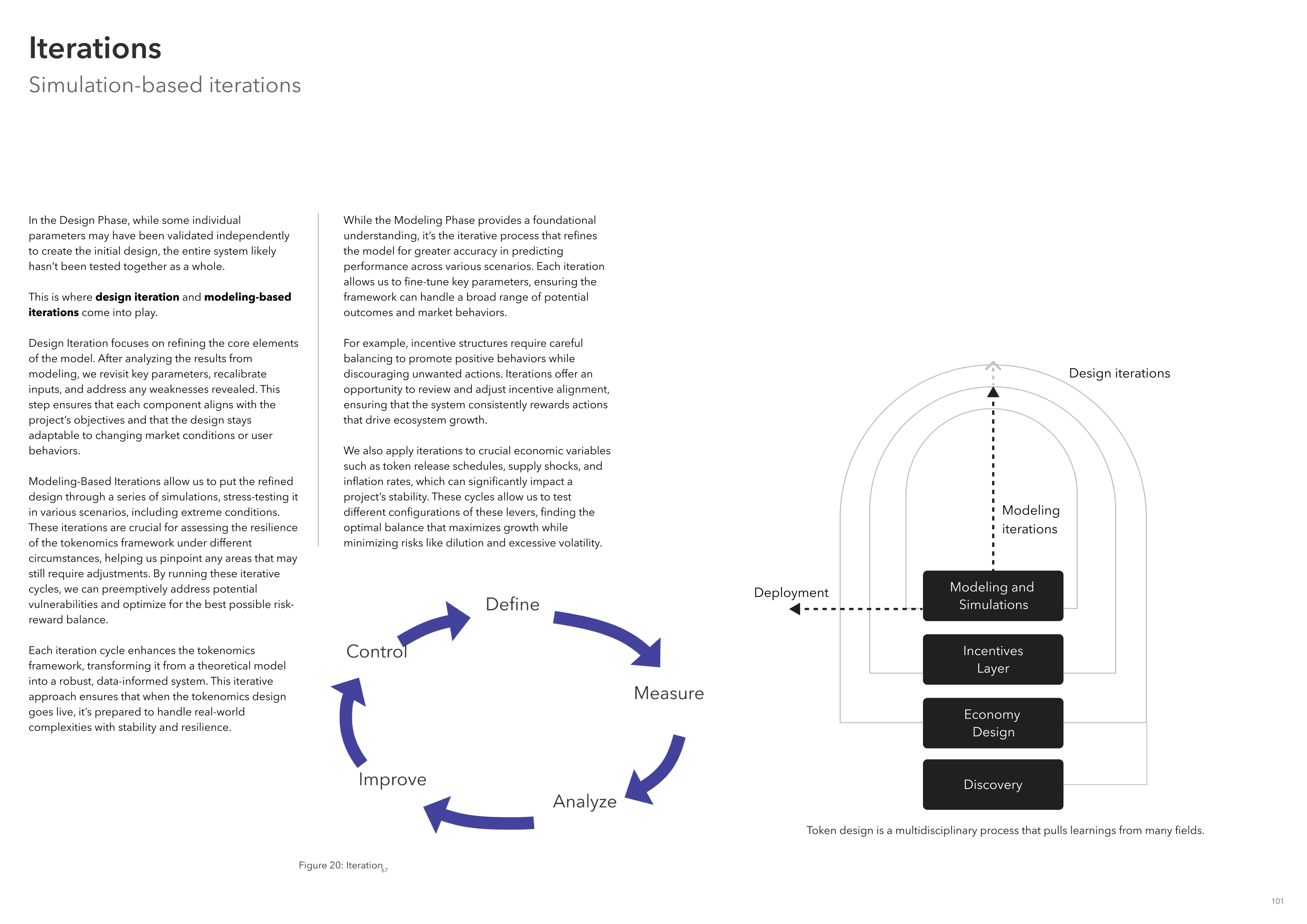

Next, we move to the Iterations Phase, where we build on insights gained from the Modeling Phase to refine and rebalance the tokenomics design. This phase includes two types of iterations: Design Iterations and Modeling-Based Iterations.

Ready to see what our team can design for you?

Explore More of Our Services

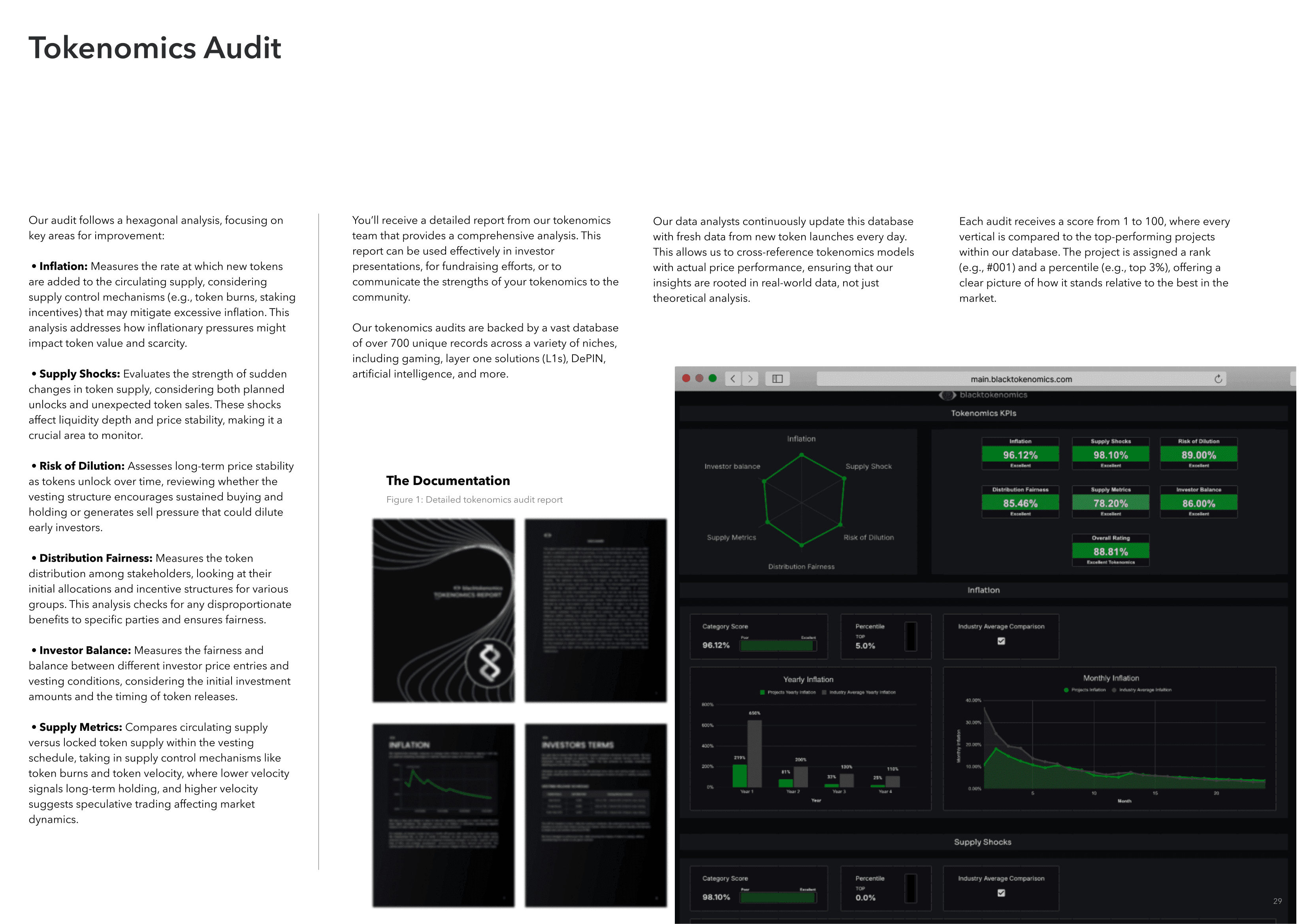

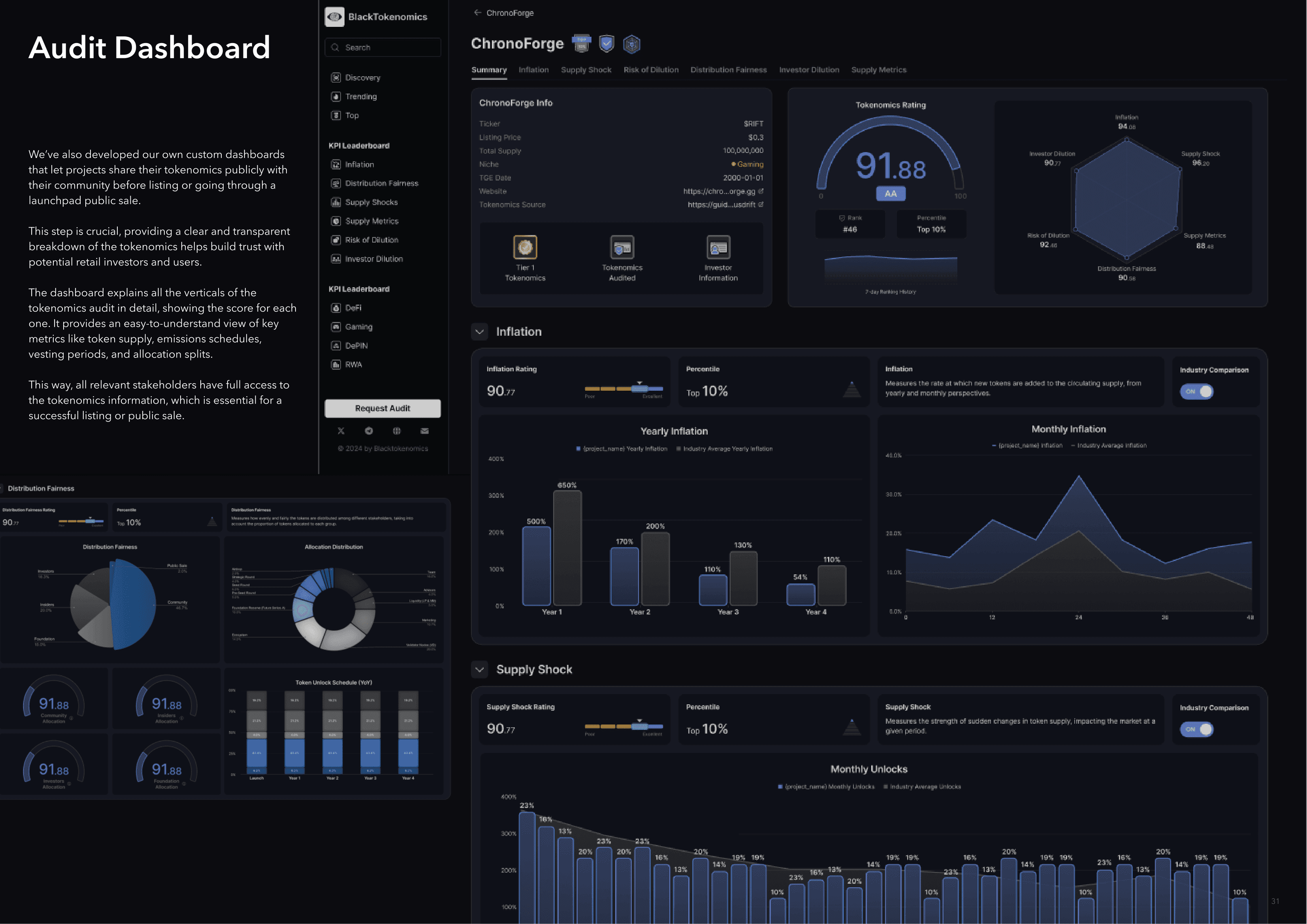

Tokenomics Audit

Inflation

Supply Shocks

Risk of Dilution

Investors Balance

Valuation

Documentation

Tokenomics Fundraising

Distribution Fairness

Fundraising Setup

Valuation

Documentation

Investors Balance

Node System

Tiered or Fixed Price

Data-Driven

Game Theory

Node System Flow

Documentation

Dashboard