Domas Golysenko

The Monte Carlo simulation is a computational algorithm that uses randomness to solve problems. In finance, it’s often used to assess the risk and uncertainty of a given system.

By generating a wide array of possible outcomes, it helps to identify potential risks and devise suitable strategies to mitigate them. The standard Monte Carlo simulation formula is a method of generating random variables based on a set of probability distributions.

By simulating a large number of these variables, the model can create a spectrum of potential outcomes, allowing a thorough analysis of risk and probability.

Monte Carlo Simulation and Crypto

When we employ the Monte Carlo simulation in designing tokenomics for a crypto project, it offers a sophisticated approach to risk assessment and management.

Unlike the traditional financial sector where data history spans years, the nascent nature of cryptocurrencies means a scarcity of past data. Here, the Monte Carlo simulation shines as it does not rely on historical data, but rather on projected possibilities.

Monte Carlo simulation allows us to predict a multitude of potential scenarios based on varied inputs, giving us a more comprehensive view of the crypto project’s potential volatility and returns.

How We Apply the Monte Carlo Simulation in Our Token Designs

To build a robust tokenomics model, we implement the Monte Carlo simulation with a keen focus on key parameters including:

Circulating token supply

Growth per month

Market capitalization

For instance, we may assign different probability distributions to token supply, which could be influenced by factors such as staking rewards, liquidity mining, or token burns.

This gives us a better understanding of how much tokens could be in the circulation if the maximum number of people stake and claim their rewards for example, compared to scenarios where nobody stakes and sells their tokens instead.

So running the Monte Carlo simulation with these varied inputs can generate a wide range of potential outcomes, helping us to assess and understand the token’s volatility and return profiles. These randomly generated outcomes provide us with an array of scenarios, from the most likely to the most extreme.

Example

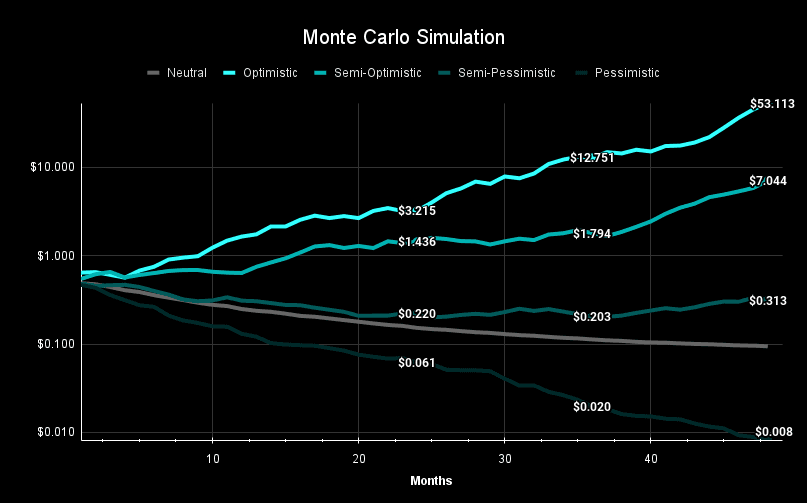

Currently, we’re running five different scenarios that could be refreshed and updated for X amount of times. The optimistic scenario presents the most favorable, yet achievable, price point for the token, assuming it achieves a market capitalization similar to top-performing crypto projects.

Conversely, the pessimistic scenario shows the worst price point that a crypto project could plummet to, presuming the project utterly fails to accomplish its objectives and the market conditions stay negative during this time period.

An example of how our Monte Carlo simulation looks like:

In conclusion, the Monte Carlo simulation is an incredibly versatile tool in our arsenal.

It allows us to create probabilistic models of the crypto market and its volatility, ensuring that your tokenomics is designed with a detailed understanding of potential risks and returns.

Here at BlackTokenomics, our objective is to use such advanced techniques to make your project not only survive but thrive in the dynamic world of cryptocurrencies.

Next to Monte Carlo simulation we also use Game Theory, Quantity Theory of Money and much more to design tokenomics for cryptocurrency projects.

If you are interested in taking your project to the next level feel free to consult with a tokenomics specialist.

Domas Golysenko

Research Department Lead