Domas Golysenko

What Is Quantity Theory of Money

The Quantity Theory of Money (QTM) is a model that connects the amount of money in an economy to the general prices of goods and services.

It’s a basic tool for understanding the idea of inflation and how changes in the amount of circulating money supply can affect the cost of things we buy.

The usual QTM formula is: MV = PT

In this equation:

M is the Money Supply or how much money is available in a given economy.

V is the Velocity of Money or how often each unit of currency is spent in a certain time period.

P stands for the Price of that currency.

T is the number of transactions, often referred to as the GDP (Gross Domestic Product).

According to the Quantity Theory of Money, the total spending in an economy (MV) is the same as the total value of goods and services produced (PT).

This equation assumes that the speed at which money is spent stays somewhat the same in the short term.

Quantity Theory of Crypto

When we use Quantity Theory of Money model in the cryptocurrency world, we need to adjust it because cryptocurrencies are different from traditional money:

So, in the cryptocurrency-adjusted model:

M is the total number of specific crypto tokens in circulation.

V is the average time a unit of the crypto token is used.

P is the current market price of that cryptocurrency.

T represents the combined volume of transactions associated with that cryptocurrency.

The QTM model gives us a basic idea of what a cryptocurrency token could be worth. However, keep in mind that this model might not always be completely accurate when used in real-time in cryptocurrency markets.

This is mainly because it doesn’t take into account the volatile nature of crypto markets and constantly changing market conditions that can greatly affect the price of the token too.

So, while QTM provides a helpful starting point for price prediction, it should be used along with other models for a more accurate prediction.

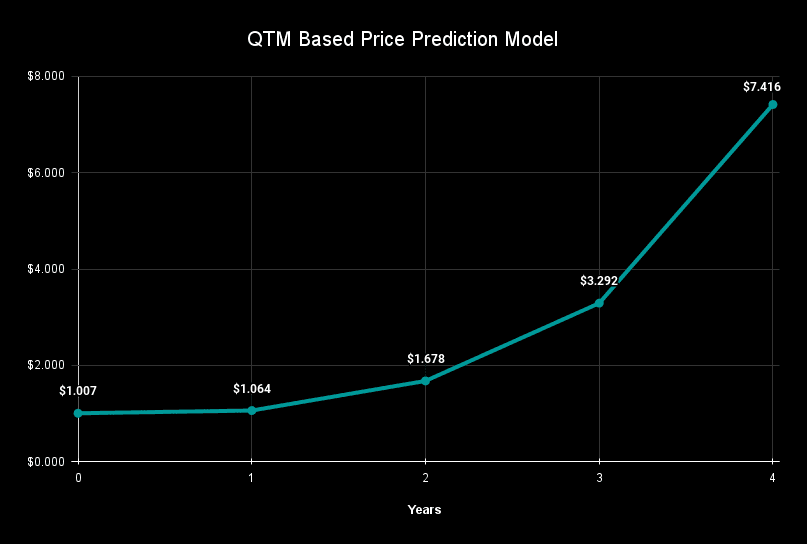

Here is an example of how QTM based price prediction model looks like:

How we Apply the QTM in our Token Designs

'T' Variable

For the variable ‘T’ or the volume of transactions in our QTM model, we use a regression model.

This model predicts the average yearly volume of a crypto project based on its initial launch market cap, by comparing similar projects to our design project and examining the correlation between their average 1-year market caps and their yearly volumes.

This way we obtain an approximate value for T. Note that this is a rough estimate, and as more data becomes available after the launch of your project, we can fine-tune our price predictions.

'V' Variable

To determine ‘V’ or the velocity of the project’s token, we calculate the median average of velocity scores from the niche of projects similar to our design project.

For example the velocity score of a gaming niche is 12, with a standard deviation of 6. This means that the velocity for gaming projects could range between 6 and 18. It’s more practical to consider a range of velocities, as it’s difficult to predict this value precisely.

Also, velocity tends to scale with the size of a project, so when the market cap gets higher, velocity scales accordingly based on the range of that specific niche, in some cases the top gaming projects are outliers and can even reach a velocity score anywhere from 40 to 60, which is important to consider when knowing that your project is consistently growing.

We have a database of average velocity scores and deviations for different areas. These areas include DeFi, Gaming, Infrastructure, Oracle, Layer-2, zk-Rollup, and other specialized niches.

Estimate 'P'

By figuring out these factors, we can estimate the price (P) of a specific project for the next four years. This is based on the amount of tokens that will enter the circulation during that time.

This helps us understand how much the project needs to grow to maintain its starting price. It prepares the project for the toughest situations and tells us the best times to start or slow down marketing campaigns.

Having this model is a must if you want your cryptocurrency project to be prepared for any market conditions. Here at BlackTokenomics, we’re doing just that to drive your project to success.

How can we help you

Navigating the complex world of tokenomics can seem daunting, but it doesn’t have to be. Our extensive library of articles, including deep-dives into Monte Carlo Simulations and the intricacies of Game Theory, can offer insight and guidance.

At BlackTokenomics, our passion lies in equipping you with the tools and knowledge necessary to understand and implement effective tokenomics strategies. Our comprehensive range of services, including Tokenomics Design, Tokenomics Audit, and Tokenomics Consulting, are expertly tailored to cater to your specific needs.

Whether you’re launching a new project and need robust tokenomics design, want to enhance the effectiveness of your current tokenomics through our auditing service, or require expert advice through one-on-one consulting, our team of seasoned professionals is at your service.

We’ve done the deep research, applied complex models, and perfected our methods so you don’t have to. With BlackTokenomics, your project is in experienced hands, ready to rise to its full potential.

Feel free to explore our services in more detail and get in touch with us for any inquiries.

We’re here to assist and guide you every step of the way in your tokenomics journey.

Domas Golysenko

Research Department Lead