Andres

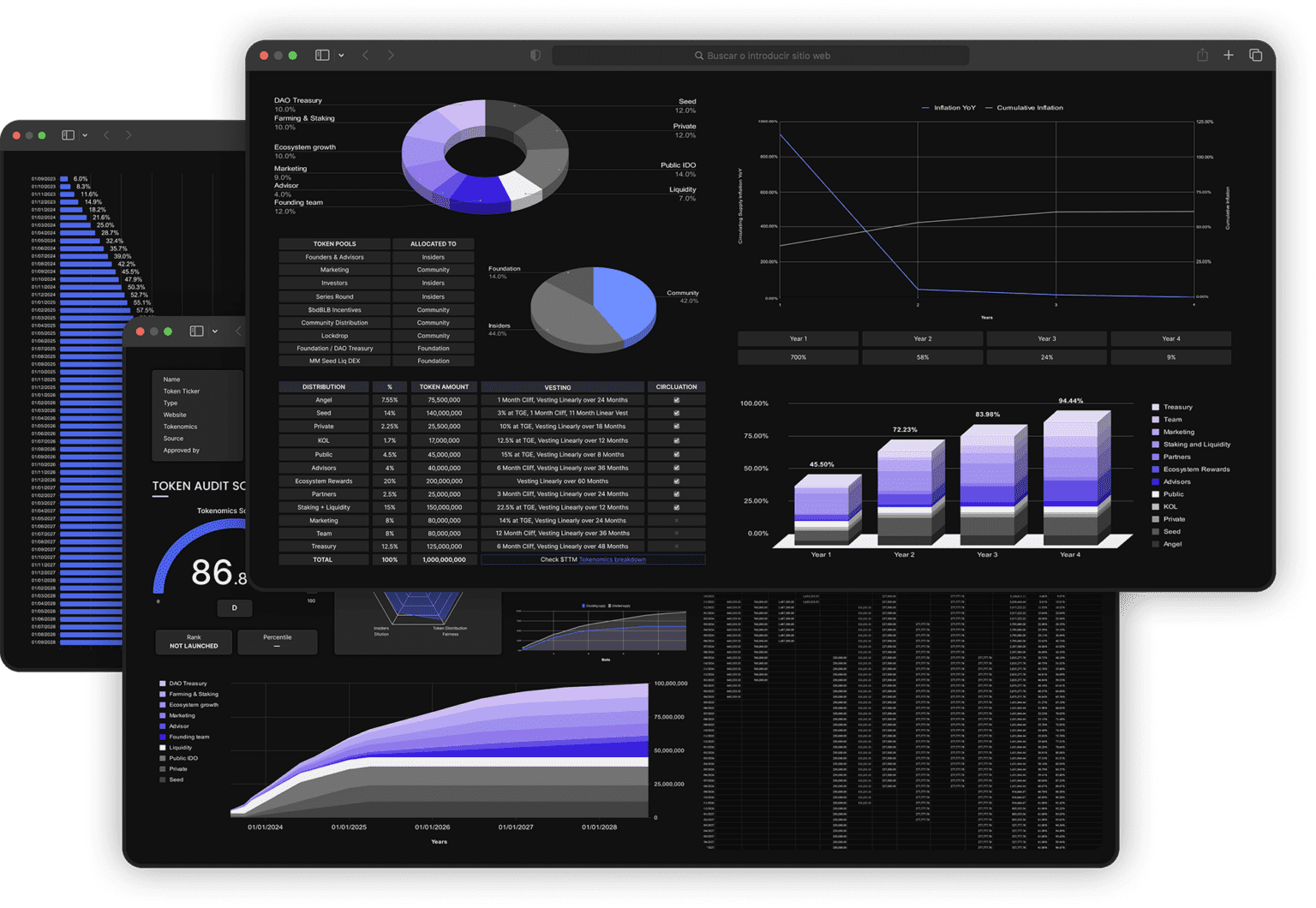

In this guide, we delve into the supply and demand dynamics and how to design the tokenomics for a memecoin, examining the intricate aspects of our token design models, and some of the learnings from our past three years.

It’s crucial to grasp both supply and demand when architecting a resilient memecoin protocol.

At the end of the guide, we will provide a tokenomics memecoin framework that you can claim and use for your project.

What is Tokenomics

At its core, tokenomics refers to the study and evaluation of the economic attributes of a cryptographic token.

This analysis aims to understand how different incentives influence a token’s supply, demand, and ultimately, its price.

Tokenomics often goes unnoticed, but for astute investors, a keen understanding of token design and its economic implications is invaluable for assessing a token’s potential value.

If you are creating a memecoin to onboard the masses you need to have a tokenomics system in place.

Metrics

The first step in designing the tokenomics for your memecoin is to establish the different metrics, as they pave the way for the project’s economic model. To create a successful tokenomics for memecoins, several key metrics need to be considered. Let’s start with supply.

When analyzing the supply side of the equation, there are a couple of key questions that we need to answer:

Based on supply dynamics alone, how should I expect the price of a given token to behave?

Will the token become more scarce, or is its value likely to deteriorate via inflation?

Inflation

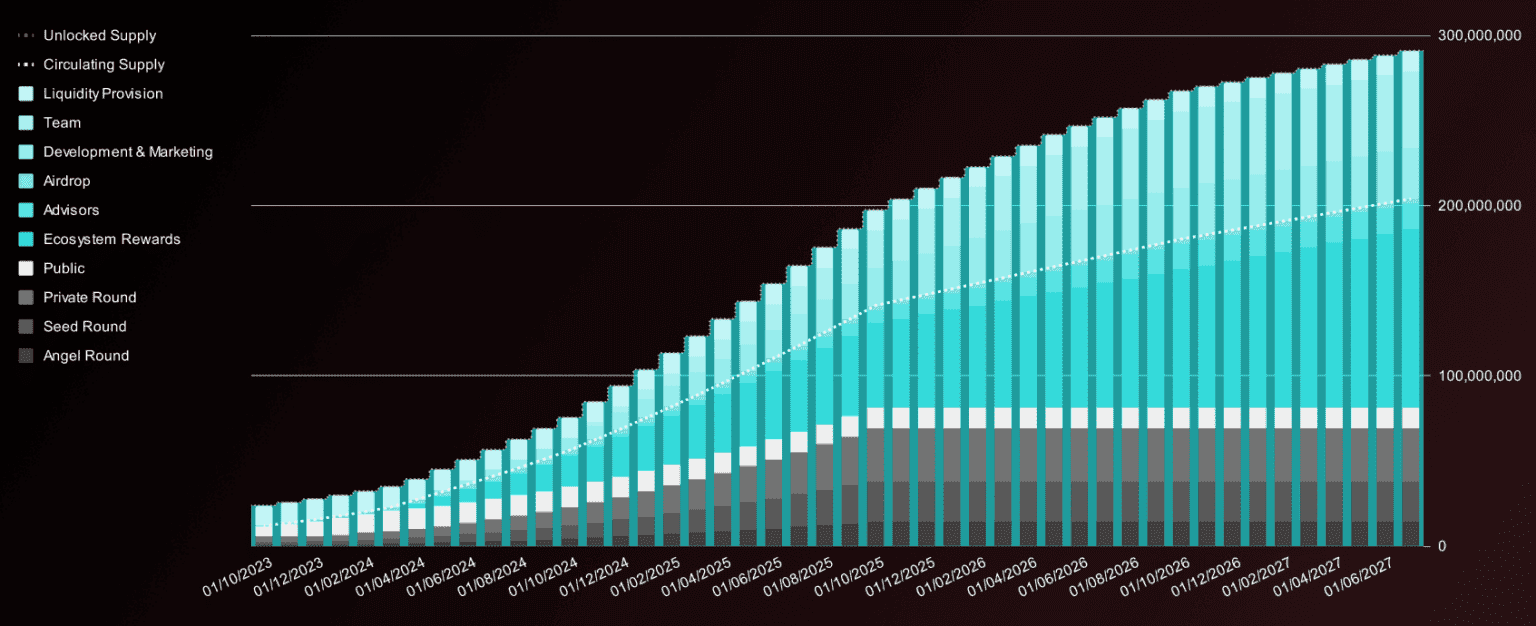

Token inflation refers to the increase in the circulating supply of a token over time, leading to a reduction in its purchasing power due to more tokens being available.

As more circulating supply is unlocked into the market and the demand remains static, it will exert downward pressure on the price.

So, how are tokens unlocked into circulation? To clarify this, we first need to define three terms: “initial circulating supply,” “unlock,” and the distinction between unlocks and circulation.

Initial Circulating Supply

This denotes the number of tokens that are available and circulating in the market immediately after a project’s launch or token listing.

It can also be referred to as the tokens circulating at the Token Generation Event (TGE).

Initial Market Cap. = Listing price * Initial amount of tokens in circulation.

Token Unlocks

hese occur when a portion of a cryptocurrency’s total supply becomes available for trading. This can lead to supply shocks that can affect the price of the coin or token.

Unlocks ≠ Circulating Supply.

Understanding this concept is essential. Unlocks don’t directly add to the circulating supply. The circulating supply is a more accurate metric than the total supply for market capitalization, as it represents the tokens that genuinely influence prices. Based on theoretical principles, we carefully select the pools we expect to enter circulation, which are likely to impact the price upon an unlock to model and stress test the tokenomics frameworks we design.

In the memecoin niche, the top performers are always fair launches, where most of the supply is completely circulating from day one, with no sudden unlocks for any stakeholders like private investors, the team, or advisors.

Fair Launch Mechanism

The reason memecoins opt into fair launch models is to ensure that all participants compete on the same level. This mechanism eliminates the existence of pre-sales and seed rounds, giving everyone an equal opportunity to participate since the listing day.

It is crucial for a memecoins to be transparent with the initial distribution. Memecoin projects should focus not only on fair and clear ways to distribute tokens to ensure everyone in the community has a chance. But also to communicate it in the right way. Events like airdrops, token sales, or liquidity mining should be transparent, with clear rules and equal opportunities for all participants.

Monetization (Tax Logics)

One common approach in memecoin monetization is implementing a transaction tax. This tax is applied to purchases, sales, and sometimes even transfers involving the memecoin.

By collecting these taxes, projects can create a revenue generation source.

And discourage speculative trading, which often leads to high price volatility.

Allocation of Transaction Tax Revenue

The revenue generated from these taxes can be allocated to several key areas, including:

Funding ongoing and future development of the project.

Improving the liquidity pool to ensure deeper market liquidity.

Burning tokens to create deflationary tokenomics.

Allocating funds for marketing, partnerships and KOLs to increase projects visibility.

The challenge with taxation lies in balancing the tax rate to ensure it does not deter new investors while still providing sufficient revenue for the project and discouraging rapid selling. Common tax rates in the current memecoin market tend to be 0%. However, depending on the project’s long-term plan and market dynamics, a tax rate ranging from 2% to 5% has been historically applied.

A critical component for earning community trust and enhancing project credibility is transparency regarding how taxes are implemented and how the collected funds are used. Good results can be achieved by implementing a governance mechanisms where token holders have the right to vote on tax rate changes and the allocation of funds, helping to decentralize the token.

Incentive Structures

Designing effective incentive structures is crucial for encouraging desired behaviors and contributions within your memecoin community. This involves creating an incentive system that includes rewards for liquidity provision, content creation, and referrals, fostering community engagement and growth.

Other crucial incentives for memecoins include empowering the community to take part in decision-making through community governance tools, such as decentralized autonomous organizations (DAOs) or governance tokens. These tools allow holders to vote on protocol changes, funding, and other important proposals like exchange listings.

Meme coins thrive on strong communities, and it’s essential to engage them by giving them decision-making power while simultaneously decentralizing the token.

Utility and use cases

If possible, your memecoin tokenomics should also clarify and incorporate the utility and use cases to create demand for the token beyond just speculative trading.

Utility can include access to platform features, voting rights, participation in decentralized applications (DApps), or access to exclusive content or services within the meme coin ecosystem.

Deflationary Token

To preserve scarcity and value, memecoin tokenomics should incorporate mechanisms to limit token supply and incentivize holders to retain their tokens, such as staking. Deflationary mechanisms, including token burns, buybacks, or token locking, can reduce the circulating supply over time, potentially increasing token value and scarcity. With fewer tokens in circulation, you control the potential selling pressure.

Conclusion

When designing your meme coin tokenomics, you need to prioritize long-term economic sustainability by balancing token issuance, inflation, and deflation mechanisms to maintain stability and avoid hyperinflation or economic collapse. Economic models should account for supply and demand dynamics, market trends, and user behavior to ensure stability and resilience.

Transparent and accountable tokenomic designs are essential for building trust and confidence among your holders. Meme coin projects should provide clear documentation of tokenomic parameters, periodic updates on token distribution and supply changes, and transparent reporting on governance decisions and fund allocation, if they happen.

Building and maintaining an engaged and active community is crucial for the success of any meme coin. You can achieve this through a well-defined incentives strategy, which should be clearly outlined in the tokenomics.

Andres

Obsessed with Tokenomics + Data Driven and Principle approach to designing them + Game theory.