Sven

As the world of cryptocurrency continues to evolve, investors must navigate through a sea of tokenomics complexities and potential pitfalls.

But fear not, for this comprehensive guide is here to help you uncover red flags in tokenomics and make informed decisions in the crypto space.

Embark on this journey to understand the significance of token utility, project transparency, and leadership reputation, and learn how to conduct due diligence with useful tools.

Are you ready to become a savvy investor in the ever-changing world of digital assets?

Short Summary

Investors should identify key red flags in tokenomics, such as unlimited supply, unfair distribution and inflationary tokens.

Analyze the project team and leadership to ensure experience, credibility and commitment to transparency.

Utilize tools such as Rugdoc.io & CoinMarketCap for conducting due diligence on crypto projects.

Identifying Key Red Flags in Tokenomics

Tokenomics is the foundation of any crypto project, and as an investor, it is crucial to identify any potential red flags that may impact the value of the token.

Understanding the risks associated with unlimited supply, unfair distribution, and inflationary tokens can save you from potential pitfalls in your investment journey.

Let’s dive deep into these key red flags and learn how to spot them before they impact your investments.

1. Unlimited Supply: The Perils of Endless Tokens

In the crypto universe, an unlimited supply of tokens might sound like a ticket to prosperity, but it’s more akin to a leaky faucet in a sinking ship.

Why? Because, in this world, scarcity is king. When tokens can be created out of thin air, they risk becoming as commonplace as grains of sand on a beach – plentiful, but not particularly valuable.

This boundless creation can trigger inflation, diluting the token’s worth. It’s like printing money non-stop; the more there is, the less it’s worth.

This lack of scarcity can overshadow the potential gains, making such tokens less appealing than their limited-supply counterparts. However there are very successful projects with unlimited supply.

Bitcoin: has a hard cap set at 21 million. Every 4 years, the network undergoes a ‘halving’ event, reducing the emission of new bitcoins in half. This mechanism insures a gradual approach to the total supply cap. Right now, approximately 19 million bitcoins are out there, which means only 2 million more will be made over the next 120 years.

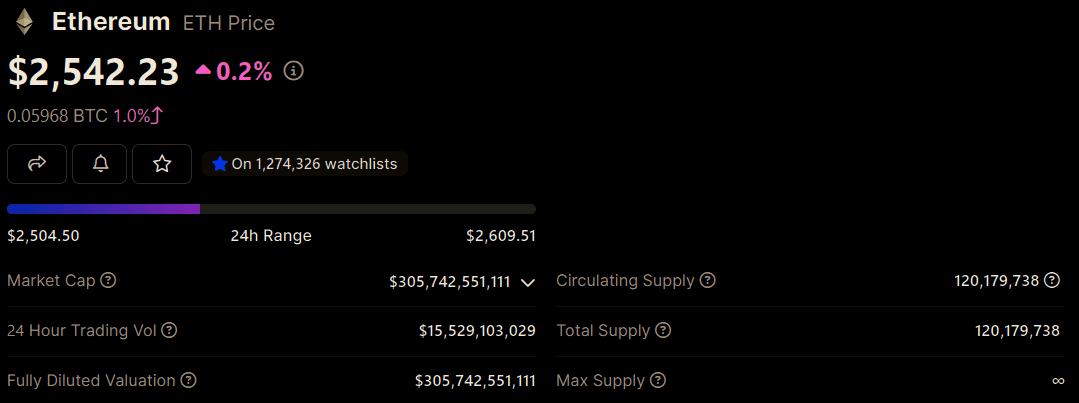

Ethereum: its Max Supply is not capped (∞), but it’s not a free-for-all either.

It grows at a measured pace, much like a carefully tended garden. This controlled growth, coupled with mechanisms like EIP-1559 that burn a portion of transaction fees, adds a layer of complexity and potential for deflation over time, distinguishing it from a purely unlimited supply model.

Dogecoin, unlike Bitcoin, has no maximum supply limit and is inflating at about 5% annually.

Therefore, among the three, Dogecoin’s value is more likely to be affected by inflationary tokenomics compared to Bitcoin or Ethereum.

So, as an investor, it’s crucial to review a project’s token supply structure.

Does it have a cap?

Is the growth controlled?

Are there deflationary or inflationary mechanics at place?

Answers to these questions can help you estimate the token’s future value and stability. Remember, in the world of crypto, less can often mean more.

2. Unfair Distribution

Monetary policies in tokenomics are the compass guiding the journey of token supply and distribution.

Much like a central bank in the traditional financial world, these policies dictate how new tokens are created, emitted, or unlocked, and how they’re dispersed among different stakeholders.

This is the essence of allocation distribution.

Unfair distribution often occurs when a majority of tokens are held by a select few, creating a scenario where market manipulation becomes a looming threat.

This concentration of ownership can lead to erratic price swings, undermining the token’s credibility and investor confidence.

A well designed tokenomics model ensures equitable distribution, aligning with the project’s objectives and offering fair terms across different investment rounds.

This approach not only fosters a sense of trust and community among participants but also lays a solid groundwork for sustainable growth and stability.

As part of sound investment due diligence, it is essential to examine a project’s distribution strategy, looking out for any signs of disproportionate allocation. A project where tokens are spread evenly, reflecting the diverse contributions of all participants, is more likely to navigate the volatile crypto market successfully.

Investors should use tools like Etherscan to verify token allocated and ensure that the project has a fair distribution process.

In summary, unfair distribution in tokenomics is a warning sign investors should not ignore, as it can significantly impact the token’s value and the project’s future prospects.

3. Inflationary Tokens

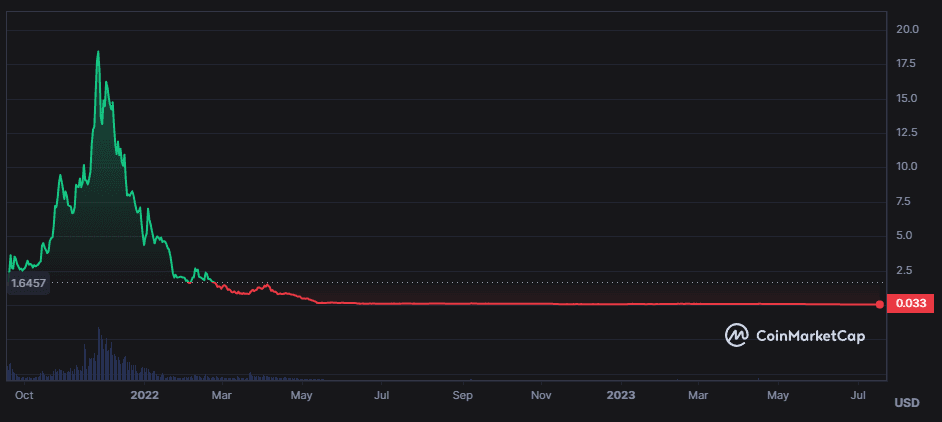

Inflationary tokens are those with a net increase in their circulation, which can lead to a decrease in their value due to the increased supply.

Some projects implement deflationary token supply mechanisms to counteract this effect, such as Binance, which allocates 20% of its quarterly profits to purchasing and eliminating its BNB supply, and Ethereum, which incinerates a segment of ETH transaction fees paid by network users (EIP-1559).

Investors should be cautious of projects with inflationary tokens, as they may result in a decrease in the value of their investment.

Learn more about the severe impacts of high inflation on cryptocurrency projects by exploring our in-depth article with case studies here.

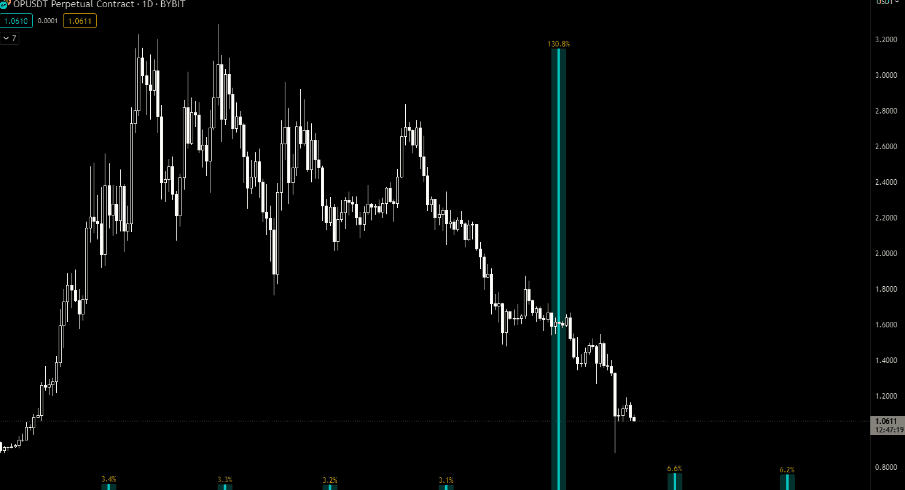

4. Supply Shocks

Supply shocks refer to unexpected occurrences that lead to a rapid alteration in the supply of a product or commodity, leading to a substantial transformation in its price.

Events such as large-scale token releases, unexpected changes in token vesting schedules, or significant shifts in project development can lead to supply shocks in the crypto market.

Investors should employ strategies such as diversification, hedging, and monitoring the market to reduce the potential of supply shocks impacting their investments.

Gain deeper insights on this topic by reading our article, ‘Supply Shocks in Cryptocurrency Vesting Schedules: A Ticking Time Bomb‘.

5. Liquidity

Liquidity is the ability to readily convert an asset into cash without incurring a considerable loss in value.

In the crypto market, liquidity issues can result in a lack of liquidity in the market, making it difficult for investors to sell their tokens quickly and at a fair price.

This can subsequently lead to a decrease in the value of the token and a loss of capital for investors, especially when a large number of tokens are sold.

To avoid liquidity issues, investors should examine projects with substantial trading volume, market capitalization, and liquidity on exchanges, as well as assess projects with a well-defined roadmap and a competent team.

Learn about the importance of liquidity in tokenomics by reading our guide here.

6. Investor Dilution

Investor dilution in cryptocurrency is a critical concern, especially when early investors (seed,…), holding tokens bought at lower prices, start selling as the token becomes publicly tradable.

This scenario can lead to a market flood, causing the token’s value to plummet. Such dilution not only impacts the token’s immediate price but also shakes the confidence and trust of later investors.

It creates a rift between the interests of early and public investors, potentially harming the long-term success of the project.

This delicate balance of investor interests underscores the importance of effective tokenomics. It's essential to mitigate dilution, align incentives, and build trust among all investor groups.

To explore the nuances of dilution between private and public investors and how it impacts a project’s health, delve into our detailed article on the subject.

Analyzing the Project Team and Leadership

A strong project team and leadership is essential for the success of any crypto project. By analyzing the project team and leadership, you can gain insights into their experience, credibility, and commitment to the project.

In this section, we will focus on two critical aspects to consider: anonymous teams and leadership reputation. Understanding these factors will help you make an informed decision when investing in a cryptocurrency project.

Anonymous Teams

Anonymous teams can be a double-edged sword. While it may not be an explicit indication of malicious intent, the lack of transparency can raise concerns for investors.

A project with an anonymous team can make it challenging to authenticate the team’s qualifications and monitor their progress.

Additionally, there is the possibility that the team may not be as dedicated to the project as they profess or that they may not possess the requisite abilities and expertise to fulfill their commitments.

Investors should exercise caution when investing in projects with anonymous teams and conduct thorough research to verify the team’s authenticity.

Leadership Reputation

The reputation of a project’s leadership can greatly impact its success. A strong and reputable leadership team can instill trust in investors and contribute to the project’s growth.

However, a negative leadership reputation can lead to a lack of trust in the project, affecting investor confidence and decreasing the value of the project’s tokens.

As an investor, it is crucial to evaluate the leadership reputation by examining their track record, industry expertise, and commitment to transparency.

Investigating Token Utility and Use Cases

Token utility is vital for a crypto project’s market value. A token with a clearly defined use-case ensures that its value is not dependent on speculation.

In this section, we will focus on two common concerns: lack of real-world applications and overpromising features.

Understanding these concerns will help you assess the potential value of a token and make informed investment decisions.

1. Lack of Real-World Applications

A project that lacks real-world applications for its tokens may struggle to find long-term success.

Tokens can serve various purposes, such as payment, access to a platform or service, or as a reward for specific activities.

Non-fungible tokens (NFTs) can be used to verify ownership of real-world or digital assets, symbolize memberships or event tickets, and tokenize awards and diplomas.

As an investor, it is crucial to identify projects with tokens that have practical applications to ensure their value is not solely dependent on speculation.

2. Overpromising Features

Overpromising features can be a significant concern for investors, as they may indicate that the project is not capable of delivering on its promises.

Examples of overpromising features include guarantees of high returns, unrealistic timelines, and features that are not technologically feasible.

Investors should be cautious of projects that make exaggerated claims and thoroughly examine the project’s white paper, team, and utility to assess its potential value.

Assessing Centralization and Network Governance

Centralization and network governance play a crucial role in the security and stability of a crypto project. In this section, we will discuss two critical aspects to consider: centralized control and dependency on third-parties.

Understanding these factors will help you assess the potential risks associated with a project and make informed investment decisions.

1. Centralized Control

Centralized control in a crypto project can pose risks to the project’s security and stability.

Projects like Ripple, EOS, and Tron, which exhibit centralized control, can suffer from a lack of transparency and accountability, as well as a lack of decentralization, creating a single point of failure.

As an investor, it is essential to analyze the level of centralized control in a project to assess its potential risks.

2. Dependency on Third-Parties

Dependency on third-parties can be a concern for investors, as it may expose the project to risks associated with changes in external entities or services.

If these entities or services become inaccessible or inconsistent, the project may be unable to operate effectively.

Investors should be cautious of many projects that rely heavily on third-parties and seek projects with a strong foundation in decentralization and self-sufficiency.

Evaluating Project Transparency and Documentation

Project transparency and documentation are vital for investors to understand a project’s goals, objectives, and technical details.

In this section, we will discuss two critical aspects to consider when evaluating project transparency and documentation: incomplete or vague white papers and closed-source or buggy code.

Understanding these factors will help you make informed decisions when investing in a cryptocurrency project.

1. Incomplete or Vague White Papers

Incomplete or vague white papers can be a red flag for investors, as they may indicate a lack of clarity or detail about the project and its objectives.

Crypto projects should provide comprehensive and transparent information in their white papers, enabling investors to make informed decisions.

Investors should scrutinize a project’s white paper to ensure it contains all the necessary information and is clear and concise.

2. Closed-Source or Buggy Code

Closed-source or buggy code can pose risks to the security and stability of a crypto project. Open-source code is essential for investors to verify the project’s security and dependability.

Dr. Raullen Chai, for example, believes that smart contracts should have accompanying source code and that web3 projects should be open-source.

Investors should evaluate a project’s code to ensure it is secure, dependable, and free from bugs.

Scrutinizing Marketing Strategies and Promotions

Marketing strategies and promotions play a significant role in the success of a crypto project. However, it is essential to scrutinize these strategies to ensure they are not misleading or manipulative.

In this section, we will discuss two critical aspects to consider when scrutinizing marketing strategies and promotions: celebrity endorsements and excessive hype and bot activity.

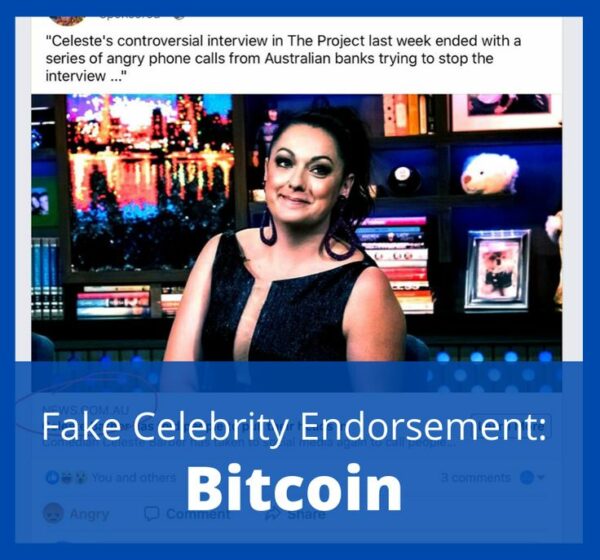

1. Celebrity Endorsements

Celebrity endorsements can be a double-edged sword in the crypto space. While they can bring attention and credibility to a project, they can also be misleading or manipulative.

Investors should be wary of celebrity endorsements that lack tangible proof of the efficacy of the product or service being endorsed.

It is essential to assess the authenticity of celebrity endorsements and the potential risks and benefits associated with them.

Excessive Hype and Bot Activity

Excessive hype and bot activity can be detrimental to a crypto project, as they may create unrealistic expectations and inflated prices.

Bots can be employed to generate hype by automatically producing and disseminating content, such as tweets, posts, and comments, to cultivate a sensation around a product or service.

Investors, including early investors, should be cautious of projects that rely heavily on hype and bot activity and seek projects with a strong foundation in real-world evidence and genuine support.

Conducting Due Diligence with Useful Tools

Due diligence is an essential aspect of successful investing in the crypto space. In this section, we will discuss two useful tools that can help you conduct due diligence on crypto projects: Rugdoc.io and CoinMarketCap.

By utilizing these tools, you can gain valuable insights into a project’s security, dependability, and market data.

Rugdoc.io

Rugdoc.io is a valuable tool that verifies the presence of “hard rug” codes in smart contracts of a project, ensuring its security and dependability.

In addition to Rugdoc.io, investors can also utilize other free tools such as Who.is to obtain registrar information for a website’s URL and Twitter Audit to verify the authenticity of a Twitter account’s followers.

These tools can help investors conduct thorough due diligence and make informed investment decisions.

CoinMarketCap

CoinMarketCap is a reliable and renowned source for observing cryptocurrency prices and market data since 2013.

The platform provides a variety of data related to cryptocurrencies.

This includes links to social media pages, whitepapers, blockchain explorers and websites.

By using CoinMarketCap, investors can quickly get an overview of a project’s market capitalization, price, and volume, allowing for informed investment decisions.

Summary

In conclusion, navigating the world of tokenomics and crypto projects can be challenging, but with the right knowledge and tools, you can make informed investment decisions.

By understanding the key red flags, analyzing project teams and leadership, investigating token utility and use cases, and scrutinizing marketing strategies, you can minimize risks and maximize potential returns.

So go forth and conquer the crypto space with confidence and wisdom.

Sven

Sven is a digital entrepreneur with over 8 years of experience in SEO. He has helped Web3 businesses optimise their online presence online. He has a deep understanding of the Web3 space and ensures to vet all the projects BlackTokenomics works with.