Our fundraising program covers everything Web3 projects need to raise capital. From compliance and economy design to investor conditions and documentation, we go beyond simply designing the right economic framework. We validate the model in python and present it in a way that resonates with potential investors.

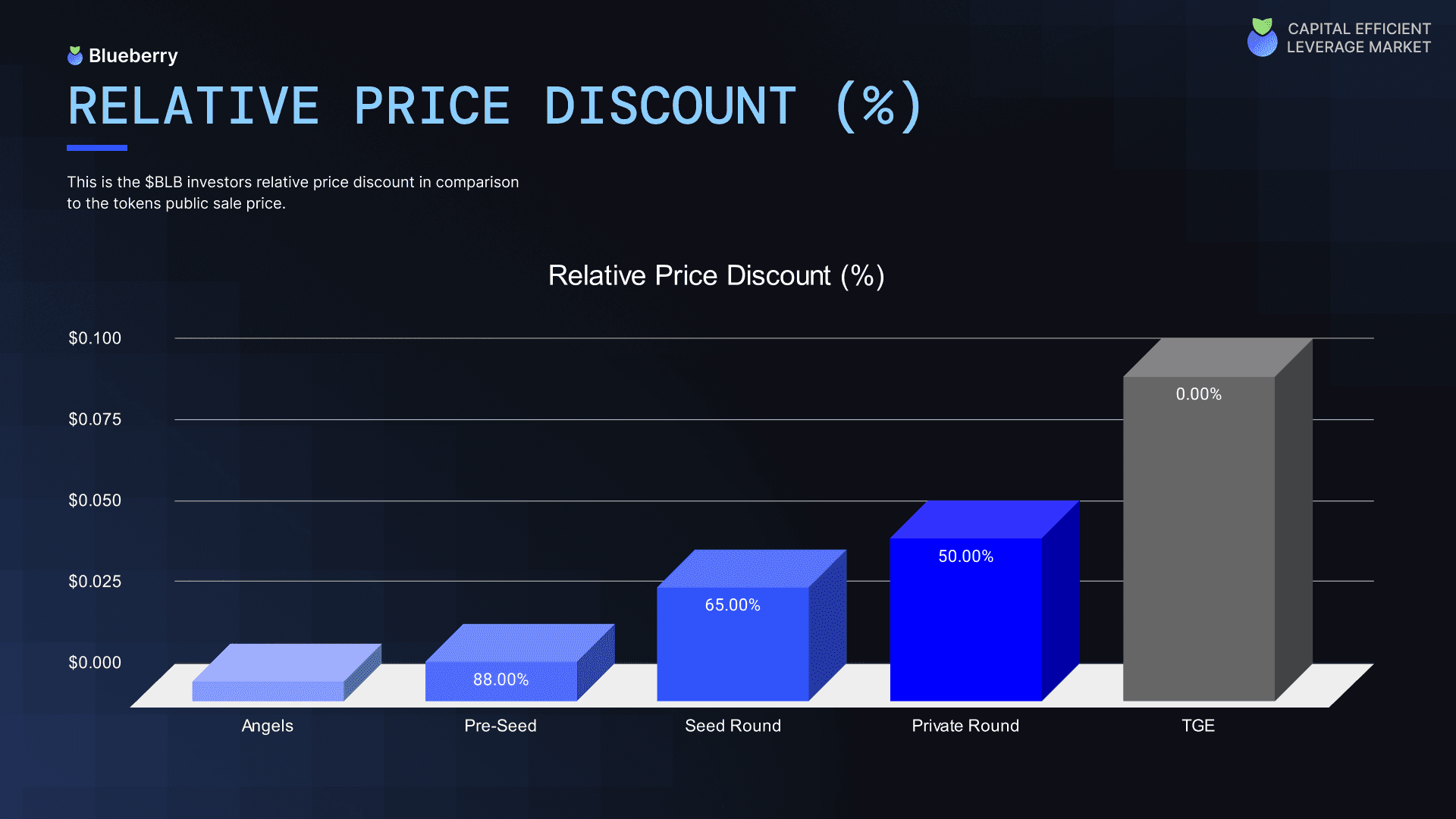

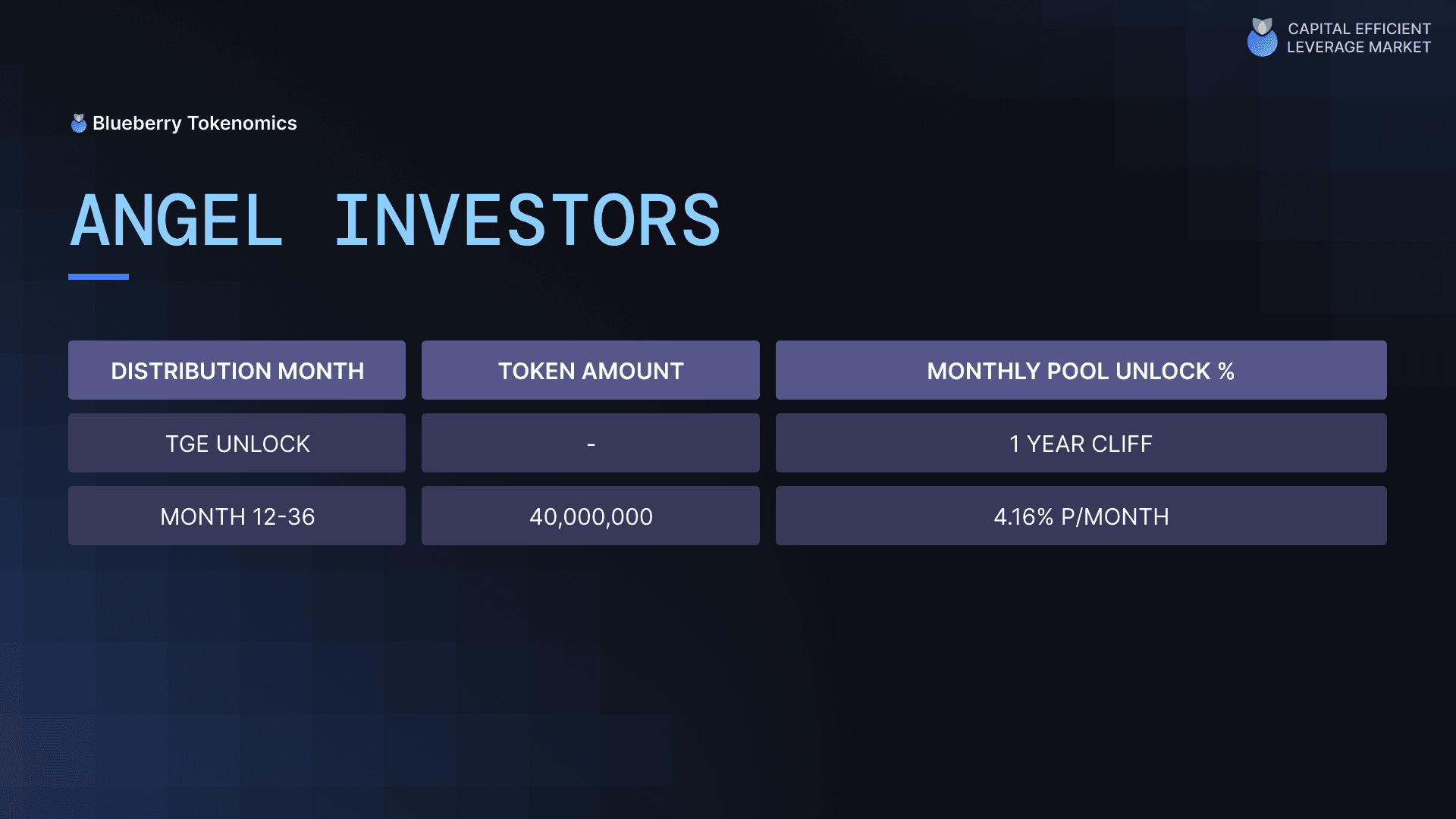

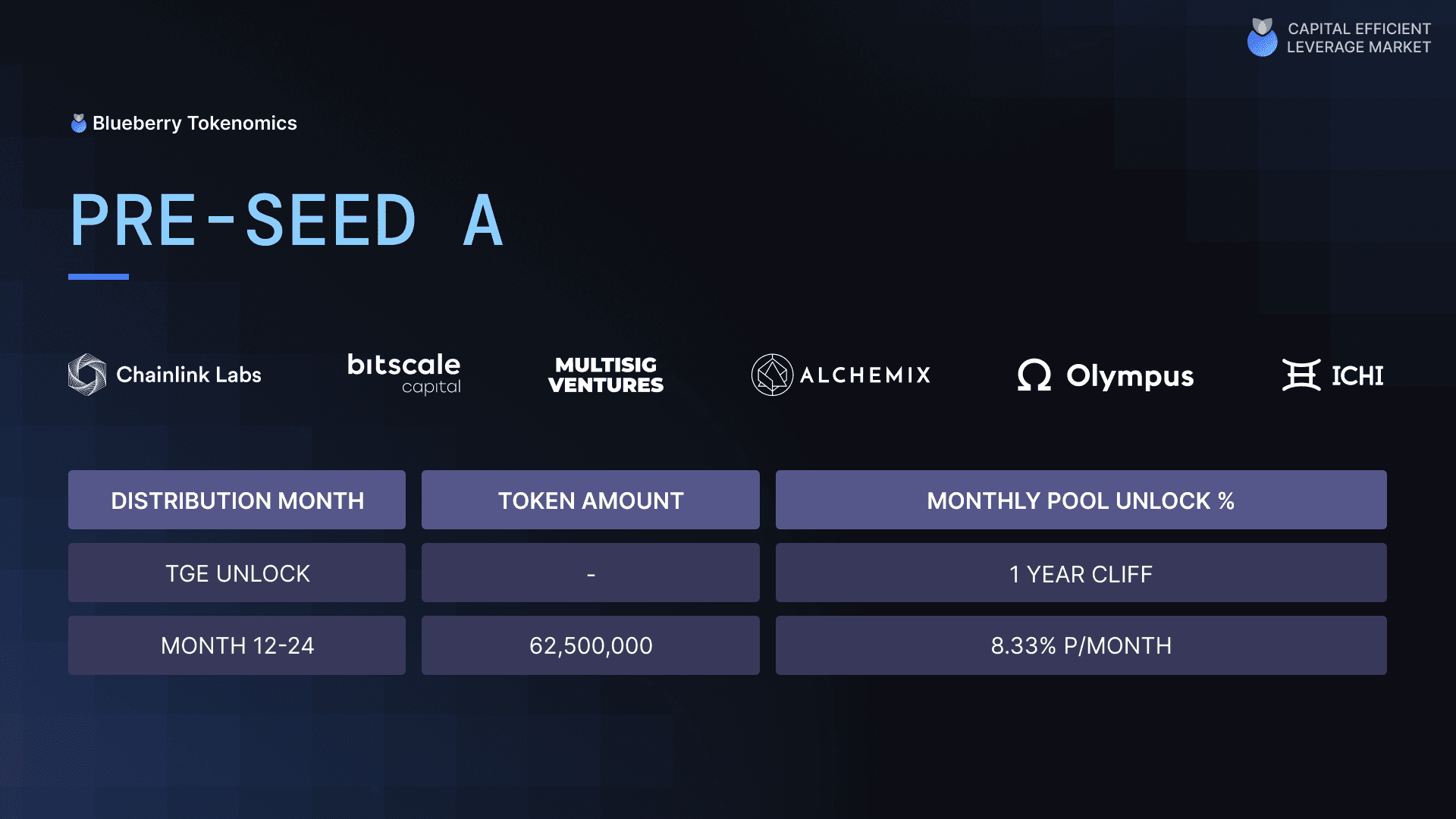

Distribution Fairness

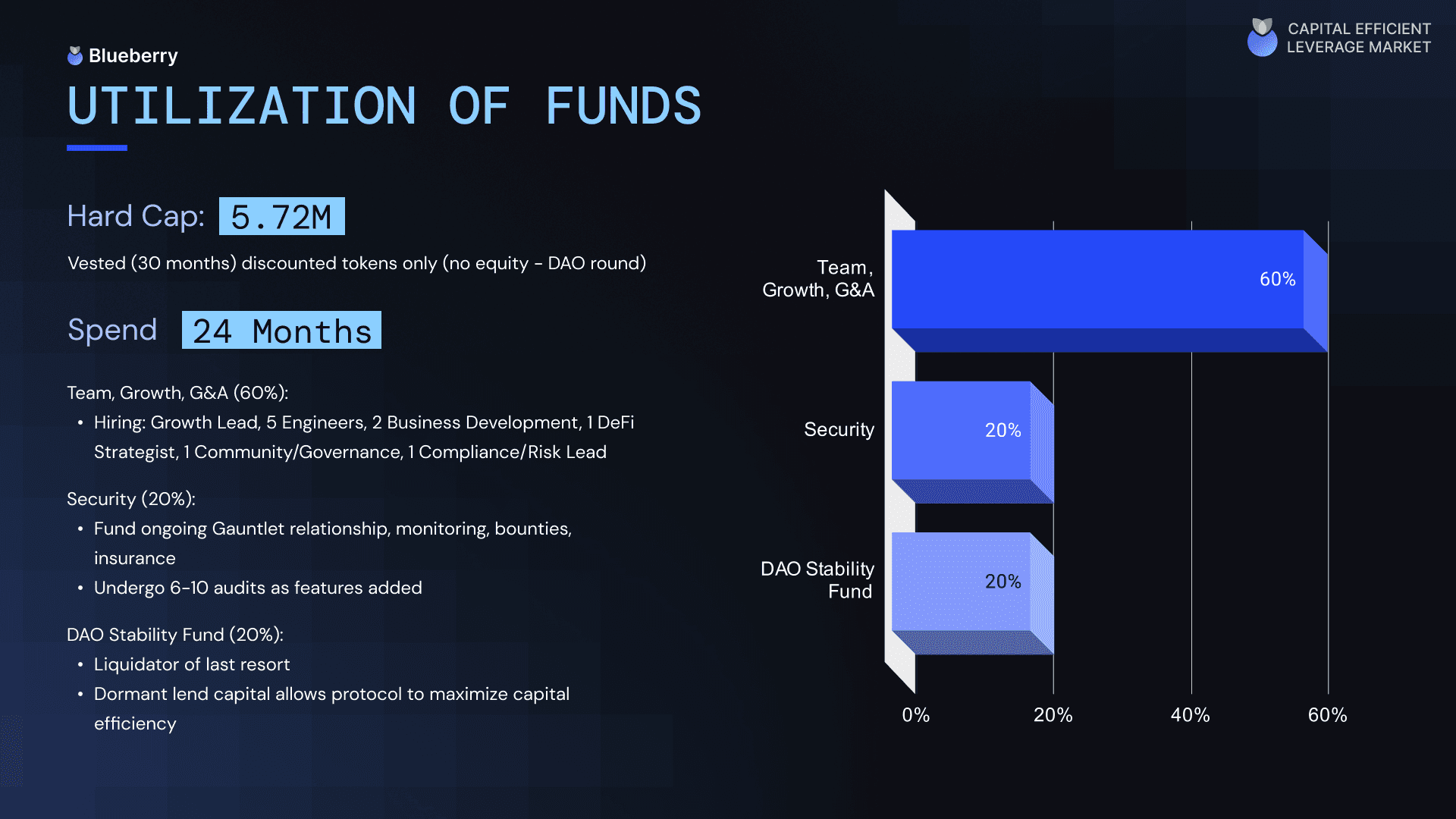

Fundraising Setup

Valuation

Documentation

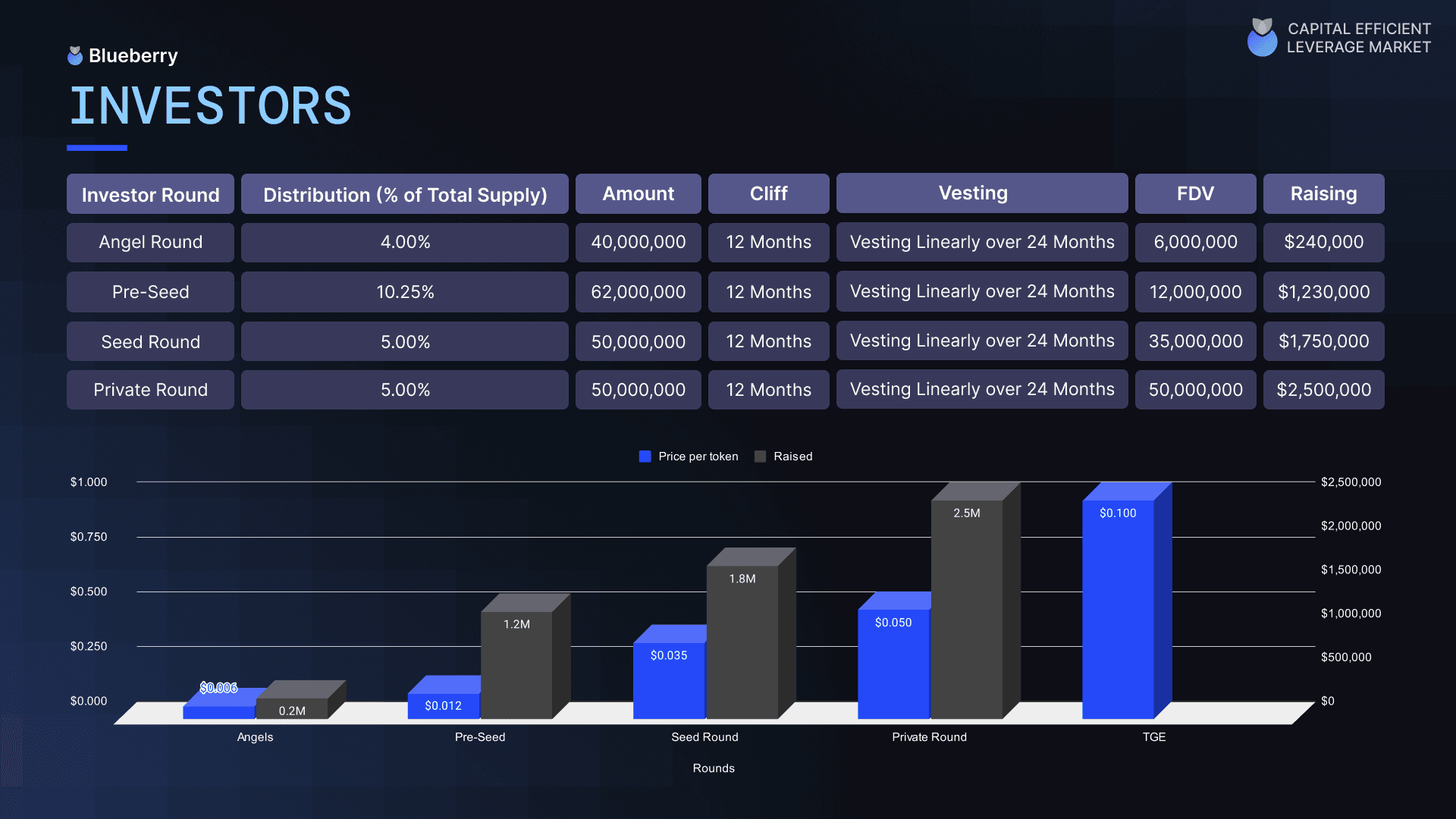

Investor's balance

We set you up with everything you need to raise capital from token sales.

1

Discovery and Fundamentals

2

Tokenomics Audit and Optimization

3

Validation and Compliance

4

Interactive Tokenomics (Python)

5

Documentation for Investors

The fundraising setup is designed to be ready in under 30 days.

Discovery and Fundamentals

In the Discovery and Fundamentals phase, we lay the groundwork for the tokenomics model by reviewing core documents (whitepaper, technical paper) and holding initial team meetings to set the fundamentals and a clear plan.

We establish a source of truth document and conduct niche-specific research, including a top 10 competitors analysis.

This foundational approach ensures all essential elements are captured for the next phases of tokenomics design

Tokenomics Audit and Optimization

If a tokenomics model is already in place, we conduct an audit to identify areas for optimization. If no framework exists, and we are working with a client from zero ground we execute the audit after the tokenomics design phase.

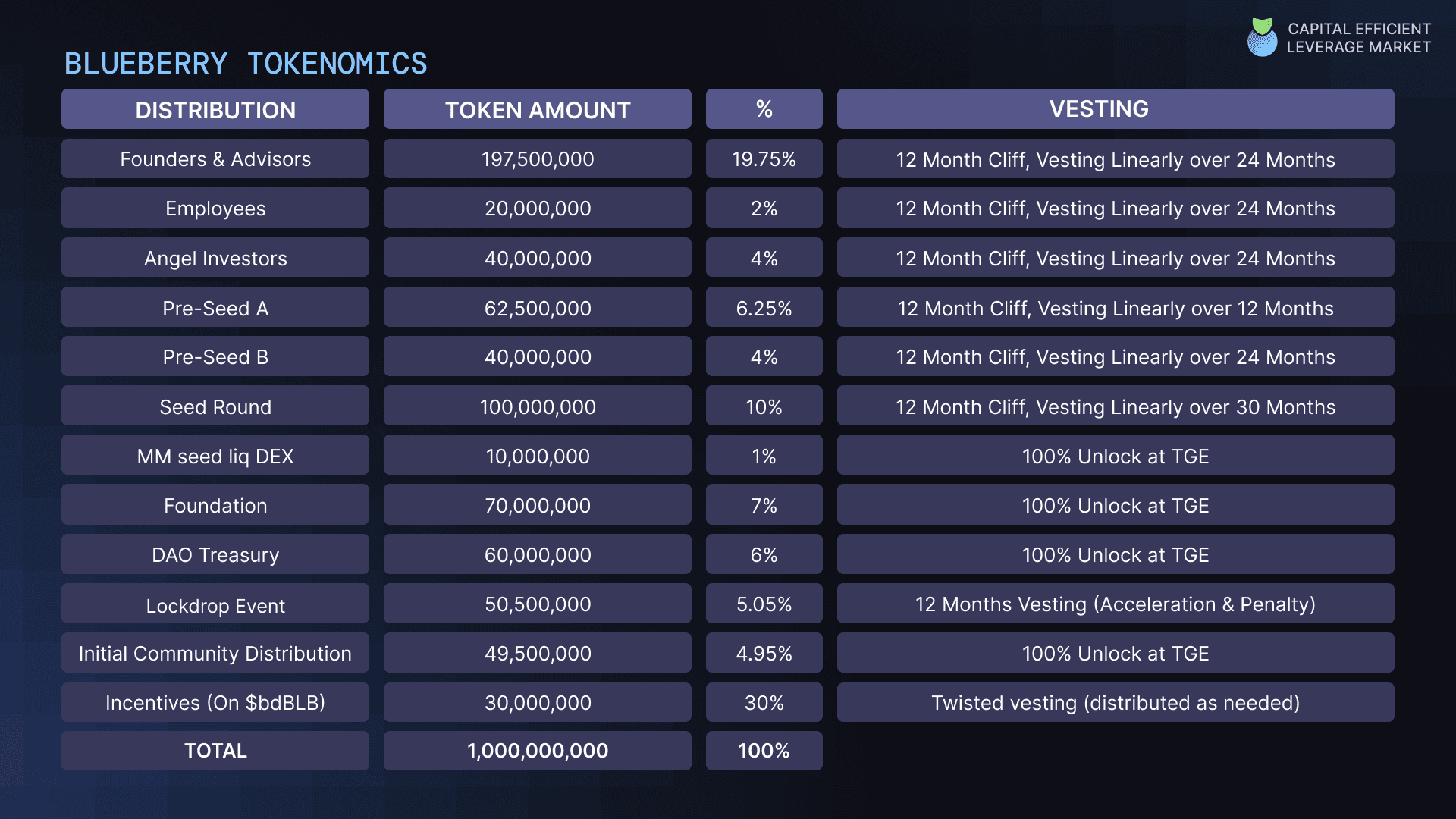

Tokenomics is a multifaceted term that goes beyond simple metrics like a token’s max supply, emissions schedule, or staking yields.

At BlackTokenomics, we design every aspect of tokenomics from governance models and incentive structures to python simulations and compliance listing models.

Compliance

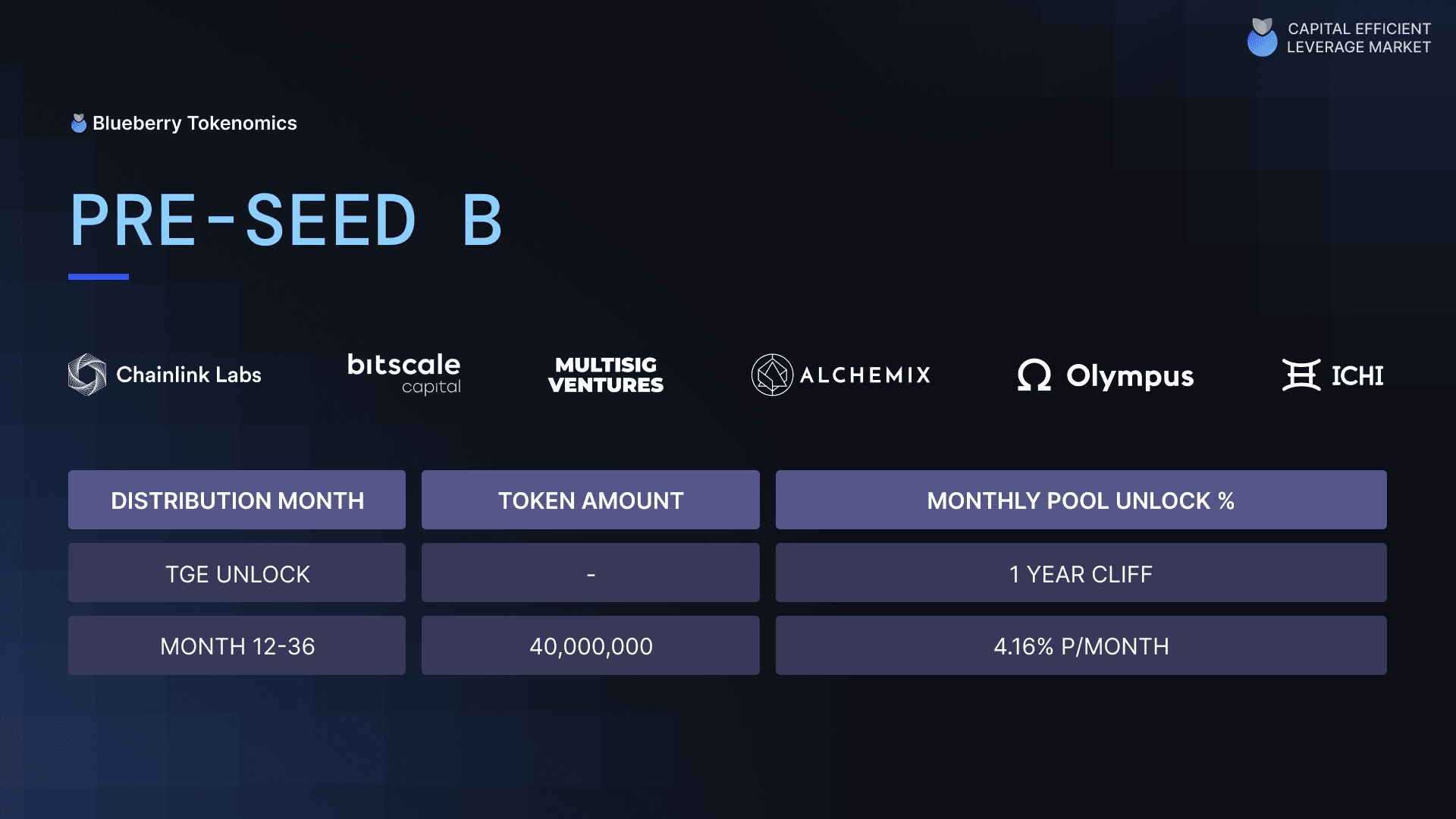

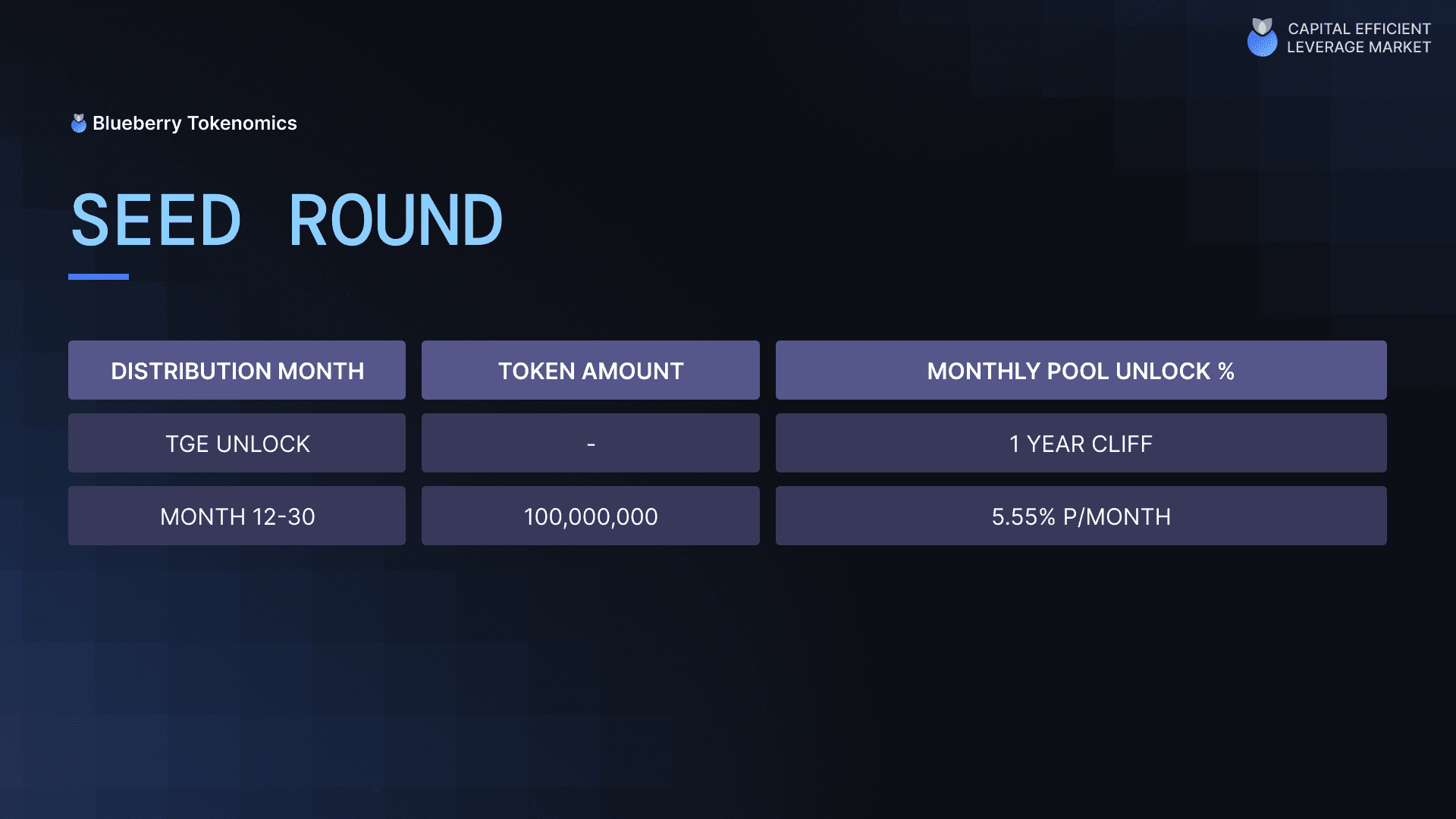

Depending on the listing strategy, we design a tokenomics model that aligns with the necessary compliance requirements.

We ensure that the tokenomics model is compliant with your target exchanges, IDO/IEO/ICO platforms and market makers.

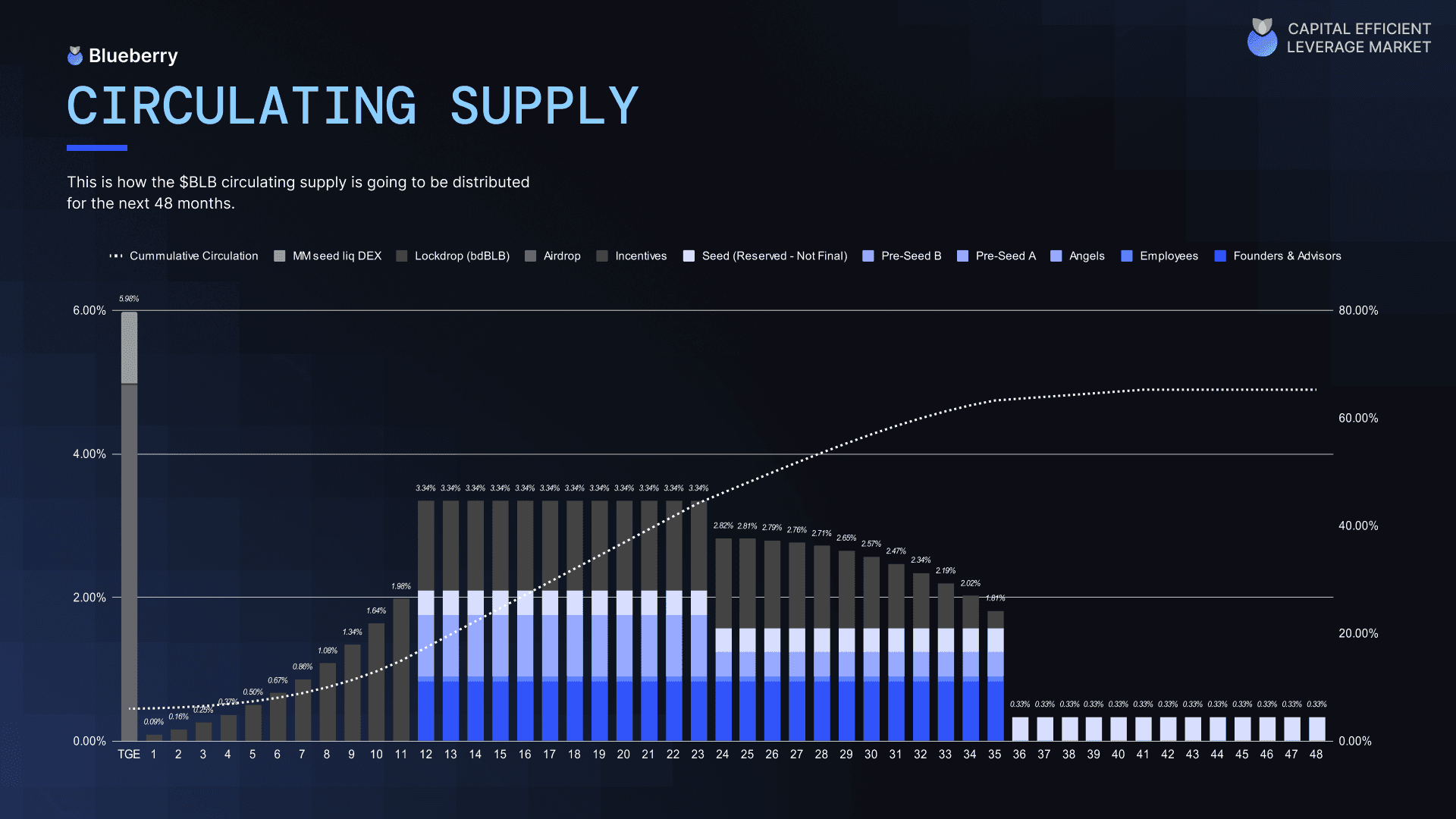

We’re well-known for our Binance-compliant model, which features a high float, low inflation, minimal supply shocks, and controlled liquidity through strategic agreements with market makers, though we won’t reveal all our secrets here.

The Binance model is fundamentally different from a IDO design.

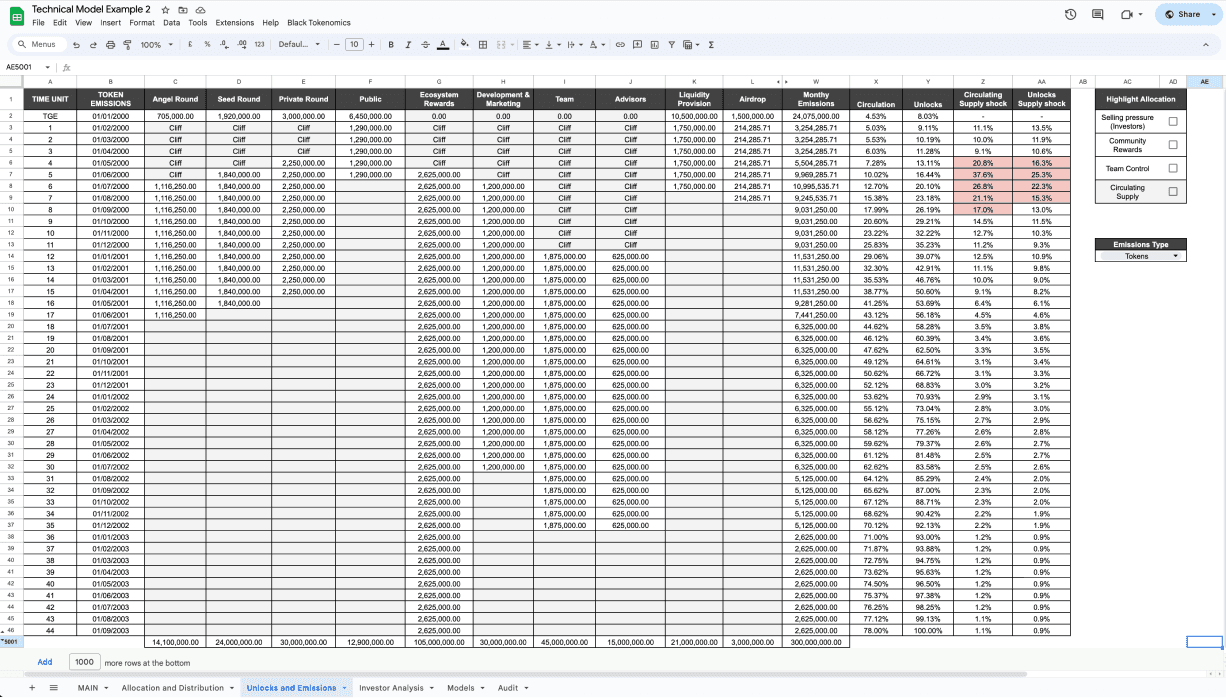

Interactive model

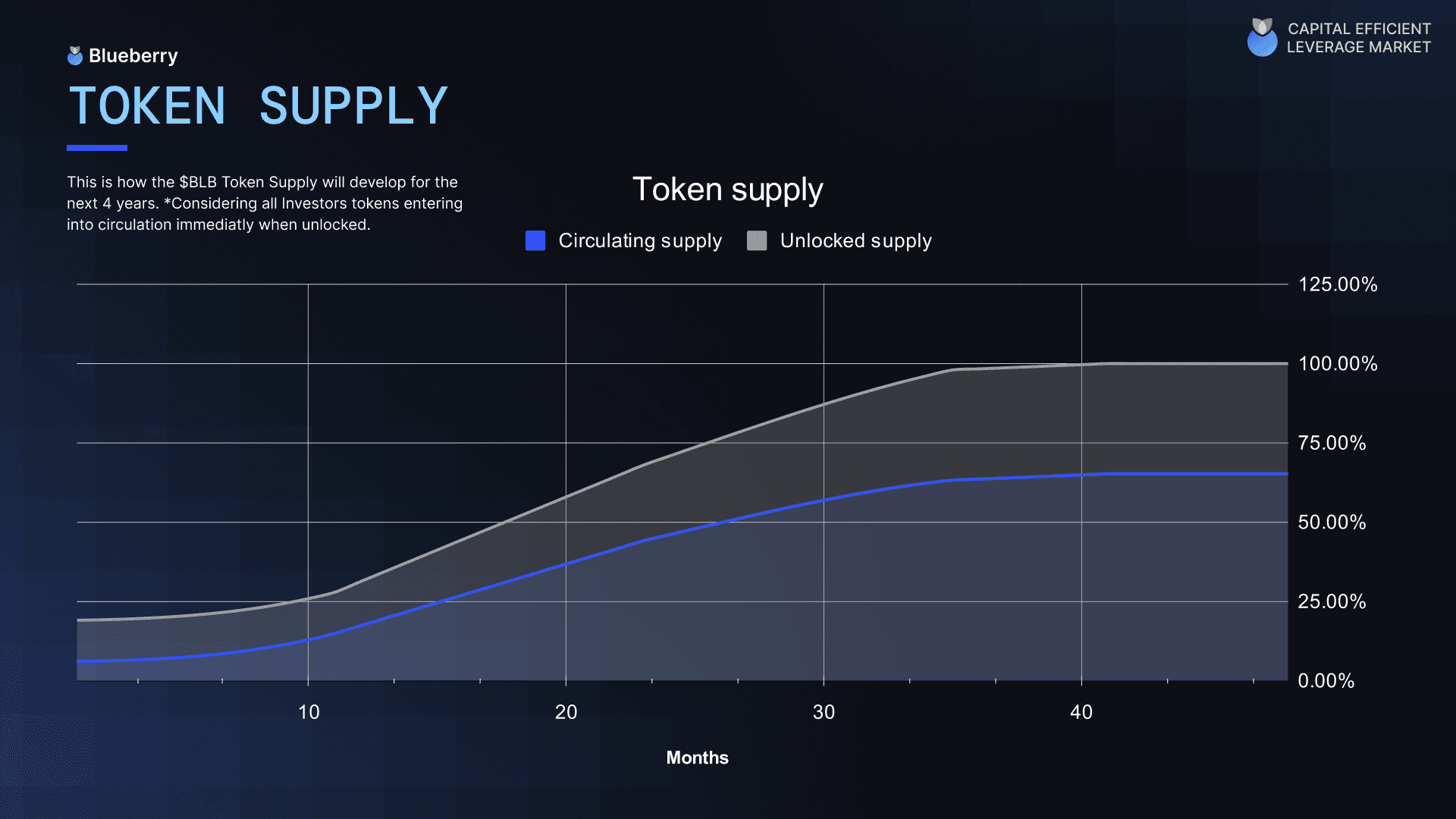

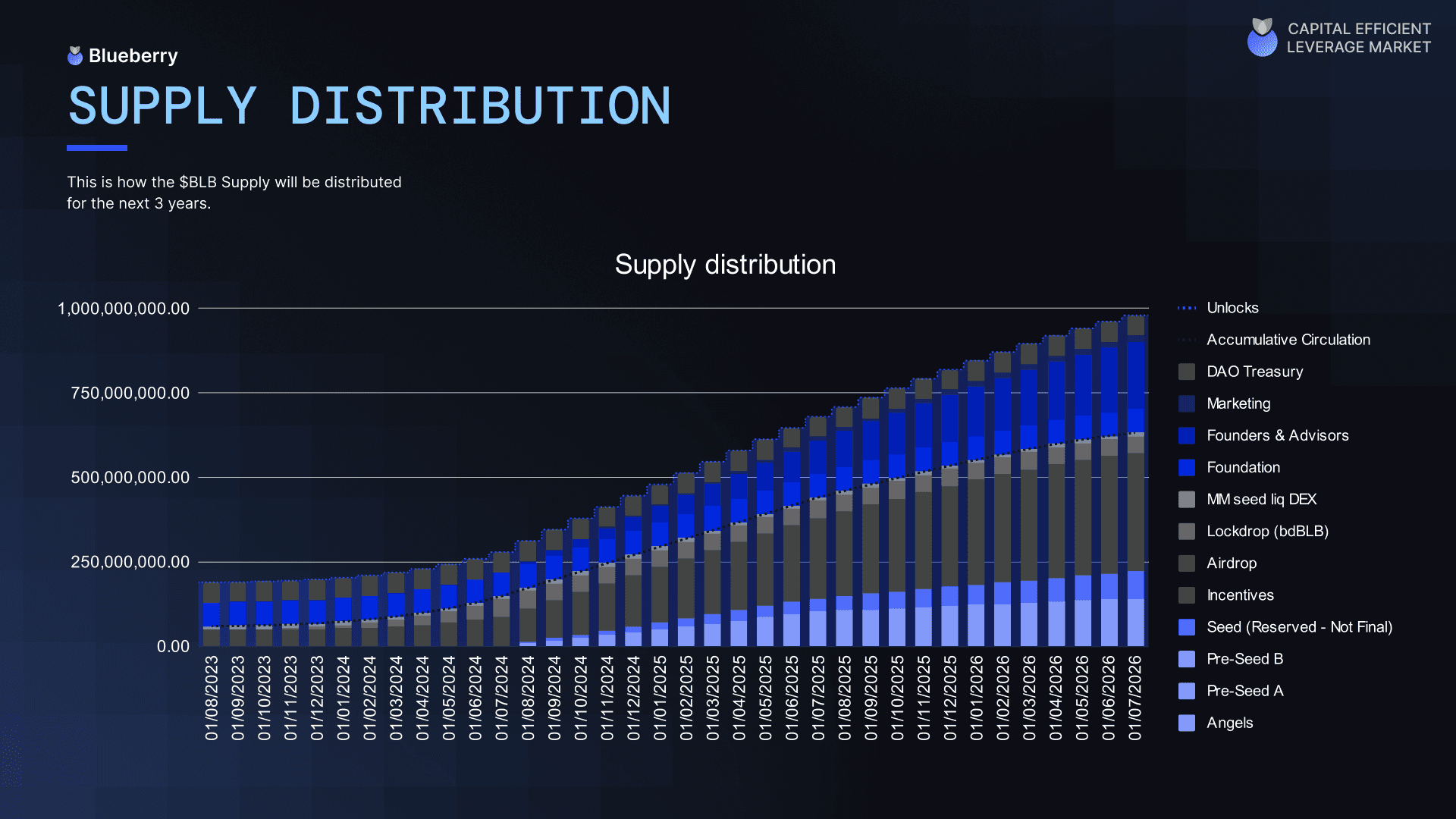

Our model is presented to investors in an interactive format, transforming the token structure into a dynamic experience.

Investors can explore various scenarios, adjust parameters, and observe how different factors influence potential returns.

By making the tokenomics model interactive and providing a clear view of potential returns, we aim to incentivize investors through transparency and clarity, encouraging them to invest with confidence.

You’ll receive a detailed report from our tokenomics team that provides a comprehensive analysis. This report can be used effectively in investor presentations, for fundraising efforts, or to communicate the strengths of your tokenomics to the community.

M+

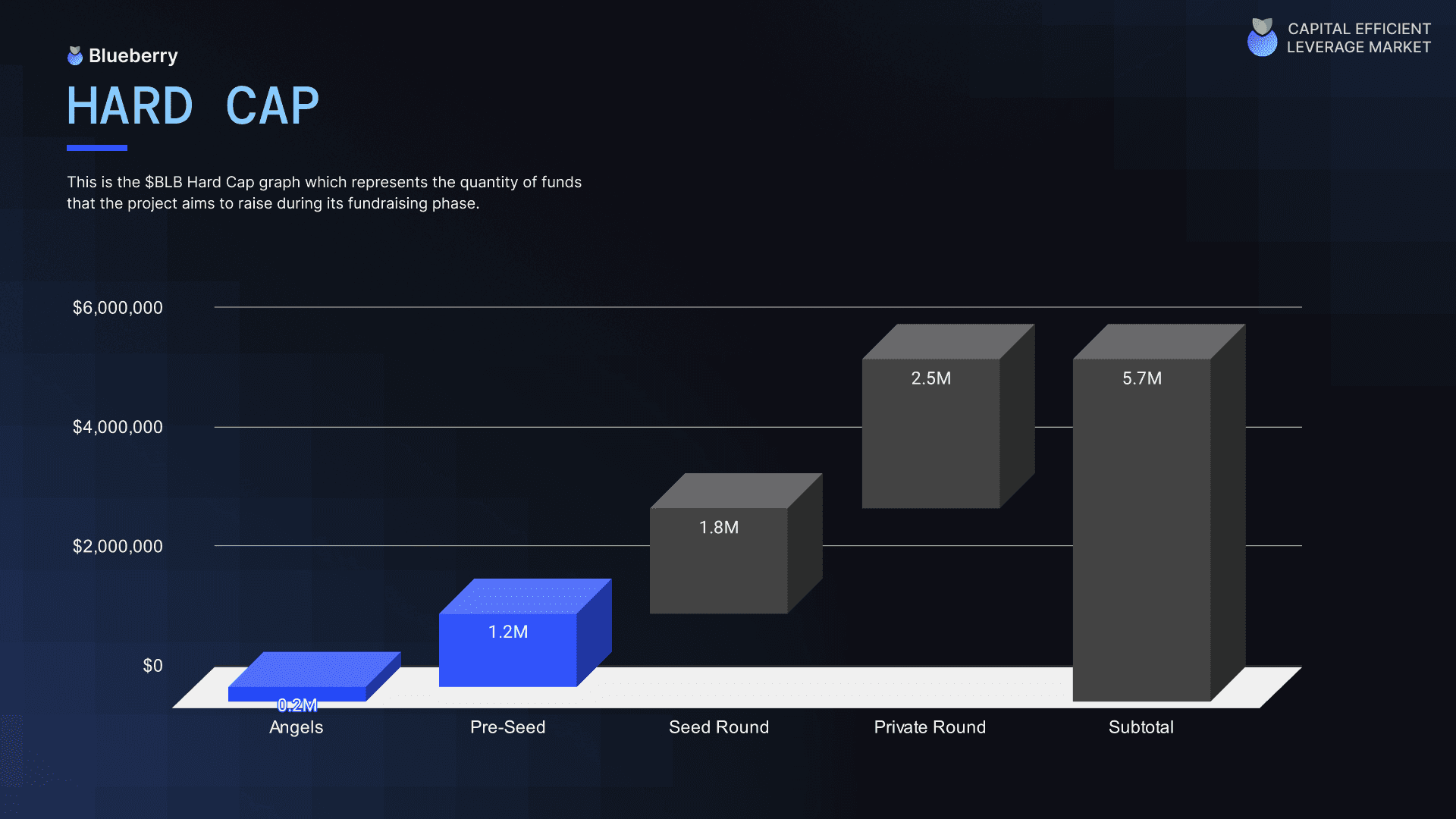

With over 40 projects, we have helped raise over $180 million from token private sales (SAFTs), with an average of $4.6 million per client, and 93% of them achieving their hard cap.

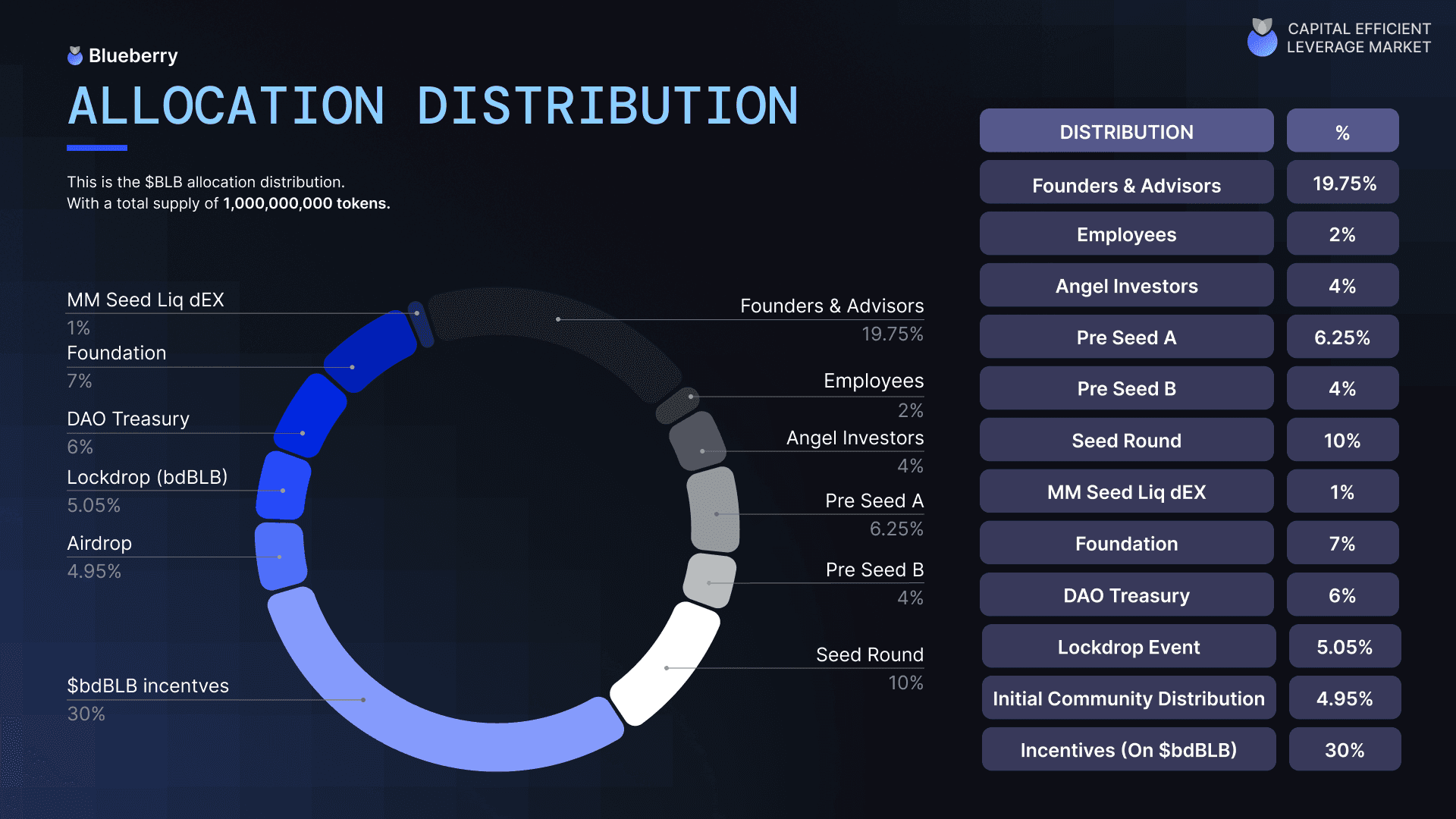

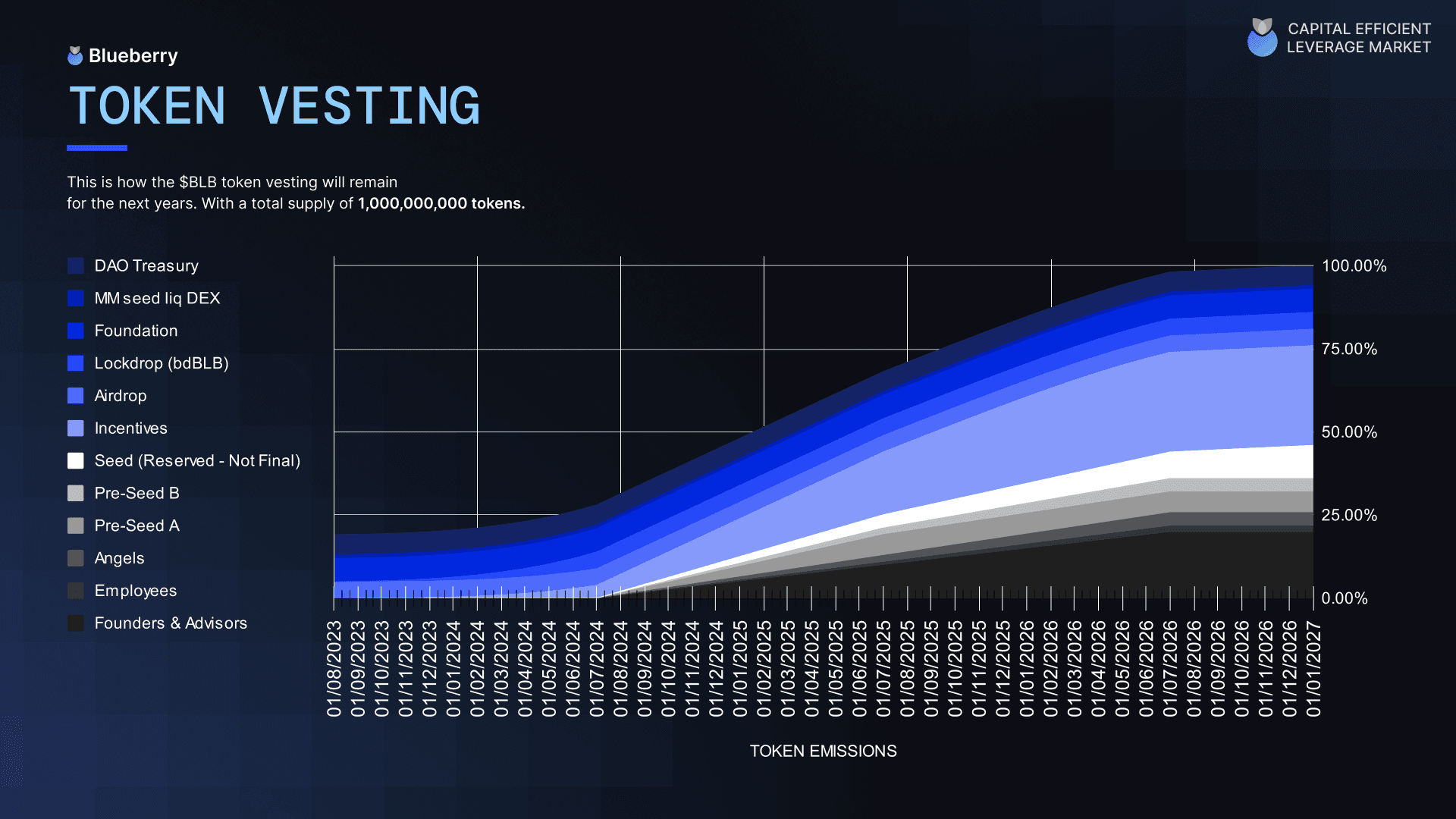

Designed by Blacktokenomics.

Explore More of Our Services

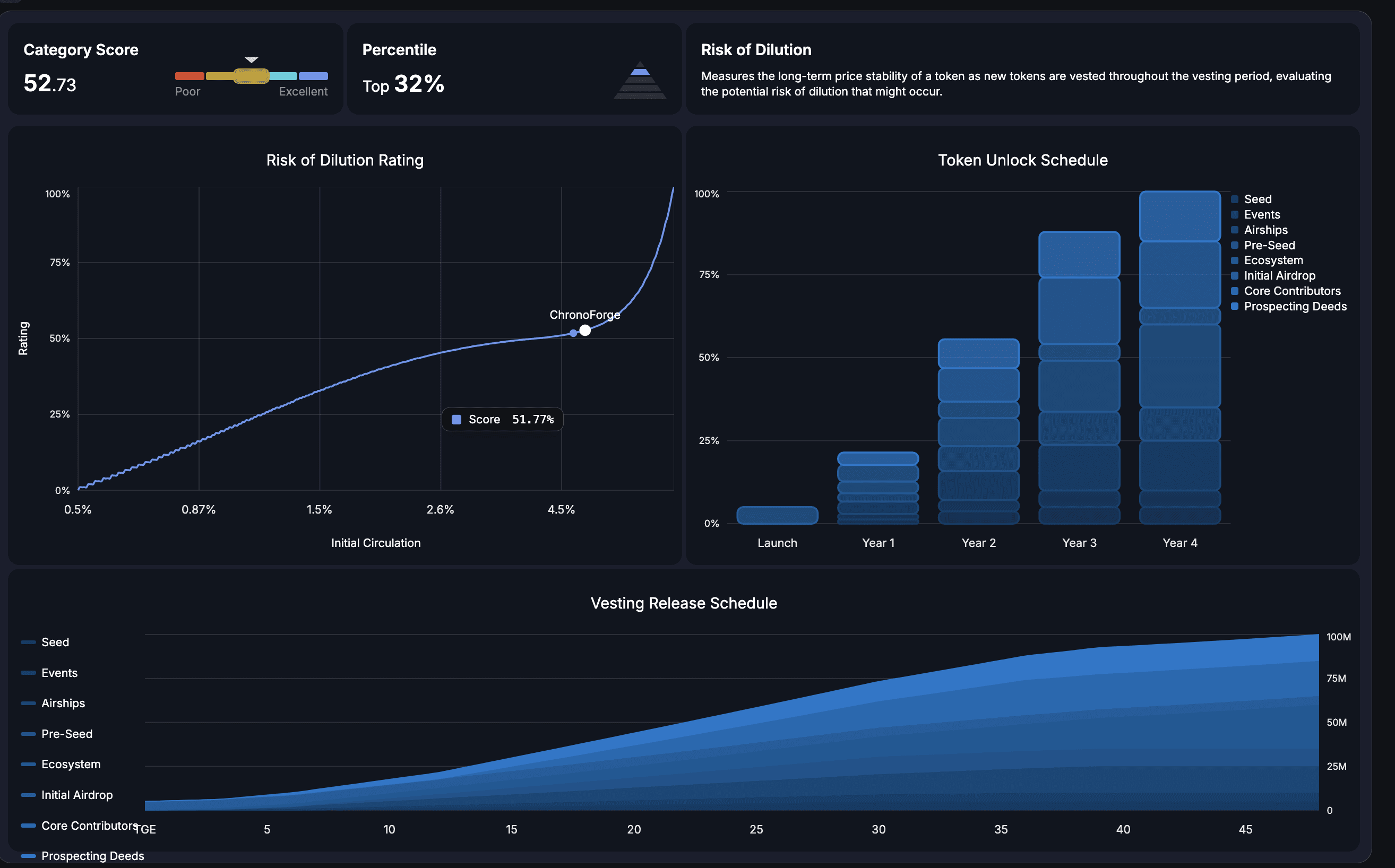

Tokenomics Audit

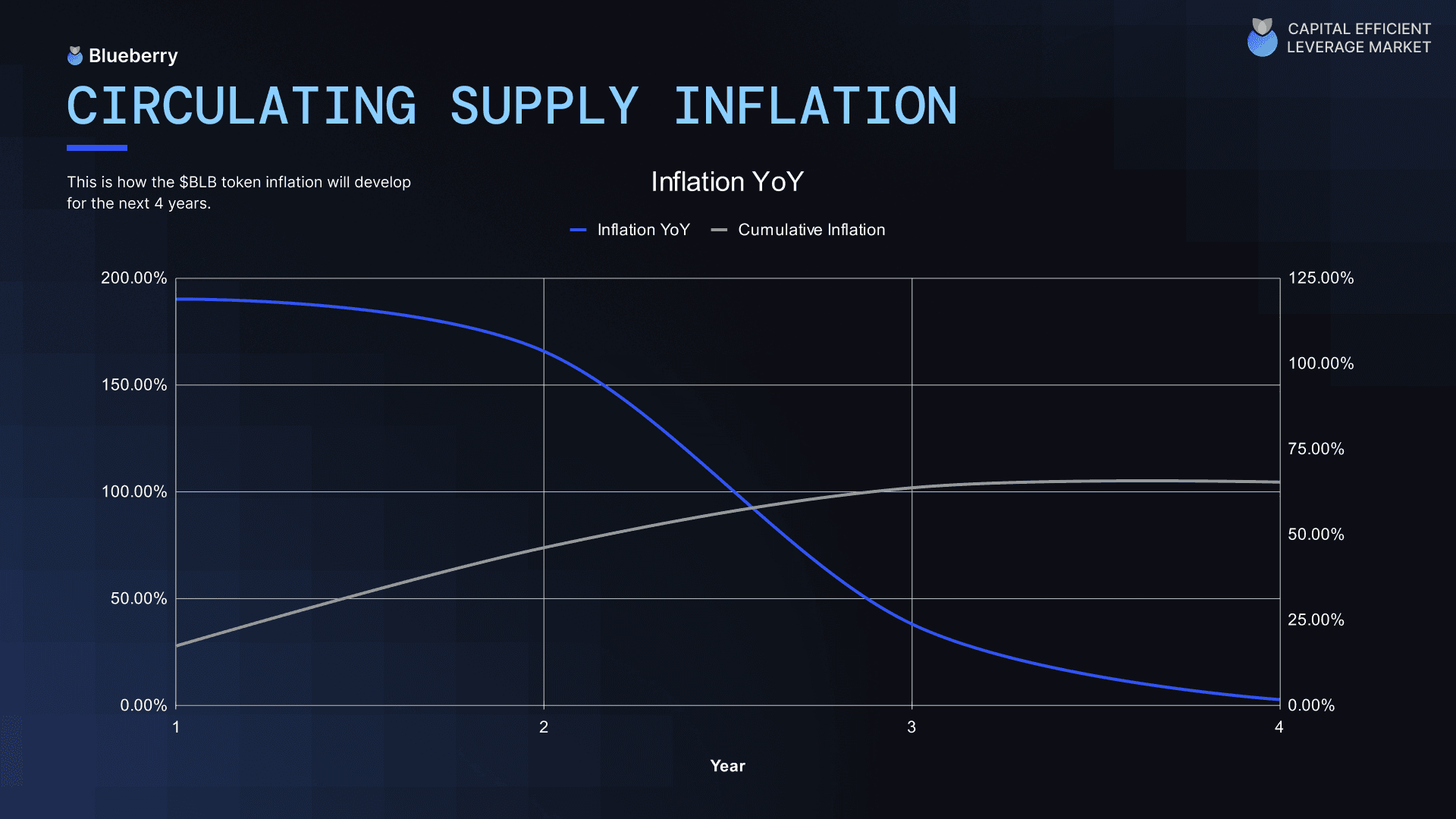

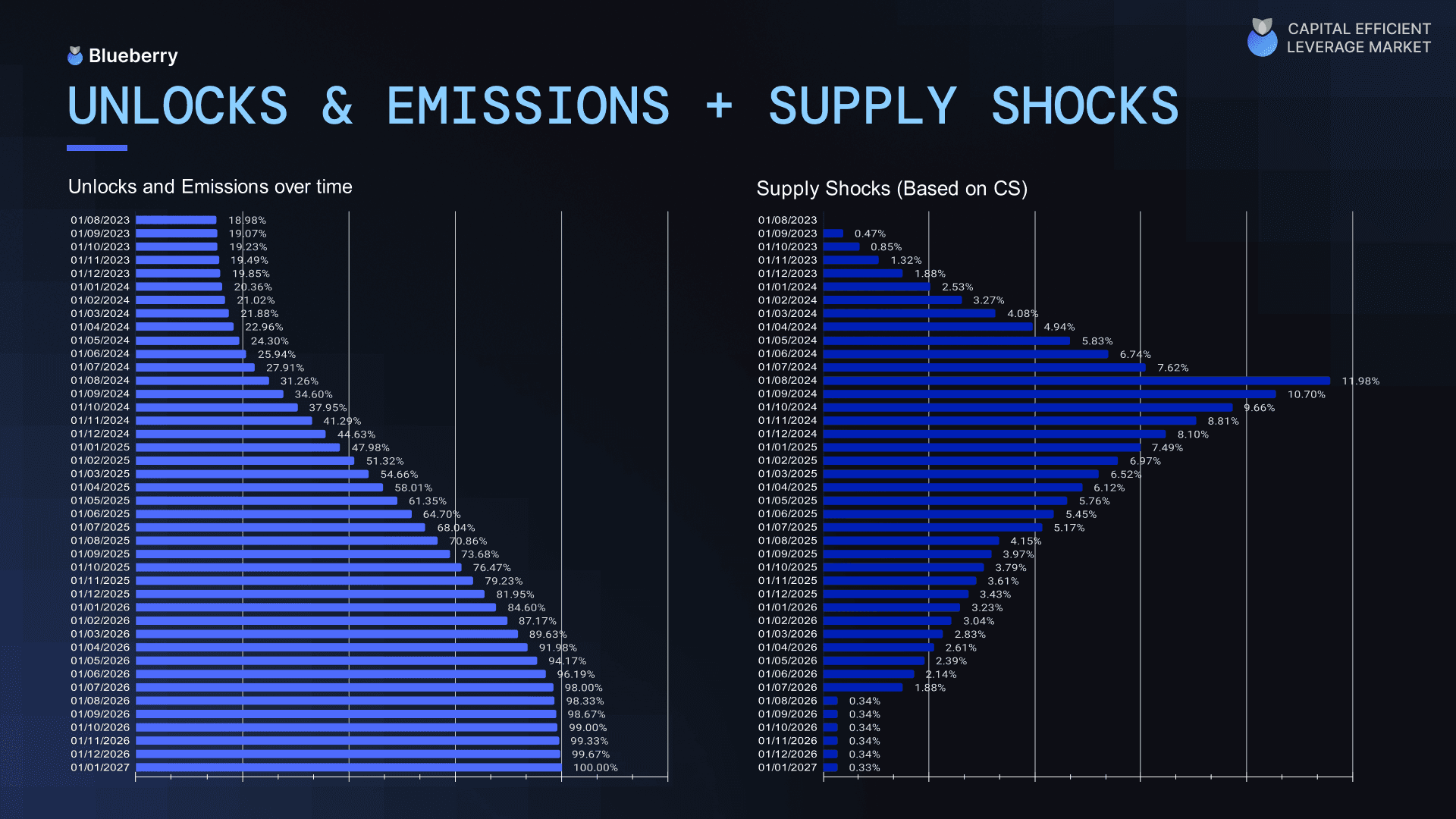

Inflation

Supply Shocks

Risk of Dilution

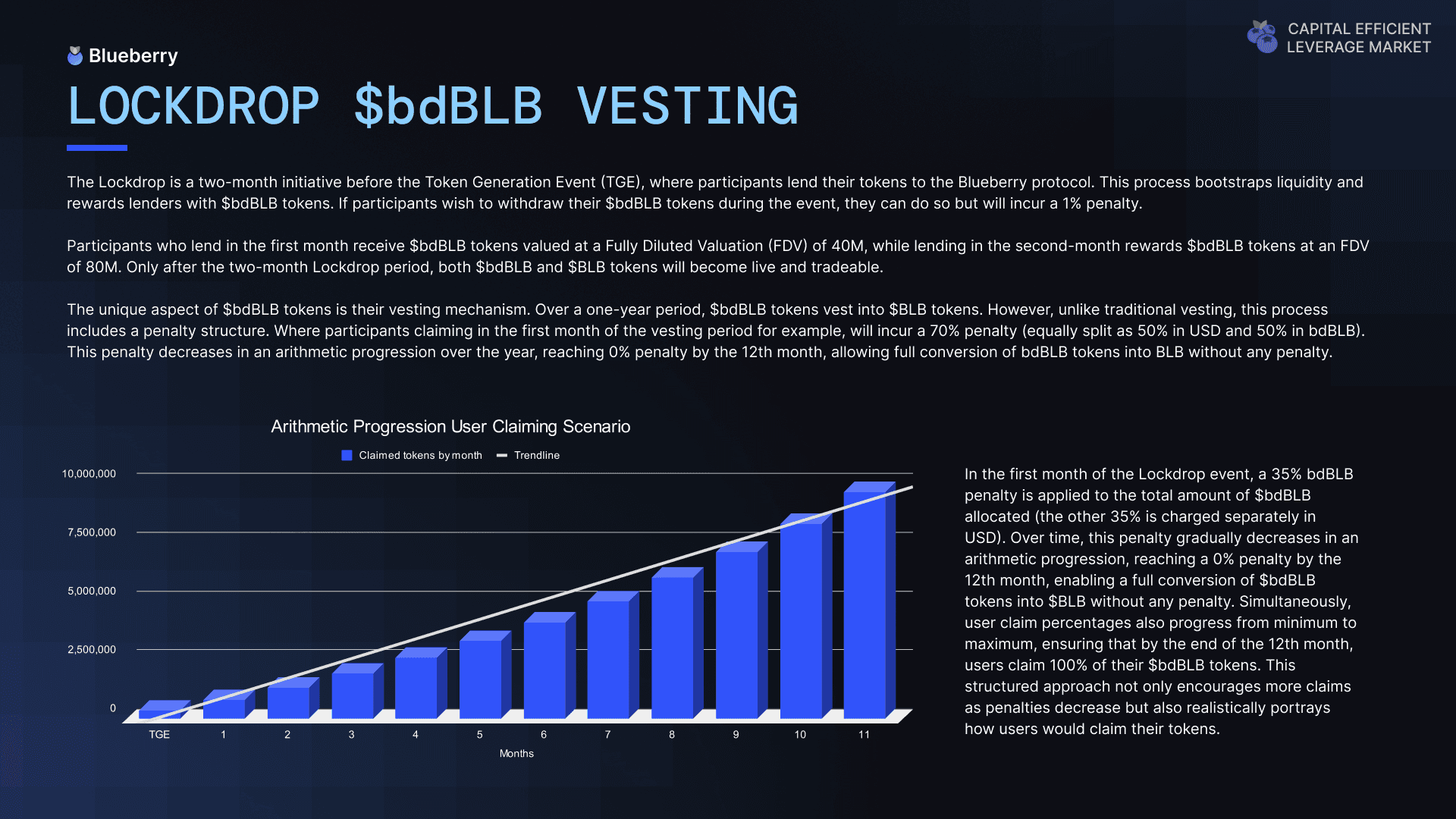

Investors Balance

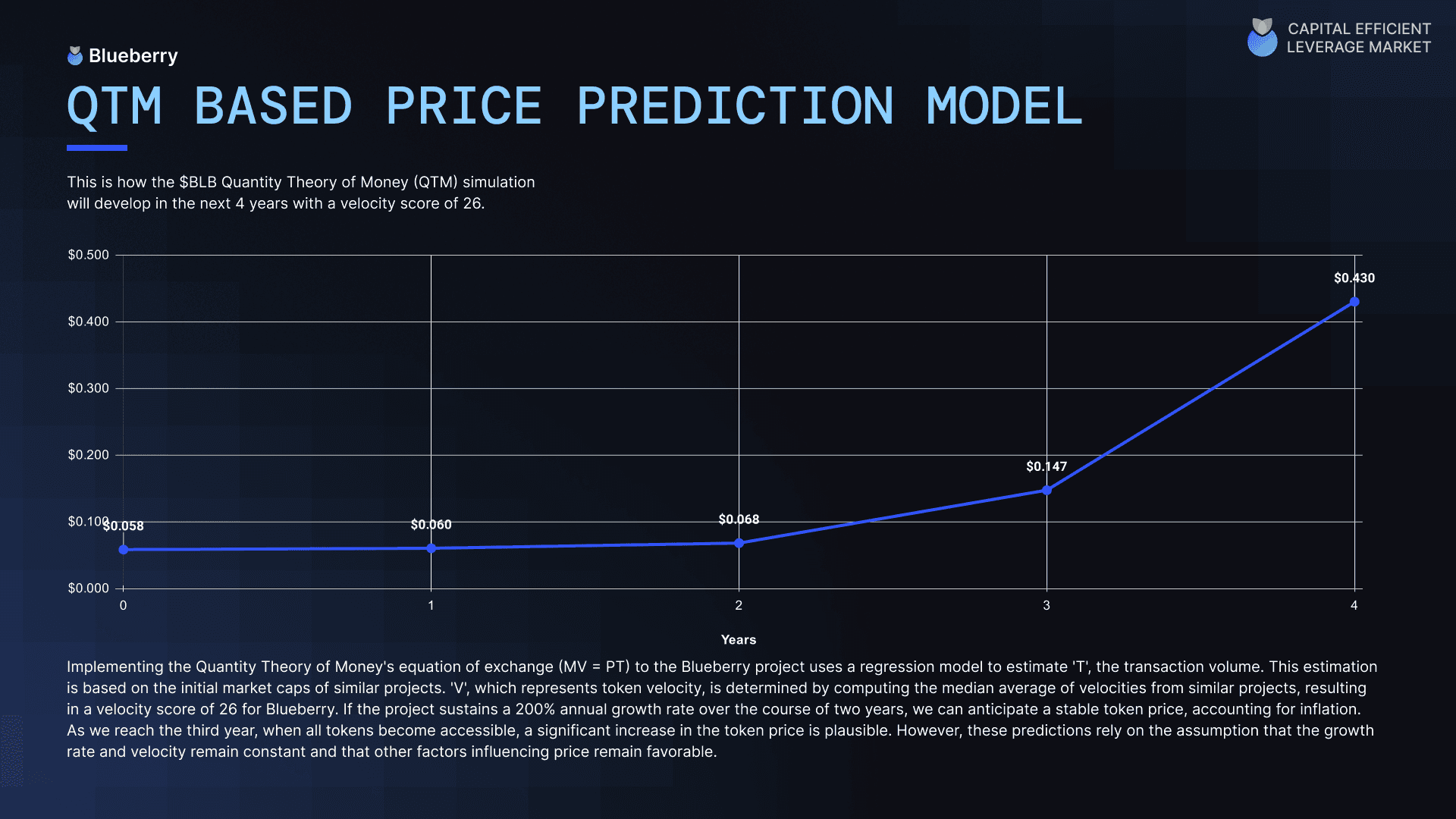

Valuation

Documentation

Tokenomics Design

Game Theory

Zero to One

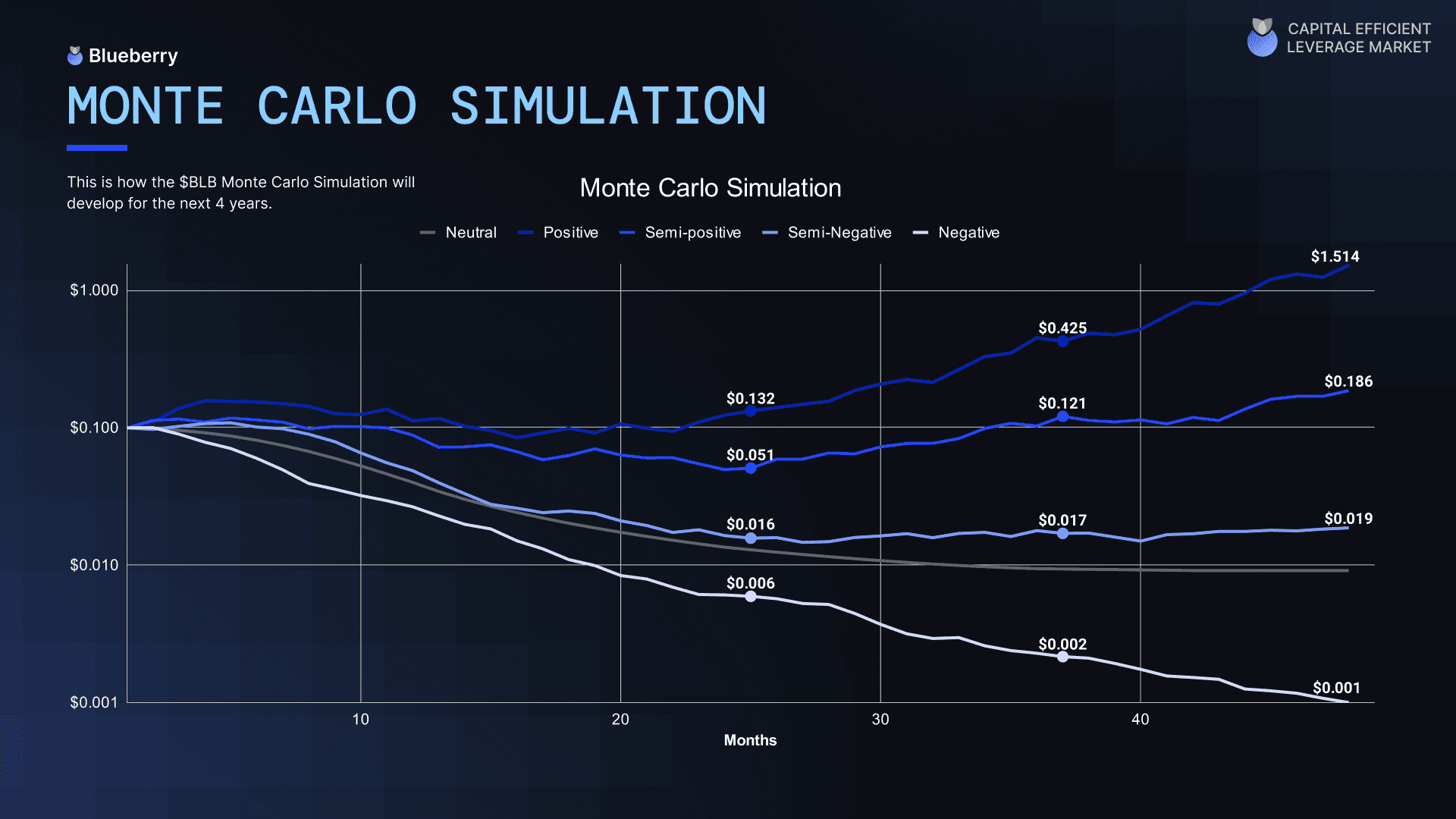

Python Simulation

Fundraising

Documentation

Audit

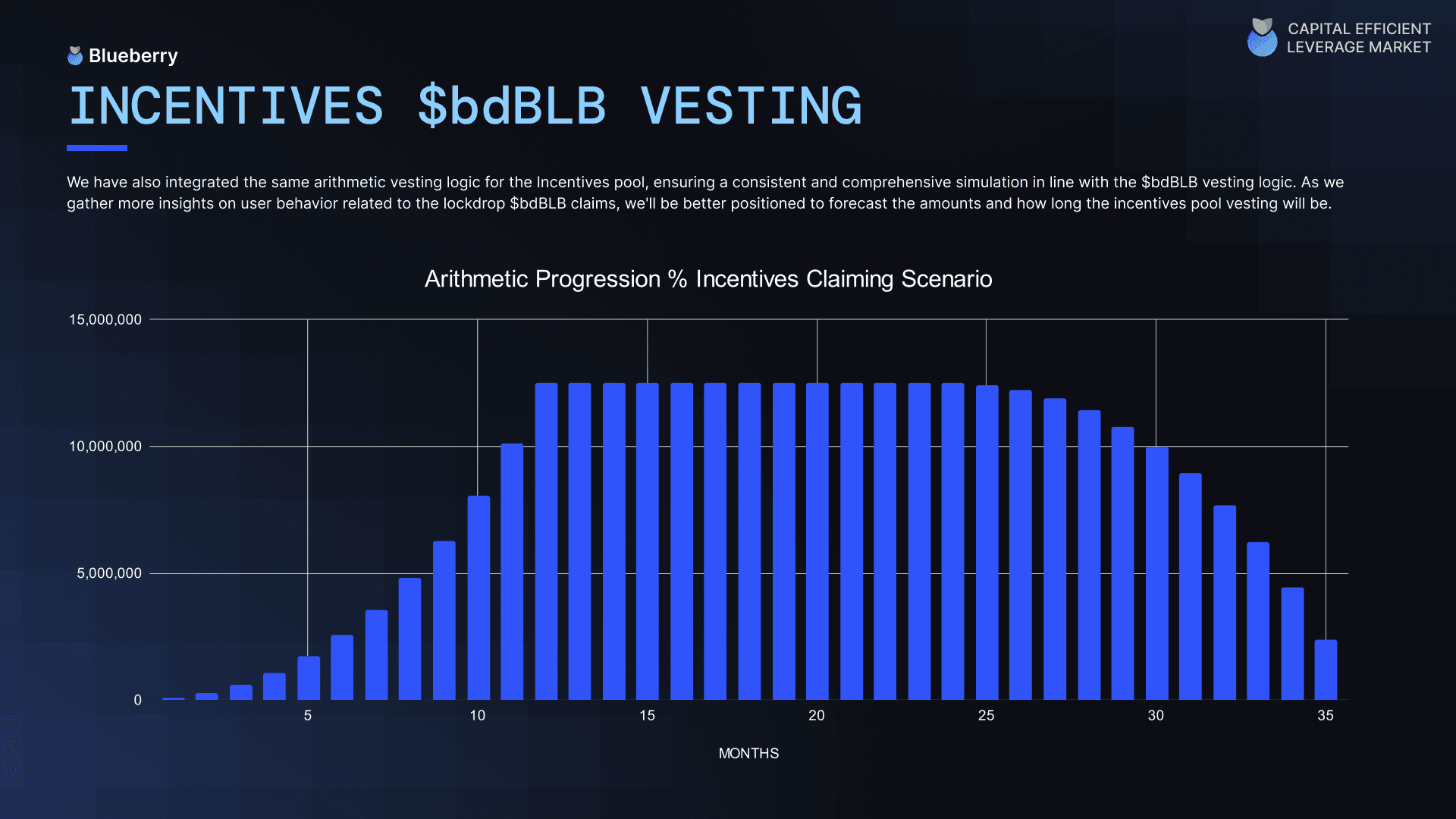

Incentives System

Node System

Tiered or Fixed Price

Data-Driven

Game Theory

Node System Flow

Documentation

Dashboard