Domas Golysenko

When it comes down to the world of cryptocurrencies, the balanced flow of supply and demand shape the market in profound ways.

The problem begins when the flow becomes a torrent. In this article, we’ll explore how sudden increases in supply – known as supply shocks – can lead to drastic and immediate price fluctuations.

We’ll also focus on real-world examples such as Optimism, Immutable X, Sandbox and Axie Infinity.

What is a Supply Shock?

A sudden increase in the circulating supply of tokens is called a ‘supply shock’, which in most cases severely disrupts the balance of supply and demand in the market in a short period of time.

Here’s why:

When a large quantity of tokens suddenly becomes available, the market’s ability to absorb the new supply plays a crucial role in price determination.

If the demand remains static while the supply skyrockets, the excess tokens will significantly drop the price of that cryptocurrency.

Furthermore, if those tokens unlocked are dedicated to investors, there is a high chance that they will sell their tokens further compounding the effects of the already high supply shock that happened, so that the price not only suffers from more tokens being in circulation, but also from the added investor selling pressure.

This is an example of a negative supply shock, that isn’t hypothetical, as demonstrated by projects like Optimism, Immutable X, Sandbox, Blur and Axie Infinity just to name a few.

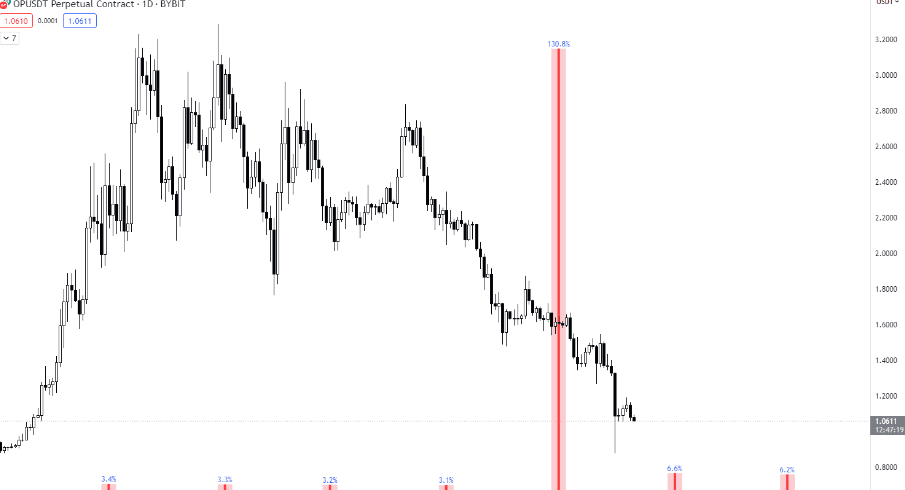

Optimism example:

In the case of Optimism, a Layer 2 scaling solution for Ethereum, the supply shock was due to happen on 30th of May of 2023. A staggering amount of tokens was released for both team and investors.

This resulted in an astronomically high supply shock of 130%, causing a sudden increase in circulating supply. The supply shock area is marked by a red line, with 130.8% at the tip of it.

This shows how the price behaved before and after the unlock happened.

Taking that into consideration we see that the market anticipated the unlock before it happened, causing a slow decrease in price before, and a sharp decrease in price after the big unlock.

As always there could have been other reasons causing these sharp price fluctuations, but thinking that it is a coincidence with all of the projects that we are about to show is irrational.

130.8% supply shock of Optimism in 2023/05/30

Sandbox multiple examples:

Sandbox project had at least three supply shocks bigger than 15% to this date, this is a really great example of how poorly designed tokenomics can haunt the project for the remainder of its existence.

Doesn’t matter if the project itself is successful or not, poor token design will always be stopping you from achieving your maximum potential.

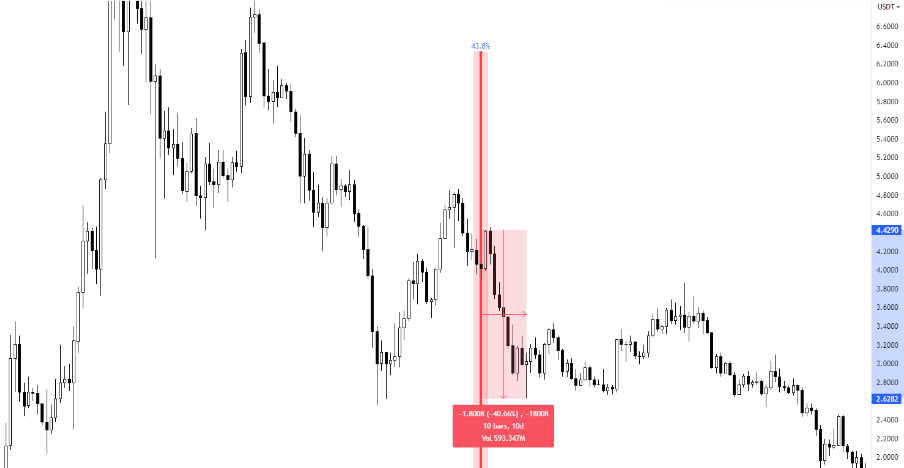

Token unlock example #1 in 2022/02/14, where a 43,8% supply shock made the price drop by 40% in just 10 days after the tokens were unlocked to investors.

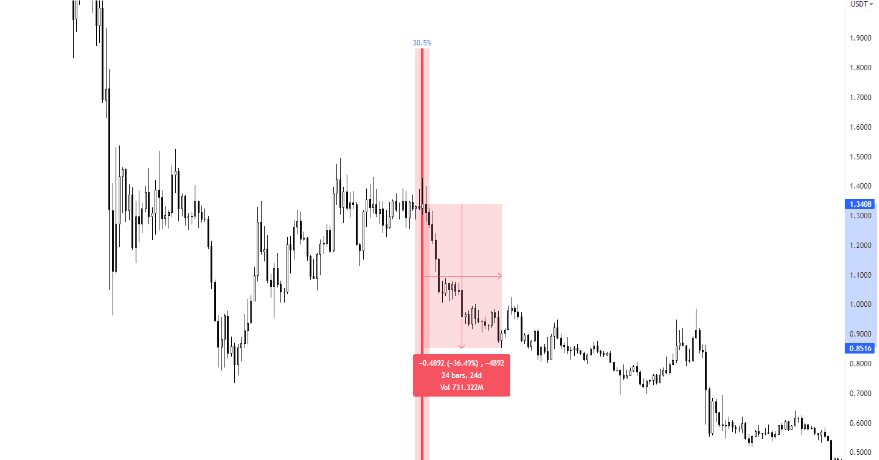

Token unlock example #2 in 2022/08/14, where a 30,5% supply shock made the price drop by 36,5% in 24 days after the tokens were unlocked to investors.

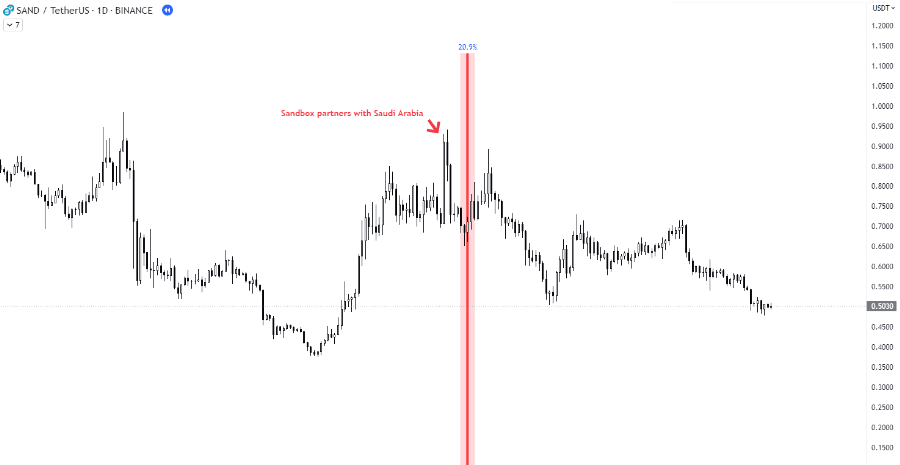

Token unlock example #3 in 2023/02/14, where a 20,9% supply shock made the price drop by 40,2% in 18 days after the tokens were unlocked to investors.

This one has a slight deviation, because the real unlock this time occurred 7 days earlier, as shown with the red arrow on the chart.

Coincidence or not, the sandbox team had a major announcement right before they unlocked investor tokens, that caused a sudden price spike where all the investors could dump their tokens on the public.

Tweet has since been deleted, but the article of the announcement is still here.

Axie Infinity example:

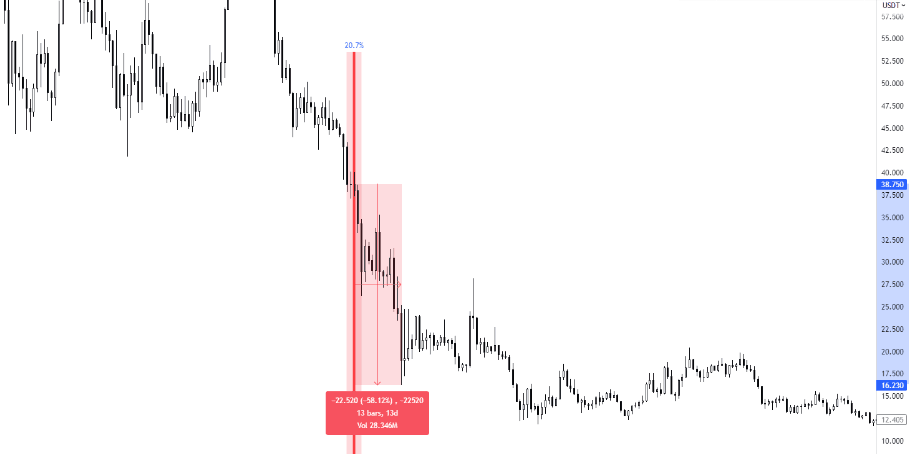

Token unlock of Axie Infinity occurred in 2022/04/28, where a 20,7% supply shock made the price drop by 58,7% in just 13 days after the tokens were unlocked to investors.

In this example the big unlock was expected, because we can see the selling pressure beginning even before the unlock occurred, in total from the local top to the bottom $AXIE token dropped 78%.

This was not the last token unlock for Axie, there were multiple releases like this in the future.

Immutable X example:

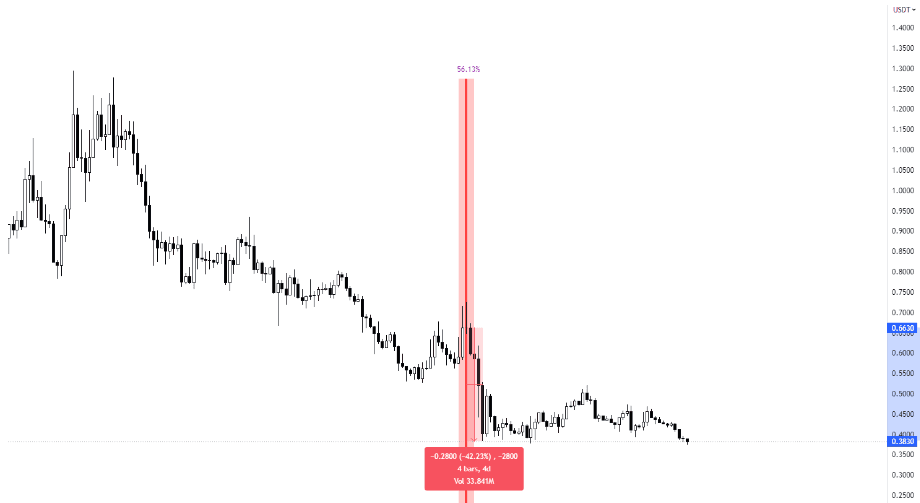

Perhaps the most devastating supply shock yet goes to Immutable X, where they had an 56,1% supply shock that made the price drop by 42,2% in only 4 days after the tokens were unlocked to investors.

This is devastating taking into consideration that it dropped so much in such a small period of time, liquidating and losing trust of every possible investor at that time.

Importance of Professional Tokenomics Design

As we’ve seen through real world cases like Optimism, Immutable X, Sandbox, and Axie Infinity, the potential for drastic price fluctuations due to supply shocks is a substantial risk within the crypto world.

These instances highlight the significance of sound and well structured tokenomics designs. Missteps in this area can haunt a project throughout its lifespan, overshadowing even its most successful accomplishments.

Poor token design not only diminishes a project’s potential but also sacrifices investor trust, a crucial asset in this domain.

Working with tokenomics experts who really know how to craft a proper token design isn’t just something your project should do, it’s something it must do.

Here at Black Tokenomics, our goal is to take the crypto token audits to the highest possible level. We want to set a new industry standard, where every project must have strong and resilient token design, that can thrive through constant changes in the markets.

With Black Tokenomics on your side, you will navigate the unpredictable seas of cryptocurrency with confidence, equipped with a fortified token design that not only withstands market volatility but propels your project towards success.

To learn more about our services:

Domas Golysenko

Research Department Lead