Sven

What is Sui

Sui is the first permissionless Layer 1 blockchain designed from the ground up to enable creators and developers to build experiences that cater to the next billion users in web3. Sui is horizontally scalable to support a wide range of application development with unrivaled speed at low cost.

Note: Sui (swē) is the water element in Japanese philosophy.

Funding Information

Mysten Labs has raised a total of $336M in funding over 3 rounds. Their latest funding was raised on Sep 8, 2022 from a Series B round.

Exclusive Funds raising info and backers here.

The lead investor is nothing more than FTX Ventures.

The SUI Token

The total supply of SUI is capped at 10,000,000,000 (i.e. ten billion tokens). A share of SUI’s total supply will be liquid at mainnet launch, with the remaining tokens vesting over the coming years or distributed as future stake reward subsidies. Each SUI token is divisible up to a large number of decimal places.

The SUI token serves four purposes on the Sui platform:

You can stake SUI to participate in the proof-of-stake mechanism.

SUI is the asset denomination needed for paying the gas fees required to execute and store transactions or other operations on the Sui platform.

SUI can be used as a versatile and liquid asset for various applications including the standard features of money — a unit of account, a medium of exchange, or a store of value — and more complex functionality enabled by smart contracts, interoperability, and composability across the Sui ecosystem.

SUI token plays an important role in governance by acting as a right to participate in on-chain voting on issues such as protocol upgrades.

Since the SUI token is available in finite supply, the same amount of tokens will need to be used across more economic activities in the long run if Sui unlocks many use cases and millions of users migrate to the platform. In addition, the storage fund’s presence creates important monetary dynamics in that higher on-chain data requirements translate into a larger storage fund, reducing the amount of SUI in circulation.

SUI Token and Validators

Sui has a native token called SUI, with a fixed supply.

The SUI token is used to pay for gas, and is also used as delegated stake on validators within an epoch.

The voting power of validators within this epoch is a function of this delegated stake. Validators are periodically reconfigured according to the stake delegated to them. In any epoch the set of validators is Byzantine fault tolerant. At the end of the epoch, fees collected through all transactions processed are distributed to validators according to their contribution to the operation of the system.

Validators can in turn share some of the fees as rewards to users that delegated stake to them.

Economics Paper

Source — Summary from the paper:

The Sui economy is characterized by three main sets of participants:

Users submit transactions to the Sui platform in order to create, mutate, and transfer digital assets or interact with more sophisticated applications enabled by smart contracts, interoperability, and composability.

SUI token holders bear the option of delegating their tokens to validators and participating in the proof-of-stake mechanism. SUI owners also hold the rights to participate in Sui’s governance.

Validators manage transaction processing and execution on the Sui platform.

The Sui economy does not include any mechanism to burn SUI tokens directly. How- ever, since the long-run supply is capped at ten billion tokens, increased activity on the Sui platform effectively acts as a deflationary force due to gas payments.

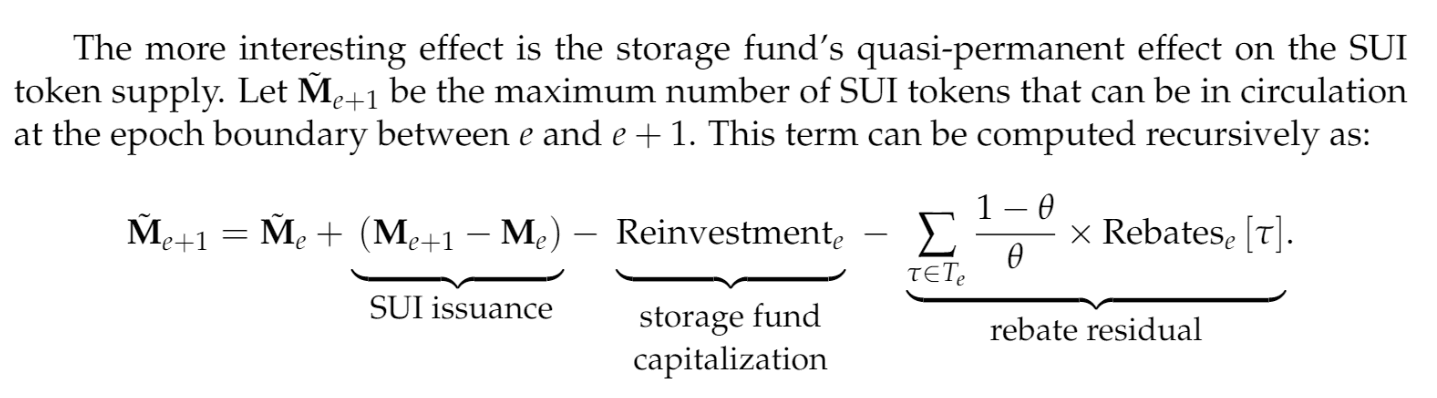

The effective number of tokens in circulation at e + 1 equals the effective number of tokens in circulation at e, plus the new issuance of SUI tokens, minus the tokens reinvested to capitalize the storage fund, minus the residual of new storage rebates.

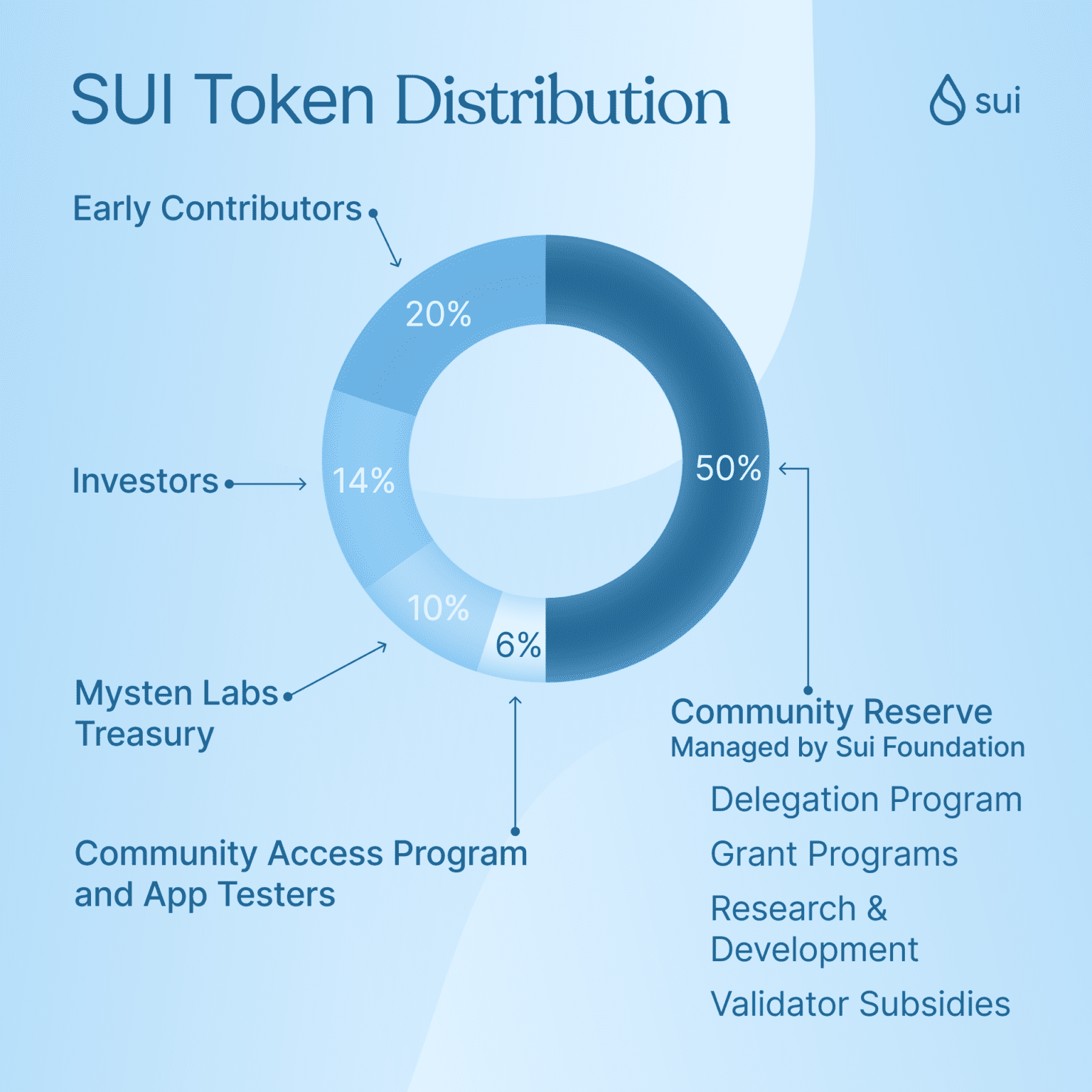

Allocation Distribution

20% will be distributed to early contributions

14% to investors

10% to Mysten Labs Treasury

50% to the Community Reserve managed by Sui Foundation

6% to the Community Access Program

In navigating the complexities of SUI’s tokenomics, the significance of a sound tokenomics strategy cannot be overstated.

If you’re managing an existing blockchain project or about to embark on a new one, you need a robust tokenomics plan in place.

Blacktokenomics is here to provide that support. From our tokenomics specialist consulting that can help shape your approach, a comprehensive tokenomics auditing service to examine and refine your current tokenomics, to a tailored tokenomics design service to develop your token economy from the ground up.

Our expertise will ensure that you make strategic decisions, optimizing your token’s potential. Make the most of your blockchain project with Blacktokenomics.

Sven

Sven is a digital entrepreneur with over 8 years of experience in SEO. He has helped Web3 businesses optimise their online presence online. He has a deep understanding of the Web3 space and ensures to vet all the projects BlackTokenomics works with.