Andres

What is The SandBox?

The Sandbox is a virtual metaverse home to a plethora of decentralized land parcels which users can develop, trade, and monetize their owned virtual real estate using a variety of monetary means.

Token Utility

SAND is the primary utility token used within The Sandbox ecosystem and it is an ERC-20 token that serves as the fungible token within the economy.

Players must acquire SAND tokens to trade on the native marketplace and also for governance purposes.

Moreover, SAND tokens are also used by the players to pay gas fees when uploading their 3D assets to the native marketplace. Other use cases are:

Acquire in-game assets (e.g. lands, equipments, avatar).

Upload assets to the marketplace.

Governance token for voting rights.

Passive revenues through staking.

Pay transaction fees.

Support the foundation (the main entity behind the project).

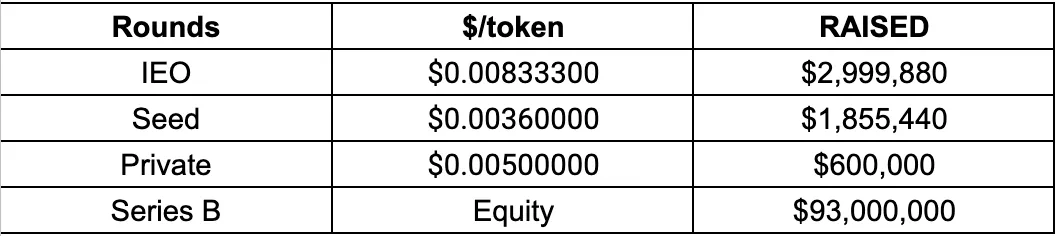

Funding Rounds

The SAND token is an ERC-20 cryptocurrency launched in August 2020.

The project raised its fundraising goal of $3 million by August 14 — 12% of the token supply was sold at a price of $0.008. IEO round.

This funds were raised using BNB as the fundraising took place on Binance Launchpad.

Before this Public Sale, Animoca Brands held a private seed round in November 2019 in which it raised $3.21 million. The tokens were sold at a rate of $0.0072 per SAND.

Another private funding round took place with a strategic sale in July 2020. The token was sold at an average price of $0.005.

Finally ending with a Series B, equity round where they raised 93M.

Some of the main investors are:

Binance Labs

Coinbase Ventures

HASHED

Huobi Capital

ParaFi Capital

True Global Ventures

Winklevoss Capital Management, LLC

Series B

SoftBank

Blue Pool Capital

Kingsway Capital

Liberty City Ventures

Galaxy Interactive

True Global Ventures (TGV)

Sterling.VC

Samsung NEXT

Tokenomics

SAND’s total distribution was configured in the following way:

Binance Launchpad Sale: 12%

Private Seed Sale: 17.18%

Private Strategic Sale: 4%

Foundation: 12%

Team: 19%

Advisors: 10%

Company Reserve: 25.82%

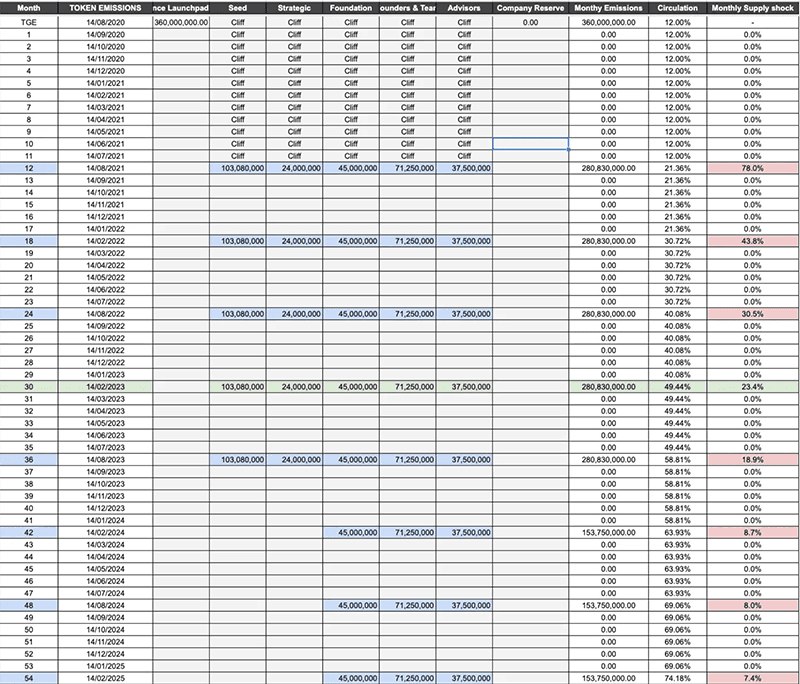

$SAND has a maximum token supply of 3 billion tokens. The cap is supposed to be reached by February 2025 after the entire supply becomes unvested.

Vesting Schedule

Seed Sale, Strategic Sale (Investors) SAND allocated to the Investors in Seed Sale and the Strategic Sale are locked for 3 years vesting with a 12 month cliff and will be distributed as shown on below table:

Founders, Team and Advisors SAND tokens are locked for 5 years vesting and 12-month cliff followed by release every 6 months and will be distributed as shown on below table:

Allocation Distribution — here

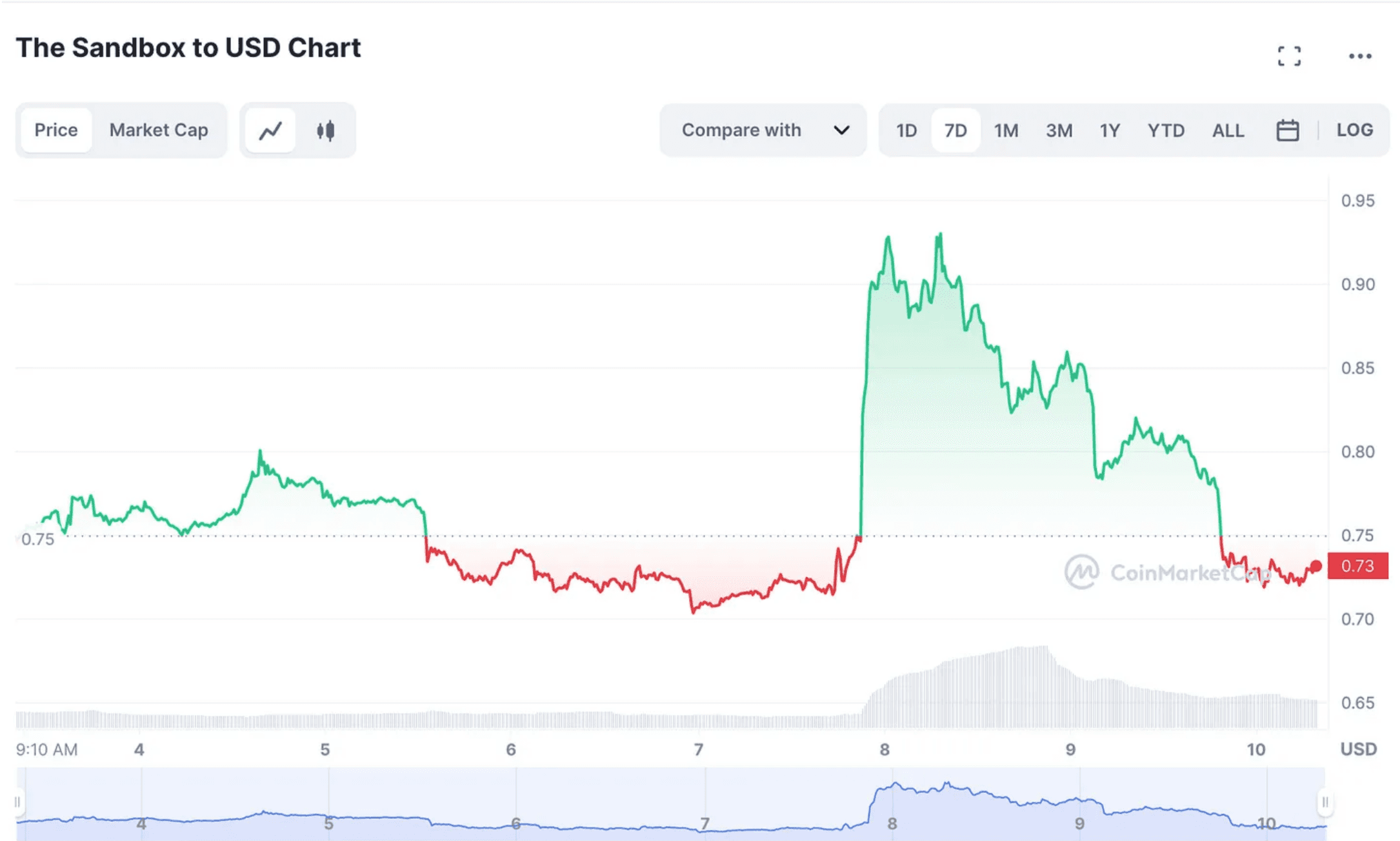

Price Action

What can we expect?

Looking at The Sandbox’s previous token unlocks and price movement, we concluded the token allocation for this upcoming unlock is similar to the August 14th 2022 one.

The day after the unlock on August 14th 2022, nearly 75% of all significant trades were sell orders as investors looked to cash out of $SAND. That sell pressure continued in the days after the unlock as sell orders dominated buys

What was $SAND behaviour in February 2023?

On Feb. 7, Borget, the SandBox CEO and the Saudi Arabian DGA signed the memorandum (MOU) while they were in the capital city Riyadh for the Leap Tech Conference. And although, Borget was unable to disclose any other information regarding the arrangement with the distinguished middle-eastern country, he claimed that additional details would be provided in the weeks coming by.

The SandBox Smart Contracts

The Genesis Contract — 0x2F2456953A2cBc21fdE058D33fb2aD8D59E72A35|

Advisors Vault — 0x07d2601739709C25FE0AfD50EC961BA589311CaA

Team — 0x5f5B8942aE6325227d5d82e5759E837271Fa2a67

Liquidity Provider Vault — 0x8FFA64FB50559c3Ff09a1022b84B2c5233ed8068

Treasury Vault — 0x4489590a116618B506F0EfE885432F6A8ED998E9

On Chain Analysis

The Sandbox vesting and transactions are restricted and run under the multisig wallet Gnosis.Founders — Gnosis Safe

Team — Gnosis Safe

Advisors — Gnosis Safe

Company Reserve — Gnosis Safe

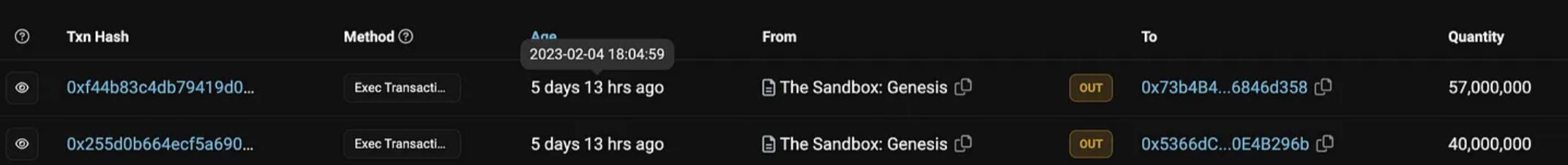

After tracking the wallets we noticed some strange activity, which was the Team, Advisors and Genesis contracts releasing the unlock on the 04th of February when the unlock was scheduled for the 14th.

Why?

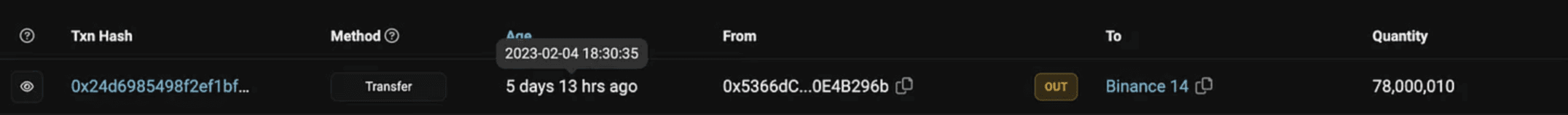

The answer is pretty simple, they release the team, foundation and advisors tokens, then 3 days later they announced the memorandum with Saudi Arabia, the retail investor jumps into it and bought the token, while they started selling their new unlocked tokens 10 days before the vesting scheduled restrictions. Well played. Sadly everything was on chain.

They released the tokens from the Genesis Wallet 10 days before the vesting schedule on the 04/02

24 minutes later send them into circulation to Binance and prepare everything for the Saudi news.

We tracked the other token releases that yet have not gotten to Binance from the movement of the Genesis, Advisors, Team multisig and Foundation addresses and we got the following addresses.

Address 1 — Holding now 60,624,750.75 SAND

This tokens came from the genesis wallet.

Address 2 — Holding now 24,649,840 SAND

This tokens came from the team multisig and the liquidity vault.

Address 3 — Holding 11,918,750 SAND

This tokens come from the Advisors vault.

We set alerts for all them.

As we explore the intricate dynamics of The Sandbox’s tokenomics, it’s clear that understanding and creating efficient token models is crucial to the success of any blockchain project.

This is where our expertise comes into play. At our firm, we provide a range of tailored services to support projects at every stage. Whether you’re seeking assistance in tokenomics consulting, requiring a detailed tokenomics audit, or needing a completely new tokenomics design service, our team of tokenomics experts is ready to help you navigate the complexity of blockchain economies.

Harness our expertise to make informed decisions for your project and maximize the potential of your token model.

Andres

Obsessed with Tokenomics + Data Driven and Principle approach to designing them + Game theory.