Architecting Superior Tokenomics

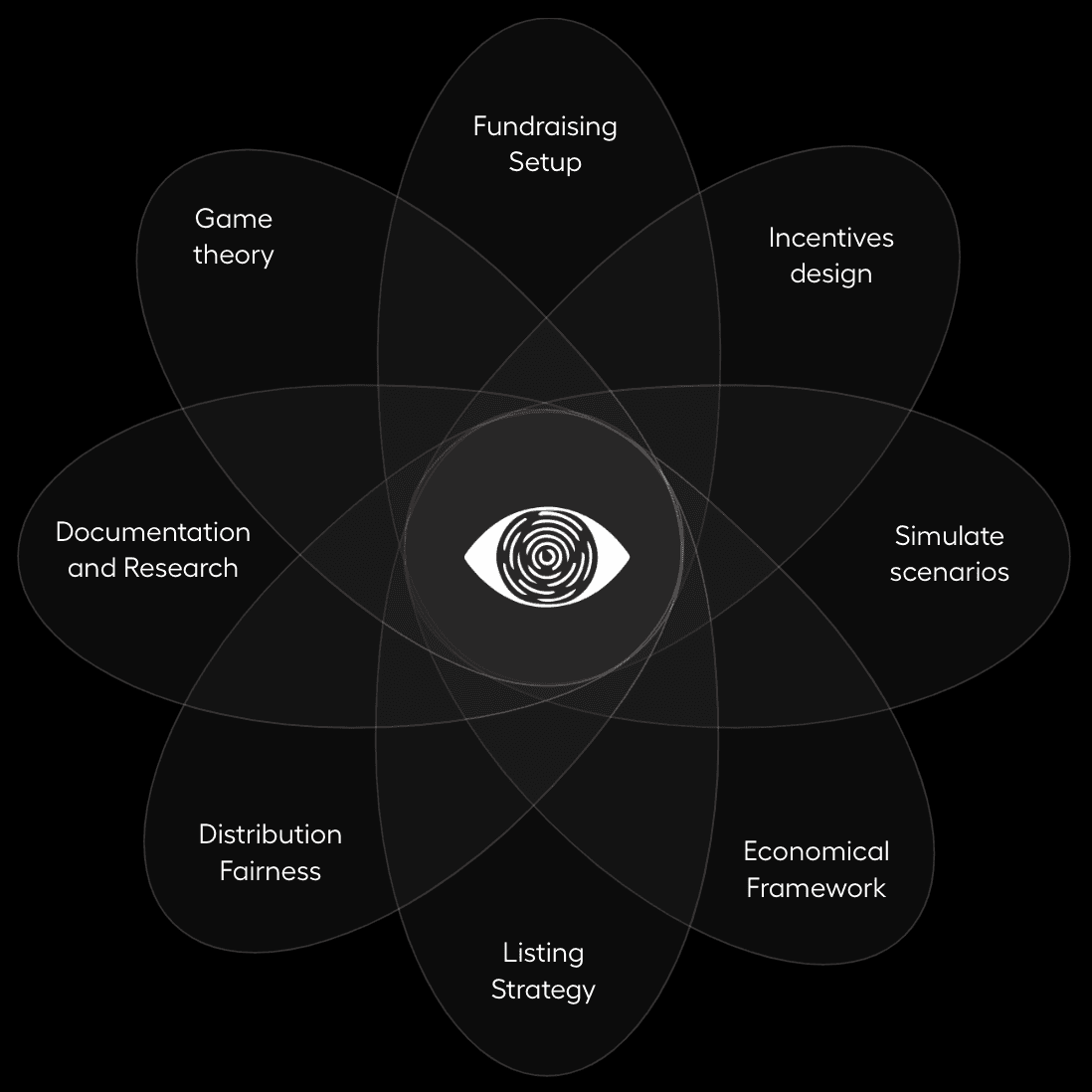

As a pioneering firm, we have developed our own proprietary software to audit, model, simulate and design superior tokenomics frameworks.

We focus on early-stage projects, where we directly support founders.

With a proven track record of 120+ successful clients, we are now extremely selective about whom we work with, maintaining our reputation of only working with the best.

We are a lean, specialized team of economists, data scientists, and simulation engineers and unlike existing models that heavily rely on speculation, we execute a complete data-driven approach to tokenomics.

Andres Gonzalez Collado

Founder, CEO

Domas Golysenko

Co-Founder, CTO

Facundo Raimondo

Head of Growth

Lee Sato

Research Director

Our headquarters are located in Lisbon, Portugal, where we operate as our central hub for strategy, and team collaboration. The company itself is registered in Hong Kong, providing us with a strategic presence in Asia and access to global markets.